AT&T Wireless 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 45

indefinite-lived trade name used by the Advertising

Solutions segment. For the Wireless and Wireline

segments, in the event of a 10% drop in the fair values

of the reporting units, the fair values would have still

exceeded the book values of the reporting units and

additional testing would still have not been necessary.

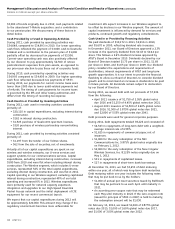

Wireless FCC licenses are tested for impairment on an

aggregate basis, consistent with the management of the

business on a national scope. As in prior years, we

performed our test of the fair values of FCC licenses using

a discounted cash flow model (the Greenfield Approach).

The Greenfield Approach assumes a company initially

owns only the wireless FCC licenses, and then makes

investments required to build an operation comparable to

the one that currently utilizes the licenses. We utilized a

17-year discrete period to isolate cash flows attributable

to the licenses, including modeling the hypothetical

build-out. The projected cash flows are based on certain

financial factors, including revenue growth rates, EBITDA

margins and churn rates. We expect wireless revenue

growth to trend down from our 2011 growth rate of 8.1%

to a long-term growth rate that reflects expected long-

term inflation trends. We expect our churn rates to decline

in 2012 from our rate of 1.37% in 2011, in line with

expected trends in the industry but at a rate comparable

with industry-leading churn. EBITDA margins should

continue to trend at about 40%.

This model then incorporates cash flow assumptions

regarding investment in the network, development of

distribution channels and the subscriber base, and other

inputs for making the business operational. We based the

assumptions, which underlie the development of the

network, subscriber base and other critical inputs of the

discounted cash flow model, on a combination of average

marketplace participant data and our historical results,

trends and business plans. We also used operating metrics

such as capital investment per subscriber, acquisition costs

per subscriber, minutes of use per subscriber, etc., to

develop the projected cash flows. Since we included the

cash flows associated with these other inputs in the

annual cash flow projections, the present value of the

unlevered free cash flows of the segment, after investment

in the network, subscribers, etc., is attributable to the

wireless FCC licenses. The terminal value of the segment,

which incorporates an assumed sustainable growth rate, is

also discounted and is likewise attributed to the licenses.

We used a discount rate of 9.0%, based on the optimal

long-term capital structure of a market participant and

its associated cost of debt and equity, to calculate the

present value of the projected cash flows. This discount

rate is also consistent with rates we use to calculate the

present value of the projected cash flows of licenses

acquired from third parties.

Goodwill, wireless FCC licenses, and other trade names

are not amortized but tested annually for impairment.

We conduct our impairment tests as of October 1.

We test goodwill on a reporting unit basis, and our

reporting units coincide with our segments, except for

certain operations in our Other segment. If, due to

changes in how we manage the business, we move a

portion of a reporting unit to another reporting unit, we

determine the amount of goodwill to reallocate to the

new reporting unit based on the relative fair value of

the portion of the business moved and the portion of

the business remaining in the reporting unit. The goodwill

impairment test is a two-step process. The first step

involves determining the fair value of the reporting unit

and comparing that measurement to the book value. If the

fair value exceeds the book value, then no further testing

is required. If the fair value is less than the book value

(i.e., an indication of impairment exists), then we perform

the second step.

In the second step, we determine the fair values of all of

the assets and liabilities of the reporting unit, including

those that may not be currently recorded. The difference

between the sum of all of those fair values and the

overall reporting unit’s fair value is a new implied goodwill

amount, which we compare to the recorded goodwill.

If implied goodwill is less than the recorded goodwill,

then we record an impairment of the recorded goodwill.

The amount of this impairment may be more or less than

the difference between the overall fair value and book

value of the reporting unit. It may even be zero if the fair

values of other assets are less than their book values.

As shown in Note 6, more than 99% of our goodwill

resides in the Wireless, Wireline, and Advertising Solutions

segments. For each of those segments, we assess their fair

value using a market multiple approach and a discounted

cash flow approach. Our primary valuation technique is to

determine enterprise value as a multiple of a company’s

Earnings Before Interest, Taxes, and Depreciation and

Amortization expenses (EBITDA). We determined the

multiples of the publicly traded companies whose services

are comparable to those offered by the segment and

then calculate a weighted average of those multiples.

Using those weighted averages, we then calculated fair

values for each of those segments. We also perform a

discounted cash flow analysis as a secondary test of fair

value to corroborate our primary market multiple test.

Except for the Advertising Solutions segment, the

calculated fair value of the reporting unit exceeded book

value in all circumstances and no additional testing was

necessary. As a result of our 2011 impairment test, we

recorded a goodwill impairment charge in the Advertising

Solutions segment due to declines in the value of our

directory business and that industry (see Note 6).

We also recorded a corresponding impairment to an