AT&T Wireless 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 69

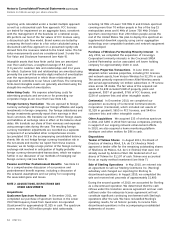

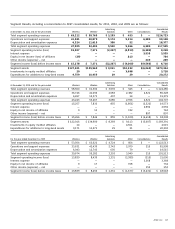

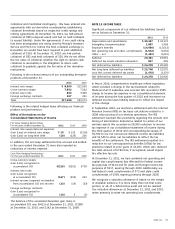

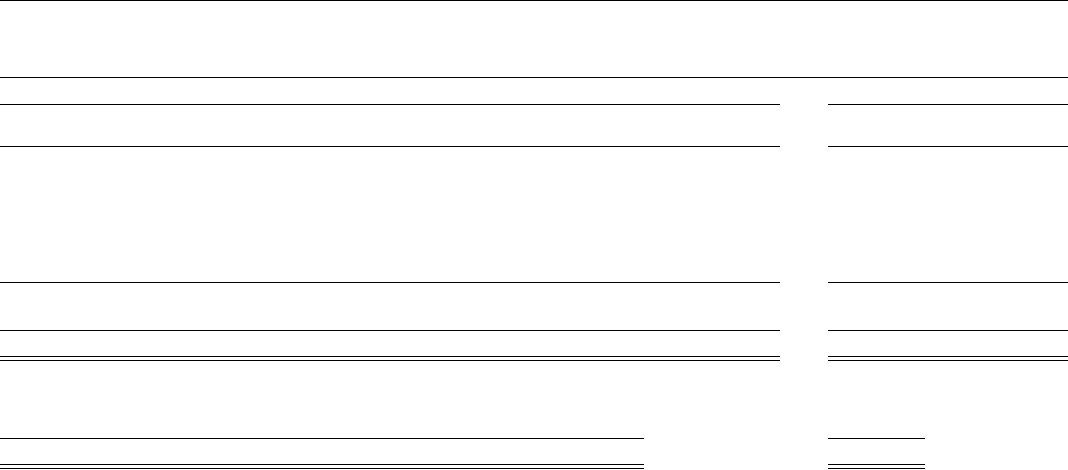

Our other intangible assets are summarized as follows:

December 31, 2011 December 31, 2010

Gross Carrying Accumulated Gross Carrying Accumulated

Other Intangible Assets Amount Amortization Amount Amortization

Amortized intangible assets:

Customer lists and relationships:

AT&T Mobility LLC $ 6,845 $ 5,906 $ 6,987 $ 5,240

BellSouth 9,205 7,686 9,215 6,807

AT&T Corp. 2,483 2,205 3,134 2,647

Other 350 329 350 284

Subtotal 18,883 16,126 19,686 14,978

Other 485 258 525 239

Total $19,368 $16,384 $20,211 $15,217

Indefinite-lived intangible assets not subject to amortization:

Licenses $51,374 $50,372

Trade names 4,985 5,154

Total $56,359 $55,526

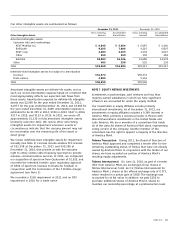

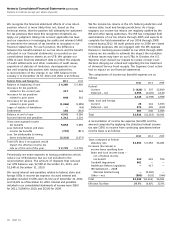

Amortized intangible assets are definite-life assets, and as

such, we record amortization expense based on a method that

most appropriately reflects our expected cash flows from

these assets. Amortization expense for definite-life intangible

assets was $2,009 for the year ended December 31, 2011,

$2,977 for the year ended December 31, 2010, and $3,666 for

the year ended December 31, 2009. Amortization expense is

estimated to be $1,335 in 2012, $744 in 2013, $347 in 2014,

$217 in 2015, and $123 in 2016. In 2011, we wrote off

approximately $1,130 in fully amortized intangible assets

(primarily customer lists). We review other amortizing

intangible assets for impairment whenever events or

circumstances indicate that the carrying amount may not

be recoverable over the remaining life of the asset or

asset group.

We review indefinite-lived intangible assets for impairment

annually (see Note 1). Licenses include wireless FCC licenses

of $51,358 at December 31, 2011 and $50,356 at

December 31, 2010, that provide us with the exclusive

right to utilize certain radio frequency spectrum to provide

wireless communications services. In 2011, we completed

our acquisition of spectrum from Qualcomm of $1,925, and

recorded the intended transfer upon regulatory approval

of $962 of spectrum licenses to Deutsche Telekom in

conjunction with the termination of the T-Mobile merger

agreement (see Note 2).

We recorded a $165 impairment in 2011 and an $85

impairment in 2010 for a trade name.

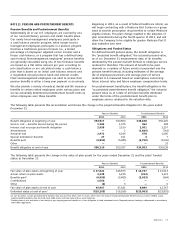

NOTE 7. EQUITY METHOD INVESTMENTS

Investments in partnerships, joint ventures and less than

majority-owned subsidiaries in which we have significant

influence are accounted for under the equity method.

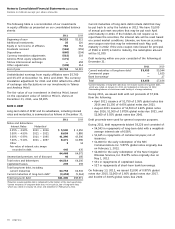

Our investments in equity affiliates include primarily

international investments. As of December 31, 2011, our

investments in equity affiliates included a 9.39% interest in

América Móvil, primarily a wireless provider in Mexico with

telecommunications investments in the United States and

Latin America. We are a member of a consortium that holds

all of the class AA shares of América Móvil stock, representing

voting control of the company. Another member of the

consortium has the right to appoint a majority of the directors

of América Móvil.

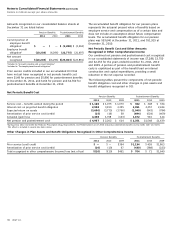

Telmex Transaction During 2011, the Board of Directors of

América Móvil approved and completed a tender offer for the

remaining outstanding shares of Telmex that were not already

owned by América Móvil. In conjunction with the tender of our

shares, we have recorded our portion of América Móvil’s

resulting equity adjustments.

Telmex Internacional On June 11, 2010, as part of a tender

offer from América Móvil, we exchanged all our shares in

Telmex Internacional, S.A.B. de C.V. (Telmex Internacional) for

América Móvil L shares at the offered exchange rate of 0.373,

which resulted in a pretax gain of $658. The exchange was

accounted for at fair value. In addition, we paid $202 to

purchase additional shares of América Móvil L shares to

maintain our ownership percentage at a pretransaction level.