AT&T Wireless 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 47

We plan to deploy this spectrum as supplemental downlink

capacity, using carrier aggregation technology once

compatible handsets and network equipment are developed.

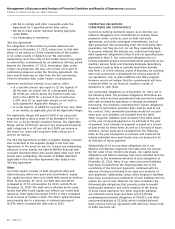

T-Mobile In March 2011, we agreed to acquire from

Deutsche Telekom AG (Deutsche Telekom) all of the shares

of T-Mobile for approximately $39,000, subject to certain

adjustments. In December 2011, in light of opposition to the

merger from the DOJ and FCC, we and Deutsche Telekom

agreed to terminate the transaction. Pursuant to the purchase

agreement, we paid a breakup fee of $3,000, entered into

a broadband roaming agreement and, pursuant to required

regulatory approvals, are in the process of transferring to

Deutsche Telekom certain wireless spectrum. Termination of

the purchase agreement also terminated our associated credit

agreement with a group of banks, dated as of March 31, 2011,

to partially fund the purchase.

Tender of Telmex Shares In August 2011, the Board of

Directors of América Móvil approved a tender offer for the

remaining outstanding shares of Telmex that were not already

owned by América Móvil. The offer was for $10.50 Mexican

pesos per share (payable in cash). The tender offer was

launched in October 2011, and we tendered all of our shares

for $1,197 of cash.

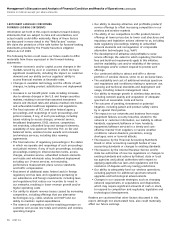

Labor Contracts As of January 31, 2012, we employed

approximately 256,000 persons. Approximately 55% of our

employees are represented by the Communications Workers

of America, the International Brotherhood of Electrical

Workers or other unions. Contracts covering approximately

120,000 employees will expire during 2012. For contracts

covering approximately 80,000 (mainly wireline) employees,

the union is entitled to call a work stoppage in the absence

of a new contract being reached.

Environmental We are subject from time to time to

judicial and administrative proceedings brought by various

governmental authorities under federal, state or local

environmental laws. Although we are required to reference in

our Forms 10-Q and 10-K any of these proceedings that could

result in monetary sanctions (exclusive of interest and costs)

of one hundred thousand dollars or more, we do not believe

that any of them currently pending will have a material

adverse effect on our results of operations.

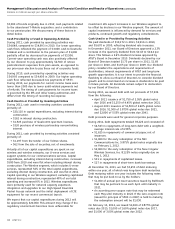

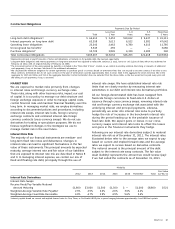

LIQUIDITY AND CAPITAL RESOURCES

We had $3,185 in cash and cash equivalents available at

December 31, 2011. Cash and cash equivalents included

cash of $1,182 and money market funds and other cash

equivalents of $2,003. Cash and cash equivalents increased

$1,748 since December 31, 2010. During 2011, cash inflows

were primarily provided by cash receipts from operations and

cash received from our tender of Telmex shares. These inflows

were largely offset by cash used to meet the needs of the

business, including but not limited to, payment of operating

expenses, funding capital expenditures, dividends to

stockholders and the acquisition of wireless spectrum; a net

reduction of debt, including our redemption of approximately

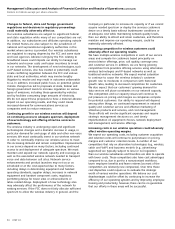

seeking to enjoin the immunity provision’s application on

grounds that it is unconstitutional was filed. In March 2009,

we and the Government filed motions to dismiss this lawsuit.

The court granted the motion to dismiss and entered final

judgment in July 2009. All cases brought against the AT&T

entities have been dismissed. In August 2009, plaintiffs in all

cases filed an appeal with the Ninth Circuit Court of Appeals.

On December 29, 2011, the Ninth Circuit Court of Appeals

affirmed the dismissals in all cases. Management believes

that any further appeal is without merit and intends to

continue to defend these matters vigorously.

Universal Service Fees Litigation In October 2010, our

wireless subsidiary was served with a purported class action

in Circuit Court, Cole County, Missouri (MBA Surety Agency,

Inc. v. AT&T Mobility, LLC), in which the plaintiffs contend that

we violated the FCC’s rules by collecting Universal Service

Fees on certain services not subject to such fees, including

Internet access service provided over wireless handsets

commonly called “smartphones” and wireless data cards, as

well as collecting certain other state and local fees. Plaintiffs

define the class as all persons who from April 1, 2003,

until the present had a contractual relationship with us for

Internet access through a smartphone or a wireless data card.

Plaintiffs seek an unspecified amount of damages as well

as injunctive relief. We believe that an adverse outcome

having a material effect on our financial statements in this

case is unlikely.

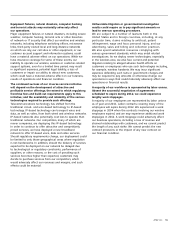

Wage and Hour Litigation Two wage and hour cases were

filed in federal court in December 2009 each asserting claims

under the Fair Labor Standards Act (Luque et al. v. AT&T Corp.

et al., U.S. District Court in the Northern District of California)

(Lawson et al. v. BellSouth Telecommunications, Inc., U.S.

District Court in the Northern District of Georgia). Luque also

alleges violations of a California wage and hour law, which

varies from the federal law. In each case, plaintiffs allege that

certain groups of wireline supervisory managers were entitled

to paid overtime and seek class action status as well as

damages, attorneys’ fees and/or penalties. Plaintiffs have been

granted conditional collective action status for their federal

claims and also are expected to seek class action status for

their state law claims. We are contesting the collective and

class action treatment of the claims, the merits of the claims

and the method of calculating damages for the claims. A jury

verdict recently was entered in favor of the Company in the

U.S. District Court in Connecticut on similar FLSA claims.

We believe that an adverse outcome in these cases having

a material effect on our financial statements is unlikely.

Qualcomm Spectrum Purchase In December 2011, we

completed our purchase of spectrum licenses in the Lower

700 MHz frequency band from Qualcomm Incorporated for

approximately $1,925 in cash. The spectrum covers more than

300 million people total nationwide, including 12 MHz of

Lower 700 MHz D and E block spectrum covering more than

70 million people in five of the top 15 metropolitan areas and

6 MHz of Lower 700 MHz D block spectrum covering more

than 230 million people across the rest of the United States.