AT&T Wireless 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 71

The obligations of the lenders under the Four-Year Agreement

to provide advances will terminate on December 19, 2015,

unless prior to that date either: (i) AT&T and, if applicable,

a Co-Borrower, reduces to $0 the commitments of the

lenders under the Agreement or (ii) certain events of default

occur. The Agreement also provides that AT&T and lenders

representing more than 50% of the facility amount may agree

to extend their commitments under the Agreement for an

additional one year beyond the December 19, 2015,

termination date, under certain circumstances. We also can

request the lenders to further increase their commitments

(i.e., raise the available credit) up to an additional $2,000

provided no event of default has occurred.

Advances would bear interest, at AT&T’s option, either:

•atavariableannualrateequaltothehighestof:

(1)(a) the base (or prime) rate of the bank affiliate of

Citibank, N.A. which is serving as administrative agent

under the Agreement, (b) 0.50% per annum above the

Federal funds rate, and (c) the London interbank offered

rate (LIBOR) applicable to U.S. Dollars for a period of

one month plus 1.00%, plus (2) an applicable margin,

as set forth in the Agreement (Applicable Margin); or

•atarateequalto:(i)theLIBORforaperiodofone,

two, three or six months, as applicable, plus (ii) the

Applicable Margin.

The Applicable Margin will equal 0.560% if our unsecured

long-term debt is rated at least A+ by Standard & Poor’s or

Fitch, Inc. or A1 by Moody’s Investors Service. The Applicable

Margin will be 0.670% per annum if our unsecured long-term

debt ratings are A or A2 and will be 0.900% per annum in the

event our unsecured long-term debt ratings are A- and A3

(or below).

The Agreement continues to require us to maintain a debt-to-

EBITDA (earnings before interest, income taxes, depreciation

and amortization, and other modifications described in the

Agreement) ratio of not more than 3-to-1, as of the last day

of each fiscal quarter, for the four quarters then ended.

Defaults under the Agreement, which would permit the

lenders to accelerate required repayment and which would

increase the Applicable Margin by 2.00% per annum, include:

•Wefailtopayprincipalorinterest,orotheramounts

under the Agreement beyond any grace period.

•Wefailtopaywhendueotherdebtof$400ormorethat

results in acceleration of that debt (commonly referred

to as cross-acceleration) or a creditor commences

enforcement proceedings within a specified period after

a money judgment of $400 or more has become final.

•Apersonacquiresbeneficialownershipofmorethan50%

of AT&T common shares or more than a majority of

AT&T’s directors change in any 24-month period other

than as elected by the remaining directors (commonly

referred to as a change in control).

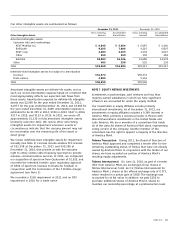

As of December 31, 2011 and 2010, we were in compliance

with all covenants and conditions of instruments governing

our debt. Substantially all of our outstanding long-term debt

is unsecured. Maturities of outstanding long-term notes and

debentures, as of December 31, 2011, and the corresponding

weighted-average interest rate scheduled for repayment are

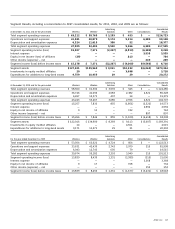

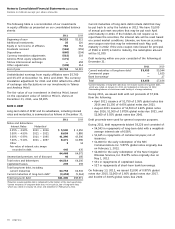

as follows:

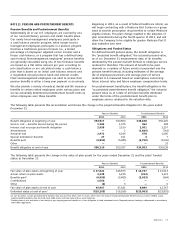

There-

2012 2013 2014 2015 2016 after

Debt

repayments1,2 $3,453 $5,824 $4,788 $4,514 $4,923 $41,111

Weighted-

average

interest rate 5.0% 5.6% 5.1% 4.3% 3.7% 6.2%

1 Debt repayments assume putable debt is redeemed by the holders at the next

opportunity.

2 Long-term debt obligations and interest payments on long-term debt were not

adjusted to reflect the January 13, 2012, notice to call $1,200 of debt, which was

completed on February 15, 2012, with an original maturity of February 15, 2056.

Credit Facilities

T-Mobile Acquisition Financing In December 2011, we

and Deutsche Telekom agreed to terminate our agreement

to purchase T-Mobile. The termination of the purchase

agreement also terminated our $20,000 associated credit

agreement with a group of banks, dated as of March 31, 2011,

to partially fund the purchase.

Other Credit Facilities In December 2011, we amended and

extended for an additional one-year term our existing $5,000,

four-year revolving credit agreement (Four-Year Agreement)

with a syndicate of banks. We also entered into a new $5,000,

364-day revolving credit agreement, with a syndicate of

banks, to replace our expiring 364-day revolving credit

agreement. In the event advances are made under either

agreement, those advances would be used for general

corporate purposes, which could include repayment of

maturing commercial paper. Advances are not conditioned

on the absence of a material adverse change. All advances

must be repaid no later than the date on which lenders are

no longer obligated to make any advances under each

agreement. Under each agreement, we can terminate, in

whole or in part, amounts committed by the lenders in excess

of any outstanding advances; however, we cannot reinstate

any such terminated commitments. At December 31, 2011,

we had no advances outstanding under either agreement and

were in compliance with all covenants under each agreement.

In January 2012, we provided notice to permanently reduce

the outstanding commitments of the lenders under our

364-day revolving credit agreement from $5,000 to $3,000.

The Four-Year Agreement

The amendments to the Four-Year Agreement include, but

are not limited to, (i) changing the interest rate charged for

advances from a rate based on AT&T’s credit default swap

spread to a fixed spread; (ii) decreasing the amount payable

as facilities fees, and (iii) at AT&T’s option, adding subsidiaries

as additional borrowers, with or without a guarantee provided

by AT&T Inc., subject to conditions provided in the agreement.

The terms of such guarantee are set forth in the agreement.