AT&T Wireless 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

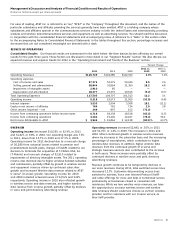

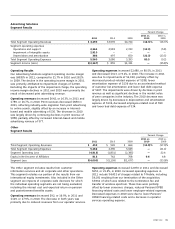

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

32 AT&T Inc.

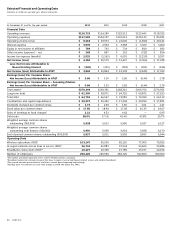

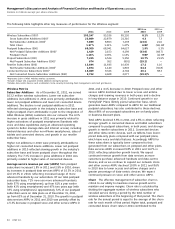

Cost of services and sales expenses increased $4,995, or

9.5%, in 2011 and $1,740, or 3.4%, in 2010. Excluding the

increase of $1,668 related to the actuarial loss, expense

increases in 2011 were primarily due to higher wireless handset

costs related to strong smartphone sales, partially offset by

lower financing-related costs associated with our pension and

postretirement benefits (referred to as Pension/OPEB expenses)

and other employee-related expenses. Excluding the increase

of more than $700 in expense related to the actuarial loss,

expense increases in 2010 were primarily due to higher

smartphone handset costs, higher interconnect and network

system costs, and higher Universal Service Fund (USF) costs,

partially offset by lower Pension/OPEB financing costs and

other employee-related expenses.

Selling, general and administrative expenses increased

$5,980, or 18.2%, in 2011 and $1,505, or 4.8%, in 2010.

The 2011 expenses increased by $2,091 related to the

actuarial loss, $4,181 associated with T-Mobile and higher

commissions paid on smartphone sales, slightly offset by

lower severance accruals, Pension/OPEB financing costs and

other employee-related charges. Expenses for 2010 increased

$1,600 related to the actuarial loss, as well as increases in

advertising and various support expenses, mostly offset by

lower bad debt expense, Pension/OPEB financing costs

and other employee-related expenses.

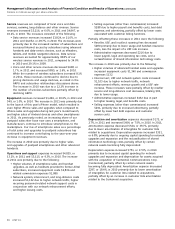

Impairment of intangible assets In 2011, we recorded

noncash charges for impairments in our Advertising Solutions

segment, which consisted of a $2,745 goodwill impairment

and a $165 impairment of a trade name. The 2010

impairment of $85 was for the impairment of a trade name.

Depreciation and amortization expense decreased $1,002,

or 5.2%, in 2011 and $136, or 0.7%, in 2010. The decreases

in 2011 and 2010 were primarily due to lower amortization

of intangibles for customer lists related to acquisitions.

Interest expense increased $541, or 18.1%, in 2011 and

decreased $374, or 11.1%, in 2010. The increase in interest

expense for 2011 was primarily due to no longer

capitalizing interest on certain spectrum that will be used

to support our Long Term Evolution (LTE) technology,

partially offset by a decrease in our average debt balances.

Effective January 1, 2011, we ceased capitalization of

interest on certain spectrum for LTE as this spectrum was

determined to be ready for its intended use.

The decline in interest expense for 2010 was primarily due

to a decrease in our average debt balances, along with a

decrease in our weighted-average interest rate.

Equity in net income of affiliates increased $22, or 2.9%,

in 2011 and $28, or 3.8%, in 2010. Increased equity in net

income of affiliates in 2011 was due to improved operating

results at América Móvil, S.A. de C.V. (América Móvil), partially

offset by lower results from Télefonos de México, S.A. de C.V.

(Telmex). The 2010 increase was due to improved results at

América Móvil.

Other income (expense) – net We had other income of

$249 in 2011, $897 in 2010 and $152 in 2009. Results for

2011 included $97 of net gains from the sale of investments,

$80 of leveraged lease income and $73 of interest and

dividend income.

Other income for 2010 included a $658 gain on the exchange

of Telmex Internacional, S.A.B. de C.V. (Telmex Internacional)

shares for América Móvil shares, $197 due to gains on the

sale of investments, $71 of interest and dividend income

and $66 of leveraged lease income, partially offset by $98

of investment impairments. Results for 2009 included gains

of $154 on the sale of investments, $77 of interest and

dividend income and leveraged lease income of $41, partially

offset by $102 of investment impairments.

Income tax expense increased $3,694 in 2011 and decreased

$7,253 in 2010. The increase in income tax in 2011 is

primarily due to a settlement with the Internal Revenue

Service (IRS) that occurred in the third quarter of 2010 related

to a restructuring of our wireless operations, which lowered

our income taxes in 2010 by $8,300. The tax benefit of the

IRS settlement was partially offset by a $995 charge to

income tax expense recorded during the first quarter of 2010

to reflect the deferred tax impact of enacted U.S. healthcare

legislation and by lower income before income taxes during

2011 (see Note 10). Our effective tax rate in 2011 was 37.7%,

compared to (6.4)% in 2010 and 32.9% in 2009.

Income from discontinued operations, net of tax In the

third quarter of 2010, we sold our subsidiary Sterling

Commerce Inc. (Sterling). Income from discontinued

operations in 2010 was $779, including a gain of $769.

Income from discontinued operations in 2009 was $20.

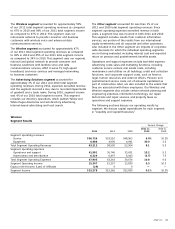

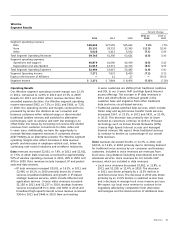

Segment Results

Our segments are strategic business units that offer different

products and services over various technology platforms and

are managed accordingly. Our operating segment results

presented in Note 4 and discussed below for each segment

follow our internal management reporting. We analyze our

various operating segments based on segment income before

income taxes. We make our capital allocations decisions

based on our strategic direction of the business, needs of

the network (wireless or wireline) providing services and

other assets needed to provide emerging services to our

customers. Actuarial gains and losses from pension and other

postretirement benefits, interest expense and other income

(expense) – net, are managed only on a total company basis

and are, accordingly, reflected only in consolidated results.

Therefore, these items are not included in the calculation

of each segment’s percentage of our total segment income.

Each segment’s percentage of total segment operating

revenue and income calculations is derived from our segment

results table in Note 4, and income percentage may total

more than 100 percent due to losses in one or more

segments. We have four reportable segments: (1) Wireless,

(2) Wireline, (3) Advertising Solutions and (4) Other.