AT&T Wireless 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

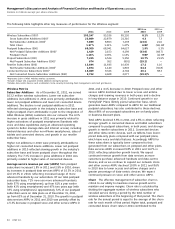

AT&T Inc. 37

Wireline

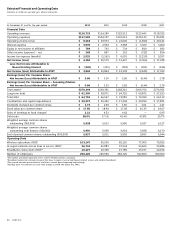

Segment Results

Percent Change

2011 vs. 2010 vs.

2011 2010 2009 2010 2009

Segment operating revenues

Data $29,606 $27,555 $25,644 7.4% 7.5%

Voice 25,131 28,332 32,345 (11.3) (12.4)

Other 5,028 5,413 5,632 (7.1) (3.9)

Total Segment Operating Revenues 59,765 61,300 63,621 (2.5) (3.6)

Segment operating expenses

Operations and support 40,879 41,096 42,439 (0.5) (3.2)

Depreciation and amortization 11,615 12,371 12,743 (6.1) (2.9)

Total Segment Operating Expenses 52,494 53,467 55,182 (1.8) (3.1)

Segment Operating Income 7,271 7,833 8,439 (7.2) (7.2)

Equity in Net Income of Affiliates — 11 17 — (35.3)

Segment Income $ 7,271 $ 7,844 $ 8,456 (7.3)% (7.2)%

U-verse customers are shifting from traditional landlines

and DSL to our U-verse VoIP and High Speed Internet

access offerings. The increase in IP data revenues in

2011 and 2010 reflects continued growth in the

customer base and migration from other traditional

data and voice circuit-based services.

•Traditionalpacket-switcheddataservices,whichinclude

frame relay and asynchronous transfer mode services,

decreased $367, or 23.2%, in 2011 and $431, or 21.4%,

in 2010. This decrease was primarily due to lower

demand as customers continue to shift to IP-based

technology such as Virtual Private Networks (VPN),

U-verse High Speed Internet access and managed

Internet services. We expect these traditional services

to continue to decline as a percentage of our overall

data revenues.

Voice revenues decreased $3,201, or 11.3%, in 2011 and

$4,013, or 12.4%, in 2010 primarily due to declining demand

for traditional voice services by our consumer and business

customers. Included in voice revenues are revenues from

local voice, long distance (including international) and local

wholesale services. Voice revenues do not include VoIP

revenues, which are included in data revenues.

•Localvoicerevenuesdecreased$2,061,or11.8%,in

2011 and $2,258, or 11.4%, in 2010. The decrease

in 2011 was driven primarily by a 12.3% decline in

switched access lines. The decrease in 2010 was driven

primarily by an 11.9% decline in switched access lines

and a decrease in average local voice revenue per user.

We expect our local voice revenue to continue to be

negatively affected by competition from alternative

technologies and the disconnection of additional lines.

Operating Results

Our Wireline segment operating income margin was 12.2%

in 2011, compared to 12.8% in 2010 and 13.3% in 2009.

Results for 2011 and 2010 reflect revenue declines that

exceeded expense declines. Our Wireline segment operating

income decreased $562, or 7.2%, in 2011 and $606, or 7.2%,

in 2010. Our operating income and margins continued to be

pressured by access line declines as our consumer and

business customers either reduced usage or disconnected

traditional landline services and switched to alternative

technologies, such as wireless and VoIP. Our strategy is to

offset these line losses by increasing non-access-line-related

revenues from customer connections for data, video and

U-verse voice. Additionally, we have the opportunity to

increase Wireless segment revenues if customers choose

AT&T Mobility as an alternative provider. The Wireline segment

operating margins also reflect increases in data revenue

growth and decreases in employee-related cost, driven by

continuing cost-control initiatives and workforce reductions.

Data revenues increased $2,051, or 7.4%, in 2011 and $1,911,

or 7.5%, in 2010. Data revenues accounted for approximately

50% of wireline operating revenues in 2011, 45% in 2010 and

40% in 2009. Data revenues include transport, IP and packet-

switched data services.

•IPdatarevenuesincreased$2,502,or16.1%,in2011and

$2,495, or 19.1%, in 2010 primarily driven by U-verse

services, broadband additions and growth in IP-based

strategic business services, which include Ethernet and

application services. U-verse video revenues increased

$1,150 in 2011 and $1,227 in 2010, strategic business

services increased $873 in 2011 and $650 in 2010 and

broadband high-speed Internet access revenue increased

$364 in 2011 and $446 in 2010. New and existing