AT&T Wireless 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 73

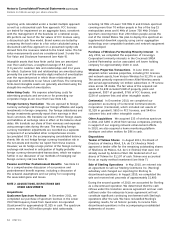

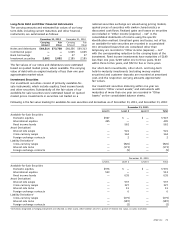

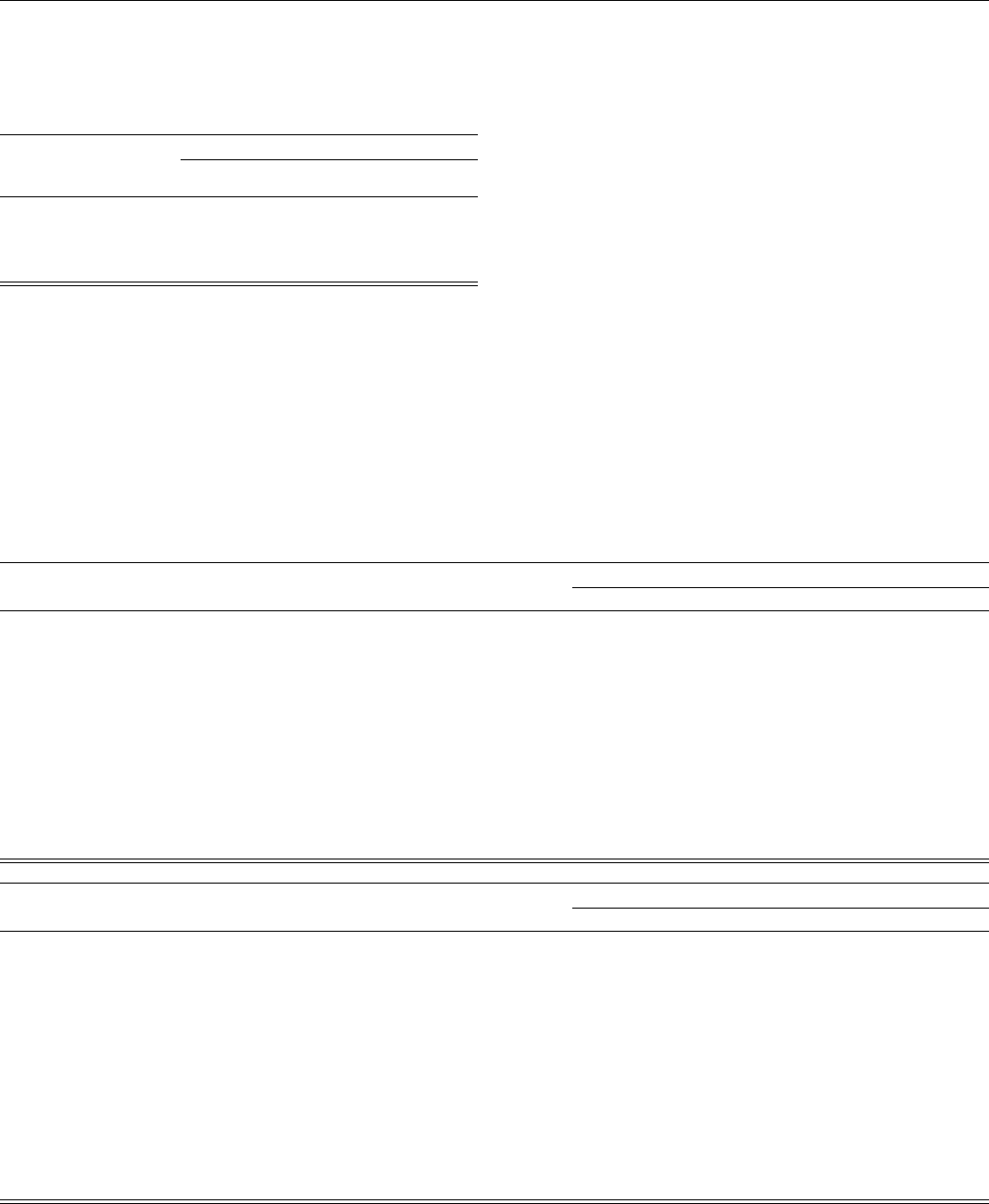

Long-Term Debt and Other Financial Instruments

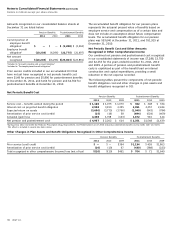

The carrying amounts and estimated fair values of our long-

term debt, including current maturities and other financial

instruments, are summarized as follows:

December 31, 2011 December 31, 2010

Carrying Fair Carrying Fair

Amount Value Amount Value

Notes and debentures $64,514 $73,738 $64,256 $69,313

Commercial paper — — 1,625 1,625

Bank borrowings — — 27 27

Investment securities 2,092 2,092 2,185 2,185

The fair values of our notes and debentures were estimated

based on quoted market prices, where available. The carrying

value of debt with an original maturity of less than one year

approximates market value.

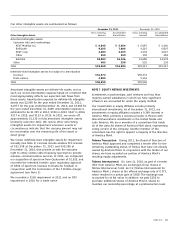

Investment Securities

Our investment securities consist of primarily available-for-

sale instruments, which include equities, fixed income bonds

and other securities. Substantially all the fair values of our

available-for-sale securities were estimated based on quoted

market prices. Investments in securities not traded on a

national securities exchange are valued using pricing models,

quoted prices of securities with similar characteristics or

discounted cash flows. Realized gains and losses on securities

are included in “Other income (expense) – net” in the

consolidated statements of income using the specific

identification method. Unrealized gains and losses, net of tax,

on available-for-sale securities are recorded in accumulated

OCI. Unrealized losses that are considered other than

temporary are recorded in “Other income (expense) – net”

with the corresponding reduction to the carrying basis of the

investment. Fixed income investments have maturities of $149

less than one year, $228 within one to three years, $103

within three to five years, and $82 for five or more years.

Our short-term investments, other short- and long-term

held-to-maturity investments (including money market

securities) and customer deposits are recorded at amortized

cost, and the respective carrying amounts approximate

fair values.

Our investment securities maturing within one year are

recorded in “Other current assets,” and instruments with

maturities of more than one year are recorded in “Other

Assets” on the consolidated balance sheets.

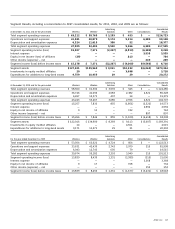

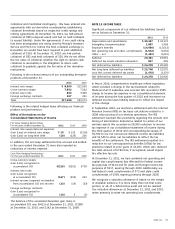

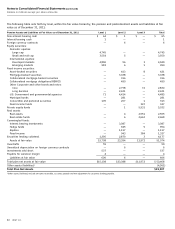

Following is the fair value leveling for available-for-sale securities and derivatives as of December 31, 2011, and December 31, 2010:

December 31, 2011

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $947 $ — $ — $ 947

International equities 495 — — 495

Fixed income bonds — 562 — 562

Asset Derivatives1

Interest rate swaps — 521 — 521

Cross-currency swaps — 144 — 144

Foreign exchange contracts — 2 — 2

Liability Derivatives1

Cross-currency swaps — (820) — (820)

Interest rate locks — (173) — (173)

Foreign exchange contracts — (9) — (9)

December 31, 2010

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $976 $ — $ — $ 976

International equities 513 — — 513

Fixed income bonds — 639 — 639

Asset Derivatives1

Interest rate swaps — 537 — 537

Cross-currency swaps — 327 — 327

Interest rate locks — 11 — 11

Foreign exchange contracts — 6 — 6

Liability Derivatives1

Cross-currency swaps — (675) — (675)

Interest rate locks — (187) — (187)

Foreign exchange contracts — (2) — (2)

1

Derivatives designated as hedging instruments are reflected as other assets, other liabilities and, for a portion of interest rate swaps, accounts receivable.