AT&T Wireless 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

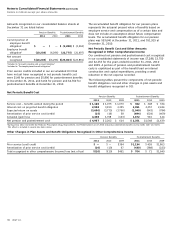

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

82 AT&T Inc.

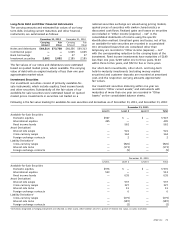

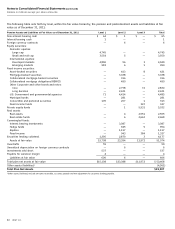

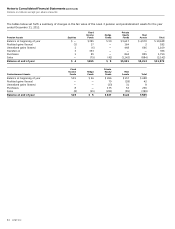

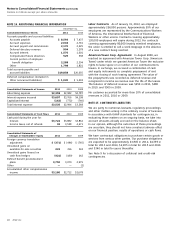

The following table sets forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at fair

value as of December 31, 2011:

Pension Assets and Liabilities at Fair Value as of December 31, 2011 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 64 $ 1 $ — $ 65

Interest bearing cash 1 — — 1

Foreign currency contracts — 6 — 6

Equity securities:

Domestic equities:

Large cap 4,745 — — 4,745

Small and mid cap 3,554 5 — 3,559

International equities:

Developed markets 4,890 56 3 4,949

Emerging markets 983 6 1 990

Fixed income securities:

Asset-backed securities — 413 8 421

Mortgage-backed securities — 3,038 — 3,038

Collateralized mortgage-backed securities — 316 — 316

Collateralized mortgage obligations/REMICS — 490 — 490

Other Corporate and other bonds and notes:

Core — 2,758 72 2,830

Long duration — 2,421 — 2,421

U.S. Government and governmental agencies 71 4,414 — 4,485

Municipal bonds — 281 — 281

Convertible and preferred securities 105 207 1 313

Fixed income funds — — 347 347

Private equity funds — 1 5,931 5,932

Real assets:

Real assets — 4 2,551 2,555

Real estate funds — 6 2,662 2,668

Commingled funds:

Interest bearing investments — 3,087 — 3,087

Hedge funds — 945 9 954

Equities — 1,117 — 1,117

Fixed income — 943 384 1,327

Securities lending collateral 1,295 2,879 3 4,177

Assets at fair value 15,708 23,394 11,972 51,074

Overdrafts 59 — — 59

Unrealized depreciation on foreign currency contracts — 6 — 6

Investments sold short 537 — — 537

Payable for variation margin 4 — — 4

Liabilities at fair value 600 6 — 606

Total plan net assets at fair value $15,108 $23,388 $11,972 $ 50,468

Other assets (liabilities)1 (4,561)

Total Plan Net Assets $45,907

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.