AT&T Wireless 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

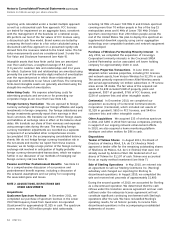

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

70 AT&T Inc.

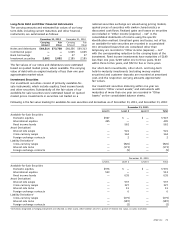

Current maturities of long-term debt include debt that may

be put back to us by the holders in 2012. We have $1,000

of annual put reset securities that may be put each April

until maturity in 2021. If the holders do not require us to

repurchase the securities, the interest rate will be reset based

on current market conditions. Likewise, we have an accreting

zero-coupon note that may be redeemed each May, until

maturity in 2022. If the zero-coupon note (issued for principal

of $500 in 2007) is held to maturity, the redemption amount

will be $1,030.

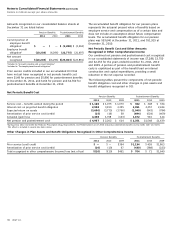

Debt maturing within one year consisted of the following at

December 31:

2011 2010

Current maturities of long-term debt1 $3,453 $5,544

Commercial paper — 1,625

Bank borrowings2 — 27

Total $3,453 $7,196

1 Current maturities of long-term debt does not include $1,200 of long-term debt,

which was called on January 13, 2012, and redeemed on February 15, 2012.

2 Outstanding balance of short-term credit facility of a foreign subsidiary.

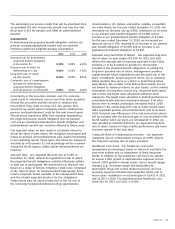

During 2011, we issued debt with net proceeds of $7,936

from the following:

•April2011issuanceof$1,750of2.95%globalnotesdue

2016 and $1,250 of 4.45% global notes due 2021.

•August2011issuanceof$1,500of2.40%globalnotes

due 2016, $1,500 of 3.875% global notes due 2021, and

$2,000 of 5.55% global notes due 2041.

Debt proceeds were used for general corporate purposes.

During 2011, debt repayments totaled $9,226 and consisted of:

•$4,543inrepaymentsoflong-termdebtwithaweighted-

average interest rate of 6.58%.

•$1,625inrepaymentsofcommercialpaper,netof

issuances.

•$1,000fortheearlyredemptionoftheSBC

Communications Inc. 5.875% global notes originally due

on February 1, 2012.

•$2,000fortheearlyredemptionoftheNewCingular

Wireless Services, Inc. 8.125% notes originally due on

May 1, 2012.

•$31inrepaymentsofcapitalizedleases.

•$27inrepaymentsofshort-termbankborrowings.

On February 13, 2012, we issued $1,000 of 0.875% global

notes due 2015, $1,000 of 1.60% global notes due 2017,

and $1,000 of 3.00% global notes due 2022.

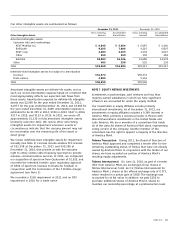

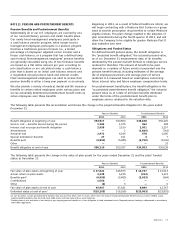

The following table is a reconciliation of our investments

in equity affiliates as presented on our consolidated balance

sheets:

2011 2010

Beginning of year $4,515 $2,921

Additional investments 35 220

Equity in net income of affiliates 784 762

Dividends received (161) (159)

Dispositions (660) (204)

Currency translation adjustments (515) 203

América Móvil equity adjustments (171) —

Telmex Internacional exchange — 658

Other adjustments (109) 114

End of year $3,718 $4,515

Undistributed earnings from equity affiliates were $5,760

and $5,137 at December 31, 2011 and 2010. The currency

translation adjustment for 2011 and 2010 reflects the effect

of exchange rate fluctuations on our investments in Telmex

and América Móvil.

The fair value of our investment in América Móvil, based

on the equivalent value of América Móvil L shares at

December 31, 2011, was $8,185.

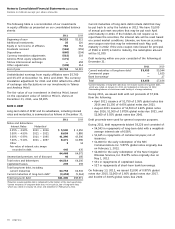

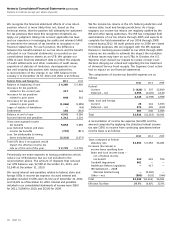

NOTE 8. DEBT

Long-term debt of AT&T and its subsidiaries, including interest

rates and maturities, is summarized as follows at December 31:

2011 2010

Notes and debentures

Interest Rates Maturities1

0.35% – 2.99% 2011 – 2016 $ 5,500 $ 2,250

3.00% – 4.99% 2011 – 2021 8,659 5,880

5.00% – 6.99% 2011 – 2095 41,390 43,506

7.00% – 9.10% 2011 – 2097 8,471 11,986

Other 3 14

Fair value of interest rate swaps

recorded in debt 445 435

64,468 64,071

Unamortized premium, net of discount 46 185

Total notes and debentures 64,514 64,256

Capitalized leases 239 259

Total long-term debt, including

current maturities 64,753 64,515

Current maturities of long-term debt2 (3,453) (5,544)

Total long-term debt $61,300 $58,971

1 Maturities assume putable debt is redeemed by the holders at the next opportunity.

2 Current maturities of long-term debt does not include $1,200 of long-term debt,

which was called on January 13, 2012, and redeemed on February 15, 2012.