AT&T Wireless 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 69

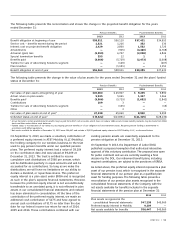

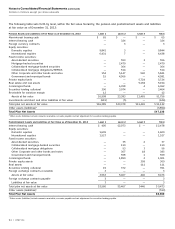

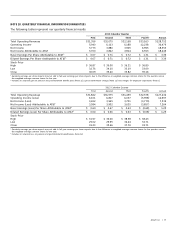

A summary of the status of our nonvested stock units as

of December 31, 2013, and changes during the year then

ended is presented as follows (shares in millions):

Weighted-Average

Nonvested Stock Units Shares Grant-Date Fair Value

Nonvested at January 1, 2013 26 $ 28.55

Granted 11 35.36

Vested (12) 27.99

Forfeited (1) 31.10

Nonvested at December 31, 2013 24 $31.93

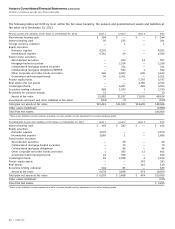

As of December 31, 2013, there was $348 of total

unrecognized compensation cost related to nonvested

share-based payment arrangements granted. That cost is

expected to be recognized over a weighted-average period

of 1.95 years. The total fair value of shares vested during

the year was $336 for 2013, compared to $333 for 2012

and $360 for 2011.

It is our policy to satisfy share option exercises using our

treasury stock. Cash received from stock option exercises

was $135 for 2013, $517 for 2012 and $250 for 2011.

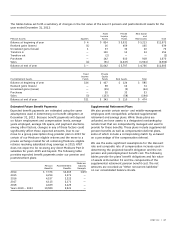

NOTE 14. STOCKHOLDERS’ EQUITY

Stock Repurchase Program From time to time, we

repurchase shares of common stock for distribution

through our employee benefit plans or in connection

with certain acquisitions. In December 2010, our Board of

Directors authorized the repurchase of 300 million shares

of our common stock. We began buying back stock under

this program in 2012 and completed the purchase of

authorized shares that year. In July 2012, our Board of

Directors approved a second authorization to repurchase

300 million shares and we completed that program in

May 2013. In March 2013, our Board of Directors

approved a third authorization to repurchase 300 million

shares, under which we are currently purchasing shares.

For the year ended December 31, 2013, we had

repurchased approximately 366 million shares totaling

$13,028 under these authorizations. For the year ended

December 31, 2012, we had repurchased approximately

371 million shares totaling $12,752 under these

authorizations. We expect to make future

repurchases opportunistically.

To implement these authorizations, we use open

market repurchase programs, relying on Rule 10b5-1

of the Securities Exchange Act of 1934 where feasible.

We also use accelerated share repurchase programs with

large financial institutions to repurchase our stock.

Authorized Shares There are 14 billion authorized

common shares of AT&T stock and 10 million authorized

preferred shares of AT&T stock. As of December 31, 2013

and 2012, no preferred shares were outstanding.

Dividend Declarations In December 2013, the Company

declared an increase in its quarterly dividend to $0.46 per

share of common stock. In November 2012, the Company

declared a quarterly dividend of $0.45 per share of common

stock, which reflected an increase from the $0.44 quarterly

dividend declared in December 2011.

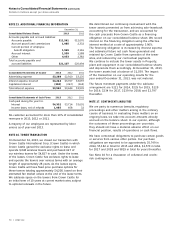

Preferred Equity Interest The preferred equity interest

discussed in Note 12 is not transferable by the trust

except through its put and call features, and therefore has

been eliminated in consolidation. After a period of five

years from the contribution or, if earlier, the date upon

which the pension plan trust is fully funded as determined

under GAAP, AT&T has a right to purchase from the

pension plan trust some or all of the preferred equity

interest at the greater of their fair market value or

minimum liquidation value plus any unpaid cumulative

dividends. In addition, AT&T will have the right to

purchase the preferred equity interest in the event

AT&T’s ownership of Mobility is less than 50% or there

is a transaction that results in the transfer of 50% or

more of the pension plan trust’s assets to an entity not

under common control with AT&T (collectively, a change

of control). The pension plan trust has the right to require

AT&T to purchase the preferred equity interest at the

greater of their fair market value or minimum liquidation

value plus any unpaid cumulative dividends, and in

installments, as specified in the contribution agreement

upon the occurrence of any of the following: (1) at

any time if the ratio of debt to total capitalization of

Mobility exceeds that of AT&T, (2) the date on which

AT&T Inc. is rated below investment grade for two

consecutive calendar quarters, (3) upon a change of

control if AT&T does not exercise its purchase option,

or (4) at any time after a seven-year period from the

contribution date. In the event AT&T elects or is required

to purchase the preferred equity interest, AT&T may elect

to settle the purchase price in cash or shares of AT&T

common stock or a combination thereof. Because the

preferred equity interest was not considered outstanding

for accounting purposes at year-end, it did not affect

the calculation of earnings per share.