AT&T Wireless 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

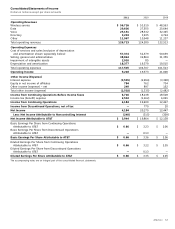

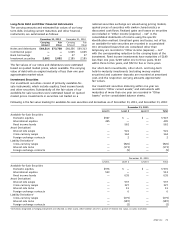

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

64 AT&T Inc.

including 12 MHz of Lower 700 MHz D and E block spectrum

covering more than 70 million people in five of the top 15

metropolitan areas and 6 MHz of Lower 700 MHz D block

spectrum covering more than 230 million people across the

rest of the United States. We plan to deploy this spectrum as

supplemental downlink capacity, using carrier aggregation

technology once compatible handsets and network equipment

are developed.

Purchase of Wireless Partnership Minority Interest In

July 2011, we completed the acquisition of Convergys

Corporation’s minority interests in the Cincinnati SMSA

Limited Partnership and an associated cell tower holding

company for approximately $320 in cash.

Wireless Properties Transactions In June 2010, we

acquired certain wireless properties, including FCC licenses

and network assets, from Verizon Wireless for $2,376 in cash.

The assets primarily represent former Alltel Wireless assets

and served approximately 1.6 million subscribers in 79 service

areas across 18 states. The fair value of the acquired net

assets of $1,439 included $368 of property, plant and

equipment, $937 of goodwill, $765 of FCC licenses, and

$224 of customer lists and other intangible assets.

Centennial In December 2010, we completed our

acquisition accounting of Centennial Communications

Corporation (Centennial), which included net assets of

$1,518 in goodwill, $655 in FCC licenses, and $449 in

customer lists and other intangible assets.

Other Acquisitions We acquired $33 of wireless spectrum

in 2011 and $265 in 2010 from various companies, primarily

in support of our ongoing network enhancement efforts.

In 2010, we also acquired a home monitoring platform

developer and other entities for $86 in cash.

Dispositions

Tender of Telmex Shares In August 2011, the Board of

Directors of América Móvil, S.A. de C.V. (América Móvil)

approved a tender offer for the remaining outstanding shares

of Télefonos de México, S.A. de C.V. (Telmex) that were not

already owned by América Móvil. We tendered all of our

shares of Telmex for $1,197 of cash. Telmex was accounted

for as an equity method investment (see Note 7).

Sale of Sterling Operations In May 2010, we entered into

an agreement to sell our Sterling Commerce Inc. (Sterling)

subsidiary and changed our reporting for Sterling to

discontinued operations. In August 2010, we completed the

sale and received net proceeds of approximately $1,400.

During the second quarter of 2010, we accounted for Sterling

as a discontinued operation. We determined that the cash

inflows under the transition services agreement and our cash

outflows under the enterprise license agreement will not

constitute significant continuing involvement with Sterling’s

operations after the sale. We have reclassified Sterling’s

operating results, for all historic periods, to income from

discontinued operations in the accompanying consolidated

statements of income.

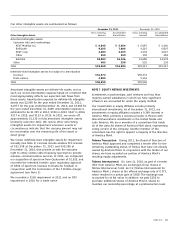

reporting units calculated under a market multiple approach

as well as a discounted cash flow approach. FCC licenses

are tested for impairment on an aggregate basis, consistent

with the management of the business on a national scope.

We perform our test of the fair values of FCC licenses using

a discounted cash flow model. Brand names are tested by

comparing the book value to a fair value calculated using a

discounted cash flow approach on a presumed royalty rate

derived from the revenues related to the brand name. The fair

value measurements used are considered Level 3 under the

Fair Value and Disclosure framework (see Note 9).

Intangible assets that have finite useful lives are amortized

over their useful lives, a weighted average of 8.3 years

(7.9 years for customer lists and relationships and 11.2 years

for other). Customer lists and relationships are amortized using

primarily the sum-of-the-months-digits method of amortization

over the expected period in which those relationships are

expected to contribute to our future cash flows. The remaining

finite-lived intangible assets are generally amortized using the

straight-line method of amortization.

Advertising Costs We expense advertising costs for

advertising products and services or for promoting our

corporate image as we incur them (see Note 14).

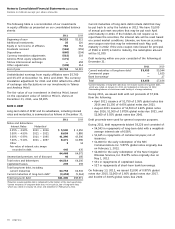

Foreign Currency Translation We are exposed to foreign

currency exchange risk through our foreign affiliates and equity

investments in foreign companies. Our foreign subsidiaries and

foreign investments generally report their earnings in their

local currencies. We translate our share of their foreign assets

and liabilities at exchange rates in effect at the balance sheet

dates. We translate our share of their revenues and expenses

using average rates during the year. The resulting foreign

currency translation adjustments are recorded as a separate

component of accumulated other comprehensive income

(accumulated OCI) in the accompanying consolidated balance

sheets. We do not hedge foreign currency translation risk in

the net assets and income we report from these sources.

However, we do hedge a large portion of the foreign currency

exchange risk involved in anticipation of highly probable

foreign currency-denominated transactions, which we explain

further in our discussion of our methods of managing our

foreign currency risk (see Note 9).

Pension and Other Postretirement Benefits See Note 11

for a comprehensive discussion of our pension and

postretirement benefit expense, including a discussion of

the actuarial assumptions and our policy for recognizing

the associated gains and losses.

NOTE 2. ACQUISITIONS, DISPOSITIONS AND

OTHER ADJUSTMENTS

Acquisitions

Qualcomm Spectrum Purchase In December 2011, we

completed our purchase of spectrum licenses in the Lower

700 MHz frequency band from Qualcomm Incorporated

(Qualcomm) for approximately $1,925 in cash. The spectrum

covers more than 300 million people total nationwide,