AT&T Wireless 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 17

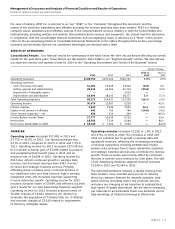

depreciation expense increased $865, or 13.5%, primarily

due to ongoing capital spending for network upgrades

and expansions partially offset by certain network

assets becoming fully depreciated. Amortization expense

decreased $270, or 55.3%, primarily due to lower

amortization of intangibles for customer lists related

to acquisitions.

Depreciation expense increased $855, or 15.5%, in 2012

primarily due to ongoing capital spending for network

upgrades and expansion and the reclassification of shared

information technology costs partially offset by certain

network assets becoming fully depreciated. Amortization

expense decreased $311, or 38.9%, in 2012 primarily due

to lower amortization of intangibles for customer lists

related to acquisitions.

Equity in net income (loss) of affiliates for the Wireless

segment includes expenses for ISIS, our mobile payment

joint venture with Verizon and T-Mobile.

• Equipment costs increased $507, reflecting sales of

more expensive smartphones, partially offset by the

overall decline in upgrade activity and total device sales.

• Network system, interconnect, and long-distance

costs increased $202 primarily due to higher network

traffic, personnel-related network support costs and

cell site related costs in conjunction with our network

enhancement efforts and storm costs.

• USF fees increased $166 primarily due to USF rate

increases.

• Handset insurance cost increased $141 due to claims

on more expensive devices.

Partially offsetting these increases, incollect roaming fees

decreased $115 primarily due to rate declines and lower

roaming use associated with the integration of previously

acquired subscribers into our network.

Depreciation and amortization expenses increased $595,

or 8.7%, in 2013 and $544, or 8.6%, in 2012. In 2013,

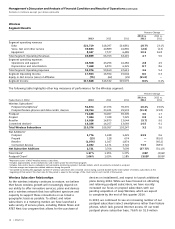

Wireline

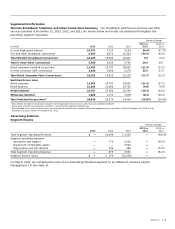

Segment Results

Percent Change

2013 vs. 2012 vs.

2013 2012 2011 2012 2011

Segment operating revenues

Data $33,593 $31,841 $29,548 5.5% 7.8%

Voice 20,333 22,614 25,121 (10.1) (10.0)

Other 4,888 5,118 5,480 (4.5) (6.6)

Total Segment Operating Revenues 58,814 59,573 60,149 (1.3) (1.0)

Segment operating expenses

Operations and support 41,638 41,207 41,361 1.0 (0.4)

Depreciation and amortization 10,907 11,123 11,615 (1.9) (4.2)

Total Segment Operating Expenses 52,545 52,330 52,976 0.4 (1.2)

Segment Operating Income 6,269 7,243 7,173 (13.4) 1.0

Equity in Net Income (Loss) of Affiliates 2 (1) (2) — —

Segment Income $ 6,271 $ 7,242 $ 7,171 (13.4)% 1.0%

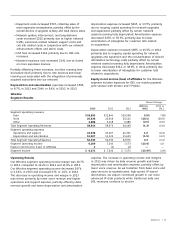

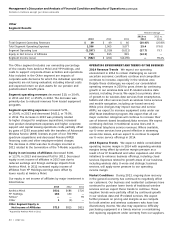

expense. The increase in operating income and margins

in 2012 was driven by data revenue growth and lower

depreciation and amortization expense, partially offset by

lower voice revenue. As we transition from basic voice and

data services to sophisticated, high-speed, IP-based

alternatives, we expect continued growth in our more

advanced IP data products while traditional data and

DSL revenues continue to decline.

Operating Results

Our Wireline segment operating income margin was 10.7%

in 2013, compared to 12.2% in 2012 and 11.9% in 2011.

Our Wireline segment operating income decreased $974,

or 13.4%, in 2013 and increased $70, or 1.0%, in 2012.

The decrease in operating income and margin in 2013

was driven primarily by lower voice revenue and higher

operations and support expense, partially offset by data

revenue growth and lower depreciation and amortization