AT&T Wireless 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

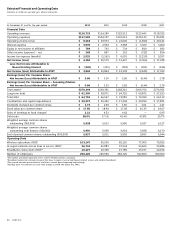

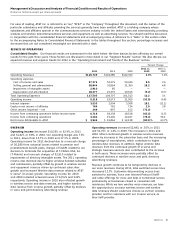

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

40 AT&T Inc.

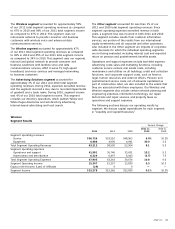

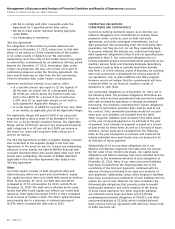

Our Other segment also includes our equity investments in

América Móvil and Telmex, the income from which we report

as equity in net income of affiliates. Our earnings from foreign

affiliates are sensitive to exchange-rate changes in the value

of the respective local currencies. Our equity in net income

of affiliates by major investment is listed below:

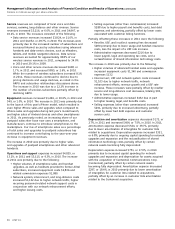

2011 2010 2009

América Móvil $720 $560 $505

Telmex1 95 150 133

Telmex Internacional2 — 34 72

Other (2) (2) (2)

Other Segment Equity in

Net Income of Affiliates $813 $742 $708

1Acquired by América Móvil in 2011

2Acquired by América Móvil in 2010

Equity in net income of affiliates increased $71, or 9.6%, in

2011 and $34, or 4.8%, for 2010. Increased equity in net

income of affiliates in both years was due to higher operating

results at América Móvil, partially offset by lower results at

Telmex in 2011. In November 2011, we tendered all of our

shares in Telmex as part of América Móvil’s acquisition of

the outstanding shares of Telmex.

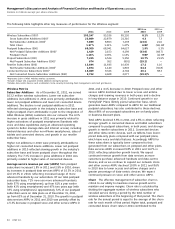

OPERATING ENVIRONMENT AND TRENDS OF THE BUSINESS

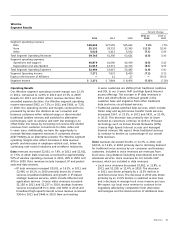

2012 Revenue Trends We expect our operating

environment in 2012 to remain challenging as weak economic

conditions continue and competition remains strong. Despite

these challenges, we expect our operating revenues in 2012

to grow, reflecting continuing growth in our wireless data

and IP-related wireline data services, including U-verse

and strategic business services. We expect our primary

driver of growth to be wireless, especially in sales of and

increases in data usage on smartphones and emerging

devices (such as tablets, eReaders and mobile navigation

devices). We expect that all our major customer categories

will continue to increase their use of Internet-based

broadband/data services. We expect continuing declines

in traditional access lines and in print directory advertising.

Where available, our U-verse services have proved effective

in stemming access line losses, and we expect to continue

to expand our U-verse service offerings in 2012.

2012 Expense Trends We will continue to focus sharply

on cost-control measures. We will continue our ongoing

initiatives to improve customer service and billing so we

can realize our strategy of bundling services and providing

a simple customer experience. We expect our 2012 operating

income margin to improve as our revenues improve.

Expenses related to growth areas of our business, especially

in the wireless and strategic business services areas, will

apply some pressure to our operating income margin.

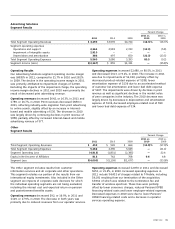

Market Conditions During 2011, the securities and fixed

income markets and the banking system in general continued

to stabilize, although bank lending and the housing industry

remained weak. The ongoing weakness in the general

economy has also affected our customer and supplier bases.

We saw lower demand from our residential customers as

well as our business customers at all organizational sizes.

Some of our suppliers continue to experience increased

financing and operating costs. These negative economic

trends were partially offset by continued growth in our

wireless data and IP-related services. While the economy

appears to have stabilized, we do not expect a return to

historical growth levels during 2012. Should the economy

instead deteriorate further, we likely will experience further

pressure on pricing and margins as we compete for both

wireline and wireless customers who have less discretionary

income. We also may experience difficulty purchasing

equipment in a timely manner or maintaining and replacing

equipment under warranty from our suppliers.

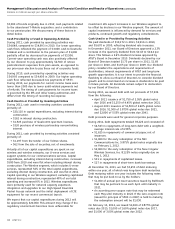

Included on our consolidated balance sheets are assets

held by benefit plans for the payment of future benefits.

We contributed $1,000 to our pension plan in the fourth

quarter of 2011 and are not required to make further

significant funding contributions to our pension plans in

2012. However, because our pension plans are subject to

funding requirements of the Employee Retirement Income

Security Act of 1974, as amended (ERISA), a continued

weakness in the equity, fixed income and real asset markets

could require us in future years to make contributions to

the pension plans in order to maintain minimum funding

requirements as established by ERISA. Investment returns on

these assets depend largely on trends in the U.S. securities

markets and the U.S. economy. In addition, our policy of

recognizing actuarial gains and losses related to our pension

and other postretirement plans in the period in which they

arise subjects us to earnings volatility caused by changes in

market conditions. Changes in our discount rate, which are

tied to changes in the bond market and changes in the

performance of equity markets, may have significant impacts

on the fair value of pension and other postretirement plans

at the end of 2012 (see “Significant Accounting Policies

and Estimates”).

OPERATING ENVIRONMENT OVERVIEW

AT&T subsidiaries operating within the United States are

subject to federal and state regulatory authorities. AT&T

subsidiaries operating outside the United States are subject

to the jurisdiction of national and supranational regulatory

authorities in the markets where service is provided, and

regulation is generally limited to operational licensing

authority for the provision of services to enterprise customers.

In the Telecommunications Act of 1996 (Telecom Act),

Congress established a national policy framework intended

to bring the benefits of competition and investment in

advanced telecommunications facilities and services to all

Americans by opening all telecommunications markets to

competition and reducing or eliminating regulatory burdens