AT&T Wireless 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 33

established interest rate risk limits that we closely monitor

by measuring interest rate sensitivities in our debt and

interest rate derivatives portfolios.

All our foreign-denominated long-term debt has been

swapped from fixed-rate foreign currencies to fixed-rate

U.S.dollars at issuance through cross-currency swaps,

removing interest rate risk and foreign currency exchange

risk associated with the underlying interest and principal

payments. Likewise, periodically we enter into interest

rate locks to partially hedge the risk of increases in the

benchmark interest rate during the period leading up to

the probable issuance of fixed-rate debt. We expect gains

or losses in our cross-currency swaps and interest rate

locks to offset the losses and gains in the financial

instruments they hedge.

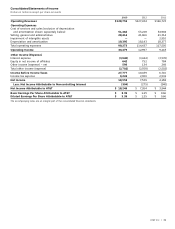

Following are our interest rate derivatives subject to

material interest rate risk as of December 31, 2013.

The interest rates illustrated below refer to the average

rates we expect to pay based on current and implied

forward rates and the average rates we expect to receive

based on derivative contracts. The notional amount is the

principal amount of the debt subject to the interest rate

swap contracts. The fair value asset (liability) represents

the amount we would receive (pay) if we had exited the

contracts as of December 31, 2013.

MARKET RISK

We are exposed to market risks primarily from changes

in interest rates and foreign currency exchange rates.

These risks, along with other business risks, impact

our cost of capital. It is our policy to manage our debt

structure and foreign exchange exposure in order to

manage capital costs, control financial risks and maintain

financial flexibility over the long term. In managing

market risks, we employ derivatives according to

documented policies and procedures, including interest

rate swaps, interest rate locks, foreign currency exchange

contracts and combined interest rate foreign currency

contracts (cross-currency swaps). We do not use

derivatives for trading or speculative purposes. We do

not foresee significant changes in the strategies we use

to manage market risk in the near future.

Interest Rate Risk

The majority of our financial instruments are medium-

and long-term fixed-rate notes and debentures. Changes

in interest rates can lead to significant fluctuations in the

fair value of these instruments. The principal amounts by

expected maturity, average interest rate and fair value

of our liabilities that are exposed to interest rate risk

are described in Notes 9 and 10. In managing interest

expense, we control our mix of fixed and floating rate debt,

principally through the use of interest rate swaps. We have

Maturity

Fair Value

2014 2015 2016 2017 2018 Thereafter Total 12/31/13

Interest Rate Derivatives

Interest Rate Swaps:

Receive Fixed/Pay Variable Notional

Amount Maturing $ 500 $1,500 $ — $ — $1,000 $1,750 $4,750 $184

Weighted-Average Variable Rate Payable1 2.3% 3.2% 4.8% 5.9% 7.3% 7.9%

Weighted-Average Fixed Rate Receivable 4.6% 5.1% 5.7% 5.7% 5.8% 5.8%

1 Interest payable based on current and implied forward rates for One, Three, or Six Month LIBOR plus a spread ranging between approximately 4 and 425 basis points.

Through cross-currency swaps, all our foreign-

denominated debt has been swapped from fixed-rate

foreign currencies to fixed-rate U.S. dollars at issuance,

removing interest rate risk and foreign currency exchange

risk associated with the underlying interest and principal

payments. We expect gains or losses in our cross-

currency swaps to offset the losses and gains in the

financial instruments they hedge.

Foreign Exchange Risk

We are exposed to foreign currency exchange risk through

our foreign affiliates and equity investments in foreign

companies. We do not hedge foreign currency translation

risk in the net assets and income we report from these

sources. However, we do hedge a portion of the exchange

risk involved in anticipation of highly probable foreign

currency-denominated transactions and cash flow

streams, such as those related to issuing foreign-

denominated debt, receiving dividends from foreign

investments, and other receipts and disbursements.