AT&T Wireless 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

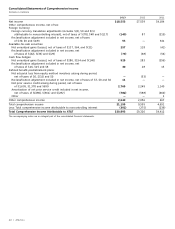

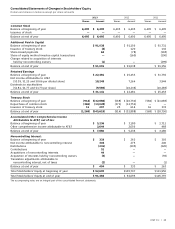

Dollars in millions except per share amounts

34 | AT&T Inc.

For the purpose of assessing specific risks, we use a

sensitivity analysis to determine the effects that market risk

exposures may have on the fair value of our financial

instruments and results of operations. To perform the

sensitivity analysis, we assess the risk of loss in fair values

from the effect of a hypothetical 10% depreciation of the

U.S. dollar against foreign currencies from the prevailing

foreign currency exchange rates, assuming no change in

interest rates. We had no foreign exchange forward

contracts outstanding at December 31, 2013.

In anticipation of other foreign currency-denominated

transactions, we often enter into foreign exchange

forward contracts to provide currency at a fixed rate.

Our policy is to measure the risk of adverse currency

fluctuations by calculating the potential dollar losses

resulting from changes in exchange rates that have a

reasonable probability of occurring. We cover the

exposure that results from changes that exceed

acceptable amounts.

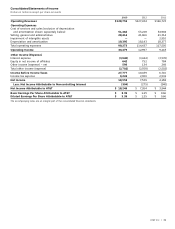

STOCK PERFORMANCE GRAPH

Comparison of Five Year Cumulative Total Return

AT&T Inc., S&P 500 Index, and S&P 500 Integrated Telecom Index

240

220

200

180

160

140

120

100

80

12/08 12/09 12/10 12/11 12/12 12/13

S&P 500 Integrated

Telecom Index

AT&T Inc. S&P 500 Index

126

128

165

117

150

105

157

174

137

106

126

145 149

172

228

The comparison above assumes $100 invested on December 31, 2008, in AT&T common stock, Standard & Poor’s 500 Index

(S&P 500), and Standard & Poor’s 500 Integrated Telecom Index (S&P 500 Integrated Telecom). Total return equals stock

price appreciation plus reinvestment of dividends.

The current U.S. economy has changed our customers’

buying habits and a failure to adequately respond could

materially adversely affect our business.

We provide services and products to consumers and large

and small businesses in the United States and to larger

businesses throughout the world. The current slow

economic recovery in the United States continues to

pressure our customers’ demand for and ability to pay

for existing services, especially local landline service, and

their interest in purchasing new services. Customers are

changing their buying habits in response to both ongoing

RISK FACTORS

In addition to the other information set forth in this

document, including the matters contained under the

caption “Cautionary Language Concerning Forward-

Looking Statements,” you should carefully read the matters

described below. We believe that each of these matters

could materially affect our business. We recognize that

most of these factors are beyond our ability to control and

therefore we cannot predict an outcome. Accordingly, we

have organized them by first addressing general factors,

then industry factors and, finally, items specifically

applicable to us.