AT&T Wireless 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 65

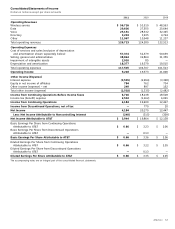

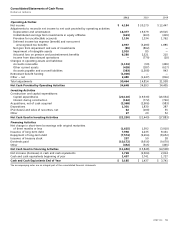

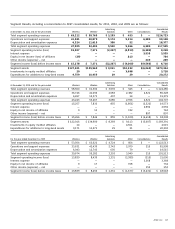

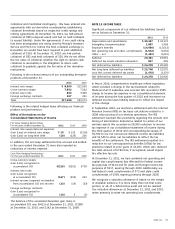

NOTE 3. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of

basic earnings per share and diluted earnings per share for

income from continuing operations for the years ended

December 31, 2011, 2010 and 2009, are shown in the

table below:

Year Ended December 31, 2011 2010 2009

Numerators

Numerator for basic earnings

per share:

Income from continuing

operations $4,184 $19,400 $12,427

Income attributable to

noncontrolling interest (240) (315) (309)

Income from continuing

operations attributable to AT&T 3,944 19,085 12,118

Dilutive potential common shares:

Other share-based payment 11 11 10

Numerator for diluted earnings

per share $3,955 $19,096 $12,128

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number of

common shares outstanding 5,928 5,913 5,900

Dilutive potential common

shares:

Stock options 4 3 3

Other share-based payment

(in shares) 18 22 21

Denominator for diluted

earnings per share 5,950 5,938 5,924

Basic earnings per share

from continuing operations

attributable to AT&T $ 0.66 $ 3.23 $ 2.06

Basic earnings per share from

discontinued operations

attributable to AT&T — 0.13 —

Basic earnings per share

attributable to AT&T $ 0.66 $ 3.36 $ 2.06

Diluted earnings per share

from continuing operations

attributable to AT&T $ 0.66 $ 3.22 $ 2.05

Diluted earnings per share from

discontinued operations

attributable to AT&T — 0.13 —

Diluted earnings per share

attributable to AT&T $ 0.66 $ 3.35 $ 2.05

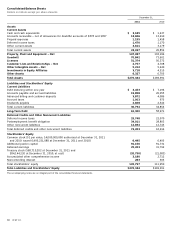

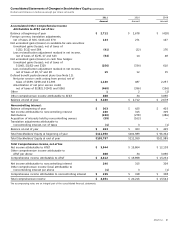

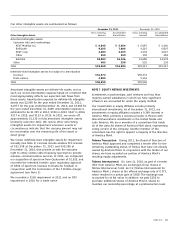

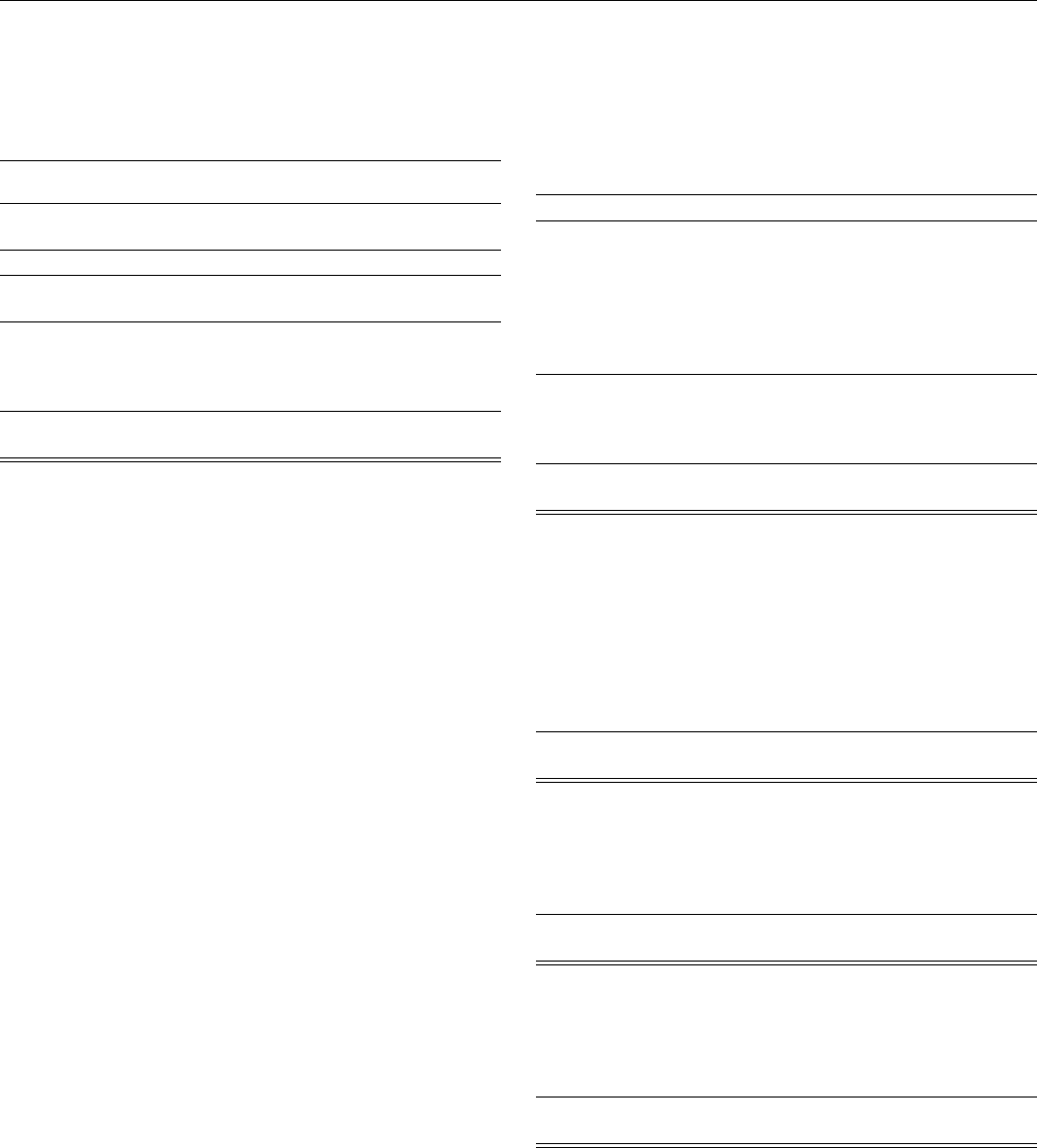

The following table includes Sterling’s operating results, which

are presented in the “Income From Discontinued Operations,

net of tax” line item on the consolidated statements of

income. Prior to the reclassification, these operating results

were reported in our Other segment:

Aug. 27, Dec. 31,

2010 2009

Operating revenues $349 $563

Operating expenses 327 523

Operating income 22 40

Income before income taxes 18 29

Income tax expense 8 9

Income from discontinued operations

during phase-out period 10 20

Gain on disposal of discontinued

operations 769 —

Income from discontinued

operations, net of tax $779 $ 20

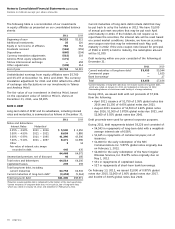

Centennial In August 2010, we sold operations in eight

service areas in Louisiana and Mississippi, as required by the

Department of Justice (DOJ), for $273 in cash.

Other Dispositions In 2010, we also sold our domestic

Japanese outsourcing services company for $109. In 2009, we

sold a professional services business for $174 and eliminated

$113 of goodwill.

Other Adjustments

T-Mobile In March 2011, we agreed to acquire from

Deutsche Telekom AG (Deutsche Telekom) all shares of

T-Mobile USA, Inc. (T-Mobile) for approximately $39,000,

subject to certain adjustments. In December 2011, in light

of opposition to the merger from the DOJ and FCC, we and

Deutsche Telekom agreed to terminate the transaction.

Pursuant to the purchase agreement, we paid a breakup fee

of $3,000, entered into a broadband roaming agreement and,

pursuant to regulatory approvals, will transfer certain wireless

spectrum with a book value of $962. These agreement

termination charges were included in “Selling, general and

administrative” expenses in our Other segment. Termination of

the purchase agreement also terminated our associated credit

agreement with a group of banks, dated as of March 31, 2011,

to partially fund the purchase.

During 2010, we recorded $78 in reductions of Dobson

Communications Corporation and BellSouth Corporation

(BellSouth) restructuring liabilities previously included in the

purchase accounting for those deals, and we recorded an

offsetting reduction of goodwill.