AT&T Wireless 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 AT&T Inc.

Rapid transitions to our new technology

platforms — especially at the scale and

speed we’re seeing with mobile broadband —

inevitably result in creative disruption, as

new and better capabilities replace legacy

services and drive economic growth.

The essence of our business has always been

to lead the way in this process — to get to the

future first — so that our customers and our

shareowners benefit.

And in our own operations, this has driven

significant changes in our business mix.

Five years ago, wireless, wireline data and

managed services represented roughly half

of our overall revenues. Today, they account

for more than three-fourths of the total, and

in 2011 they had combined growth of

7.5 percent, showing considerable strength

in a slow economy.

Meanwhile, other parts of our operations —

most notably our print directory business and

voice-centered fixed-line consumer services —

continue to decline as customers migrate from

legacy technologies to newer platforms.

These declines were reflected in the noncash

charges we took in the fourth quarter of 2011;

we wrote down the value of our directory

business to reflect peer values and made

actuarial adjustments to our benefit plans,

which were predominantly associated with our

legacy operations’ employees and retirees.

We expect this shift in our business to accelerate

as we drive further mobile broadband growth

and make strategic decisions to improve our

overall growth profile.

The gap between our growth businesses and

our legacy operations continues to widen. That

makes evaluating the best options for our low-

growth and nonstrategic assets a top priority.

Meanwhile, we recognize that as swift and

pervasive as the mobile Internet revolution has

been, we’re still early in the growth trajectory.

So our dominant strategic focus will continue

to be acquiring the spectrum and building the

network capabilities we need for robust growth as

the mobile Internet enters its next stage.

To advance that strategy, we undertook

a major strategic initiative in 2011: our

proposed acquisition of Deutsche Telekom’s

T-Mobile USA unit.

This transaction was the right move at the

right time because it would have increased

overall network capacity at a pivotal time in

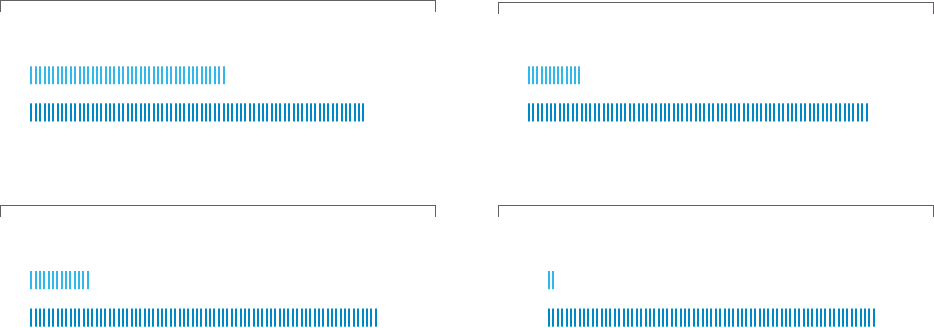

total wireless subscribers

in millions >

smartphones on AT&T’s network

postpaid smartphones at end of year, in millions >

06 06

11 11

103.2 39.4

<761.0

wireless data revenues

in billions >

06 12/06

11 12/1 1

total mobile data traffic on our network

billions of MBs >

$22.0 27.1

$4.3 0.1