AT&T Wireless 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 79

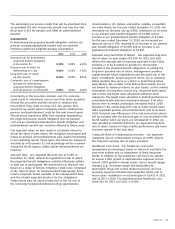

denominated in U.S. dollars, and neither callable, convertible

nor index linked. For the year ended December 31, 2011, we

decreased our discount rate by 0.50%, resulting in an increase

in our pension plan benefit obligation of $3,384 and an

increase in our postretirement benefit obligation of $2,114.

For the year ended December 31, 2010, we decreased our

discount rate by 0.70%, resulting in an increase in our pension

plan benefit obligation of $3,995 and an increase in our

postretirement benefit obligation of $2,817.

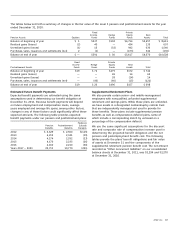

Expected Long-Term Rate of Return Our expected long-term

rate of return on plan assets of 8.25% for 2012 and 2011

reflects the average rate of earnings expected on the funds

invested, or to be invested, to provide for the benefits

included in the projected benefit obligations. In setting the

long-term assumed rate of return, management considers

capital markets future expectations and the asset mix of the

plans’ investments. Actual long-term return can, in relatively

stable markets, also serve as a factor in determining future

expectations. We consider many factors that include, but are

not limited to, historical returns on plan assets, current market

information on long-term returns (e.g., long-term bond rates)

and current and target asset allocations between asset

categories. The target asset allocation is determined based on

consultations with external investment advisers. If all other

factors were to remain unchanged, we expect that a 1.00%

decrease in the actual long-term rate of return would cause

2012 combined pension and postretirement cost to increase

$525. However, any differences in the rate and actual returns

will be included with the actuarial gain or loss recorded in the

fourth quarter when our plans are remeasured. In 2012, we

have decided to maintain 8.25% for our expected long-term

rate of return, based on future market performance and lower

economic growth in the near term.

Composite Rate of Compensation Increase Our expected

composite rate of compensation increase of 4.00% reflects

the long-term average rate of salary increases.

Healthcare Cost Trend Our healthcare cost trend

assumptions are developed based on historical cost data, the

near-term outlook and an assessment of likely long-term

trends. In addition to the healthcare cost trend, we assume

an annual 3.00% growth in administrative expenses and an

annual 3.00% growth in dental claims. Due to benefit design

changes (e.g., increased copays and deductibles for

prescription drugs and certain medical services), we have

generally experienced better-than-expected claims cost in

recent years, resulting in an actuarial gain of $1,432 in 2011

and $1,263 in 2010. Our assumed annual healthcare cost

trend rate for 2012 and 2011 is 5.00%.

The estimated prior service credits that will be amortized from

accumulated OCI into net periodic benefit cost over the next

fiscal year is $15 for pension and $846 for postretirement

benefits.

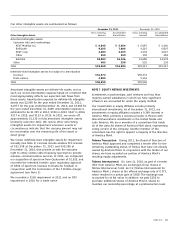

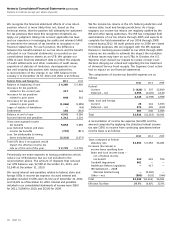

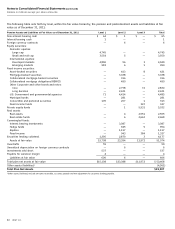

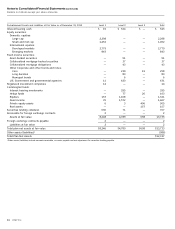

Assumptions

In determining the projected benefit obligation and the net

pension and postemployment benefit cost, we used the

following significant weighted-average assumptions:

2011 2010 2009

Discount rate for determining

projected benefit obligation

at December 31 5.30% 5.80% 6.50%

Discount rate in effect for

determining net cost 5.80% 6.50% 7.00%

Long-term rate of return

on plan assets 8.25% 8.50% 8.50%

Composite rate of compensation

increase for determining

projected benefit obligation

and net pension cost (benefit) 4.00% 4.00% 4.00%

Uncertainty in the securities markets and U.S. economy

could result in investment returns less than those assumed.

Should the securities markets decline or medical and

prescription drug costs increase at a rate greater than

assumed, we would expect increasing annual combined net

pension and postretirement costs for the next several years.

Should actual experience differ from actuarial assumptions,

the projected pension benefit obligation and net pension

cost and accumulated postretirement benefit obligation and

postretirement benefit cost would be affected in future years.

Our expected return on plan assets is calculated using the

actual fair value of plan assets. We recognize actual gains and

losses on pension and postretirement plan assets immediately

in our operating results. These gains and losses are measured

annually as of December 31 and accordingly will be recorded

during the fourth quarter, unless earlier remeasurements are

required.

Discount Rate Our assumed discount rate of 5.30% at

December 31, 2011, reflects the hypothetical rate at which

the projected benefit obligations could be effectively settled

or paid out to participants. We determined our discount rate

based on a range of factors, including a yield curve composed

of the rates of return on several hundred high-quality, fixed

income corporate bonds available at the measurement date

and the related expected duration for the obligations.

These bonds were all rated at least Aa3 or AA- by one of

the nationally recognized statistical rating organizations,