AT&T Wireless 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

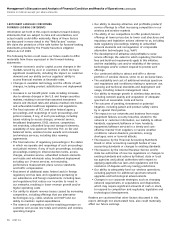

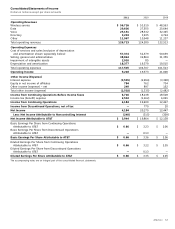

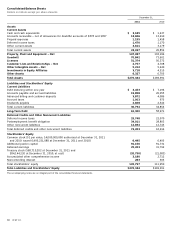

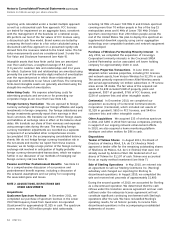

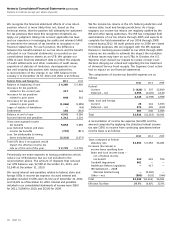

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

66 AT&T Inc.

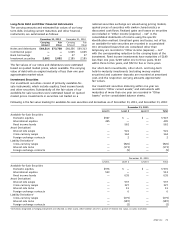

The Wireline segment uses our regional, national and global

network to provide consumer and business customers with

landline voice and data communications services, AT&T

U-verse® TV, high-speed broadband and voice services and

managed networking to business customers. Additionally, we

receive commissions on sales of satellite television services

offered through our agency arrangements.

The Advertising Solutions segment includes our directory

operations, which publish Yellow and White Pages directories

and sell directory advertising and Internet-based advertising

and local search. In 2011, we moved $1,927 of goodwill from

the Advertising Solutions segment to the Wireline segment

based on a change in how we managed the U-verse related

advertising business (see Note 6).

The Other segment includes results from customer information

services, our portion of the results from our international

equity investments and all corporate and other operations.

Also included in the Other segment are impacts of corporate-

wide decisions for which the individual operating segments

are not being evaluated, including interest cost and expected

return on plan assets for our pension and postretirement

benefit plans.

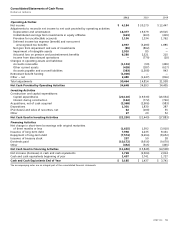

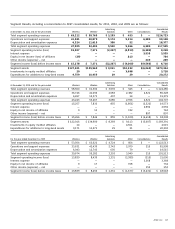

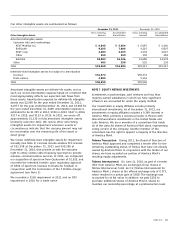

In the following tables, we show how our segment results are

reconciled to our consolidated results reported. The Wireless,

Wireline, Advertising Solutions and Other columns represent

the segment results of each such operating segment.

The Consolidations column adds in those line items that

we manage on a consolidated basis only: actuarial gains

and losses from pension and other postretirement benefits,

interest expense and other income (expense) – net.

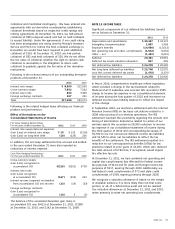

At December 31, 2011, 2010 and 2009, we had issued and

outstanding options to purchase approximately 66 million,

130 million, and 178 million shares of AT&T common stock.

The exercise prices of 40 million, 100 million, and 163 million

shares in 2011, 2010, and 2009 were above the average

market price of AT&T stock for the respective periods.

Accordingly, we did not include these amounts in determining

the dilutive potential common shares. At December 31, 2011,

the exercise prices of 24 million vested stock options were

below market price.

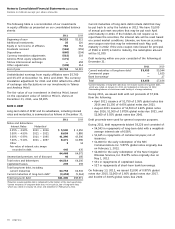

NOTE 4. SEGMENT INFORMATION

Our segments are strategic business units that offer different

products and services over various technology platforms

and are managed accordingly. We analyze our various

operating segments based on segment income before

income taxes. We make our capital allocations decisions

based on our strategic direction of the business, needs of

the network (wireless or wireline) providing services and

other assets needed to provide emerging services to our

customers. Actuarial gains and losses from pension and

other postretirement benefits, interest expense and other

income (expense) – net, are managed only on a total

company basis and are, accordingly, reflected only in

consolidated results. Therefore, these items are not included

in the calculation of each segment’s percentage of our

total segment income. The customers and long-lived assets

of our reportable segments are predominantly in the

United States. We have four reportable segments:

(1) Wireless, (2) Wireline, (3) Advertising Solutions

and (4) Other.

The Wireless segment uses our nationwide network to provide

consumer and business customers with wireless voice and

advanced data communications services.