AT&T Wireless 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

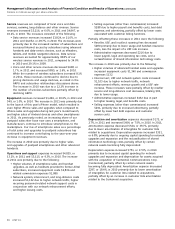

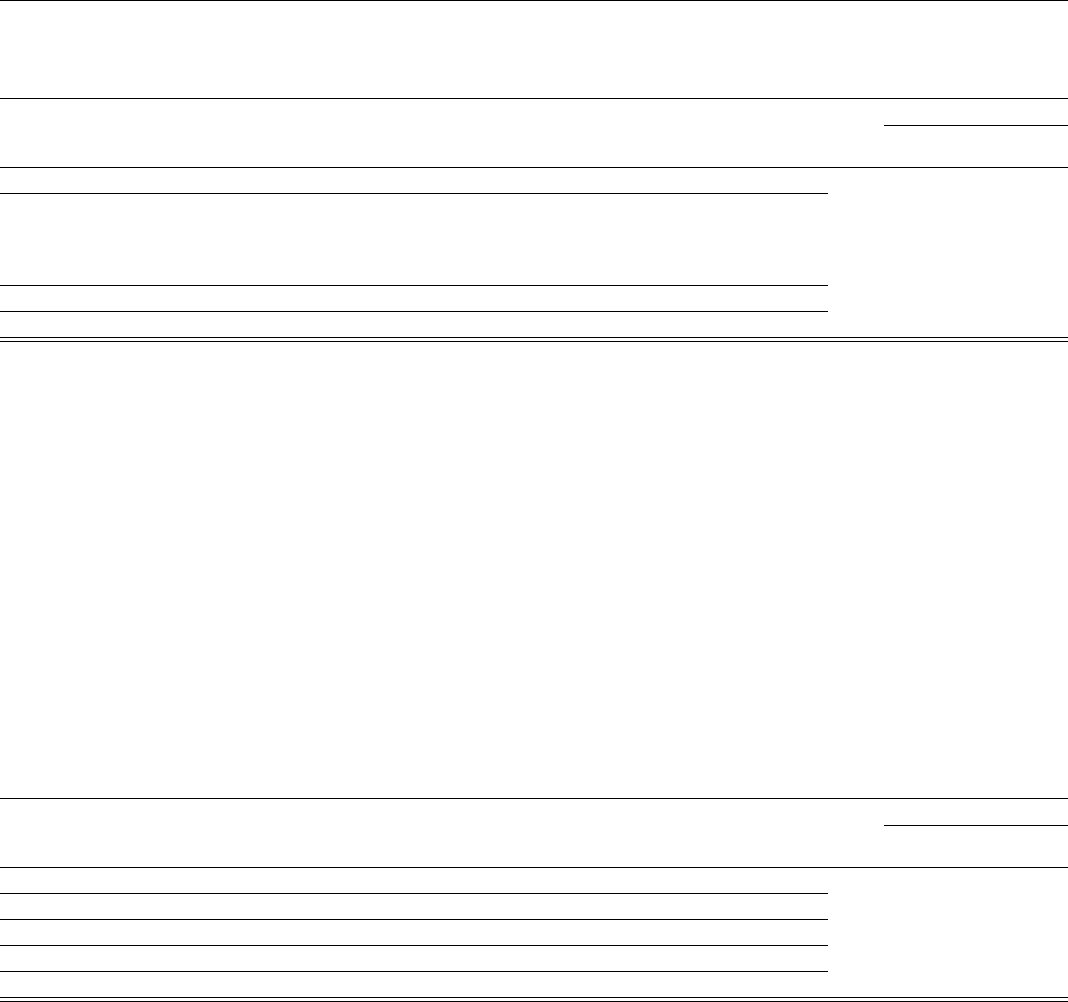

AT&T Inc. 39

Advertising Solutions

Segment Results

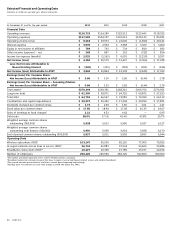

Percent Change

2011 vs. 2010 vs.

2011 2010 2009 2010 2009

Total Segment Operating Revenues $ 3,293 $3,935 $4,724 (16.3)% (16.7)%

Segment operating expenses

Operations and support 2,264 2,583 2,743 (12.3) (5.8)

Impairment of intangible assets 2,910 — — — —

Depreciation and amortization 386 497 650 (22.3) (23.5)

Total Segment Operating Expenses 5,560 3,080 3,393 80.5 (9.2)

Segment Income (Loss) $(2,267) $ 855 $1,331 — (35.8)%

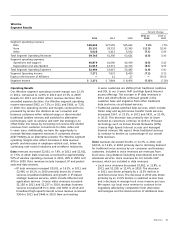

Operating expenses increased $2,480, or 80.5%, in 2011

and decreased $313, or 9.2%, in 2010. The increase in 2011

was due to impairments of $2,910, partially offset by

decreased product-related expense of $188, lower

amortization expense of $136 due to an accelerated method

of customer list amortization and lower bad debt expense

of $107. The impairments were driven by declines in print

revenue as well as significant declines in the market value

of peer companies in the industry. The 2010 decrease was

largely driven by decreases in depreciation and amortization

expense of $136, decreased employee-related cost of $99

and lower bad debt expense of $34.

Operating Results

Our Advertising Solutions segment operating income margin

was (68.8)% in 2011, compared to 21.7% in 2010 and 28.2%

in 2009. The decline in the operating income margin in 2011

was primarily attributed to impairment charges of $2,910.

Excluding the impacts of the impairment charge, the operating

income margin declines in 2011 and 2010 were primarily the

result of decreased print advertising revenue.

Operating revenues decreased $642, or 16.3%, in 2011 and

$789, or 16.7%, in 2010. Print revenues decreased $680 in

2011, reflecting industry-wide migration from print advertising

to online search, slightly offset by an increase in Internet-

based and mobile advertising of $30. The decrease in 2010

was largely driven by continuing declines in print revenue of

$858, partially offset by increased Internet-based and mobile

advertising revenue of $77.

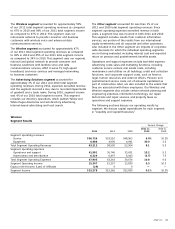

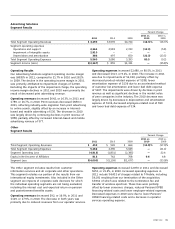

Other

Segment Results

Percent Change

2011 vs. 2010 vs.

2011 2010 2009 2010 2009

Total Segment Operating Revenues $ 453 $ 545 $ 664 (16.9)% (17.9)%

Total Segment Operating Expenses 5,266 2,396 3,049 — (21.4)

Segment Operating Loss (4,813) (1,851) (2,385) — 22.4

Equity in Net Income of Affiliates 813 742 708 9.6 4.8

Segment Loss $(4,000) $(1,109) $(1,677) — (33.9)%

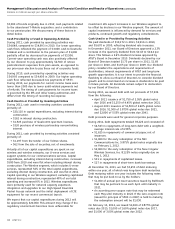

Operating expenses increased $2,870 in 2011 and decreased

$653, or 21.4%, in 2010. Increased operating expenses in

2011 include $4,432 of charges related to T-Mobile, including

$4,181 resulting from our termination of the acquisition,

$3,962 of which was related to the termination fee and

transfer of wireless spectrum. These fees were partially

offset by lower severance charges, reduced Pension/OPEB

financing-related costs and lower employee-related expenses.

Decreased expenses in 2010 were due to lower Pension/

OPEB financing-related costs and a decrease in operator

services operating expense.

The Other segment includes results from customer

information services and all corporate and other operations.

This segment includes our portion of the results from our

international equity investments. Also included in the Other

segment are impacts of corporate-wide decisions for which

the individual operating segments are not being evaluated,

including the interest cost and expected return on pension

and postretirement benefits assets.

Operating revenues decreased $92, or 16.9%, in 2011 and

$119, or 17.9%, in 2010. The decrease in both years was

primarily due to reduced revenues from our operator services.