AT&T Wireless 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 75

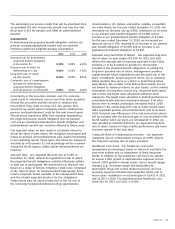

NOTE 10. INCOME TAXES

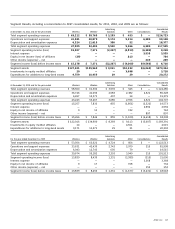

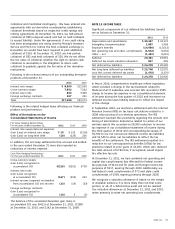

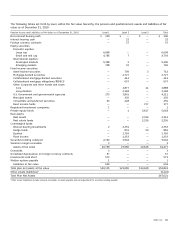

Significant components of our deferred tax liabilities (assets)

are as follows at December 31:

2011 2010

Depreciation and amortization $ 39,367 $ 34,172

Intangibles (nonamortizable) 1,897 1,958

Employee benefits (14,950) (13,612)

Net operating loss and other carryforwards (1,502) (1,552)

Other – net (1,451) (1,015)

Subtotal 23,361 19,951

Deferred tax assets valuation allowance 917 949

Net deferred tax liabilities $ 24,278 $ 20,900

Net long-term deferred tax liabilities $ 25,748 $ 22,070

Less: Net current deferred tax assets (1,470) (1,170)

Net deferred tax liabilities $ 24,278 $ 20,900

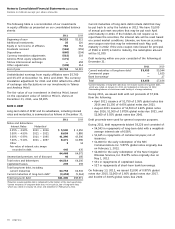

In March 2010, comprehensive healthcare reform legislation,

which included a change in the tax treatment related to

Medicare Part D subsidies, was enacted. We recorded a $995

charge to income tax expense in our consolidated statement

of income during the first quarter of 2010 and increased our

deferred income taxes liability balance to reflect the impact

of this change.

In September 2010, we reached a settlement with the Internal

Revenue Service (IRS) on tax basis calculations related to a

2008 restructuring of our wireless operations. The IRS

settlement resolved the uncertainty regarding the amount and

timing of amortization deductions related to certain of our

wireless assets. We recorded an $8,300 reduction to income

tax expense in our consolidated statement of income during

the third quarter of 2010 and corresponding decreases of

$6,760 to our net noncurrent deferred income tax liabilities

and $1,540 to other net tax liabilities to reflect the tax

benefits of the settlement. The IRS settlement resulted in a

reduction to our unrecognized tax benefits (UTBs) for tax

positions related to prior years of $1,057, which also reduced

the total amount of UTBs that, if recognized, would impact

the effective tax rate.

At December 31, 2011, we had combined net operating and

capital loss carryforwards (tax effected) for federal income

tax purposes of $114 and for state and foreign income tax

purposes of $917, expiring through 2030. Additionally, we

had federal credit carryforwards of $73 and state credit

carryforwards of $398, expiring primarily through 2028.

We recognize a valuation allowance if, based on the weight

of available evidence, it is more likely than not that some

portion, or all, of a deferred tax asset will not be realized.

Our valuation allowances at December 31, 2011 and 2010,

relate primarily to state net operating loss carryforwards.

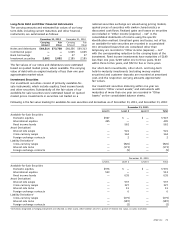

Collateral and Credit-Risk Contingency We have entered into

agreements with our derivative counterparties establishing

collateral thresholds based on respective credit ratings and

netting agreements. At December 31, 2011, we had posted

collateral of $98 (a deposit asset) and had no held collateral

(a receipt liability). Under the agreements, if our credit rating

had been downgraded one rating level by Moody’s Investors

Service and Fitch, Inc. before the final collateral exchange in

December, we would have been required to post additional

collateral of $161. At December 31, 2010, we had posted

collateral of $82 and held collateral of $26. We do not offset

the fair value of collateral, whether the right to reclaim cash

collateral (a receivable) or the obligation to return cash

collateral (a payable), against the fair value of the derivative

instruments.

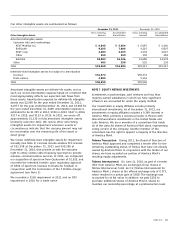

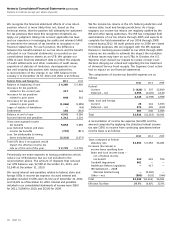

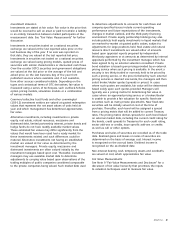

Following is the notional amount of our outstanding derivative

positions at December 31:

2011 2010

Interest rate swaps $ 8,800 $11,050

Cross-currency swaps 7,502 7,502

Interest rate locks 800 3,400

Foreign exchange contracts 207 221

Total $17,309 $22,173

Following is the related hedged items affecting our financial

position and performance:

Effect of Derivatives on the

Consolidated Statements of Income

Fair Value Hedging Relationships

For the years ended December 31, 2011 2010 2009

Interest rate swaps (Interest expense):

Gain (Loss) on interest rate swaps $ 10 $ 125 $(216)

Gain (Loss) on long-term debt (10) (125) 216

In addition, the net swap settlements that accrued and settled

in the year ended December 31 were also reported as

reductions of interest expense.

Cash Flow Hedging Relationships

For the year ended December 31, 2011 2010 2009

Cross-currency swaps:

Gain (Loss) recognized in

accumulated OCI $(219) $(201) $738

Interest rate locks:

Gain (Loss) recognized

in accumulated OCI (167) (320) 203

Interest income (expense) reclassified

from accumulated OCI into income (23) (19) (23)

Foreign exchange contracts:

Gain (Loss) recognized in

accumulated OCI (10) 5 (2)

The balance of the unrealized derivative gain (loss) in

accumulated OCI was $(421) at December 31, 2011, $(180)

at December 31, 2010, and $142 at December 31, 2009.