AT&T Wireless 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

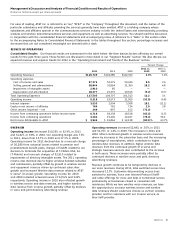

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

34 AT&T Inc.

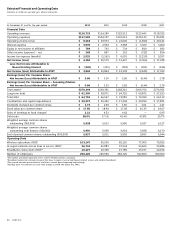

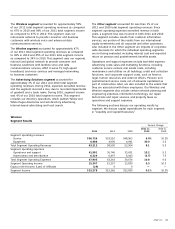

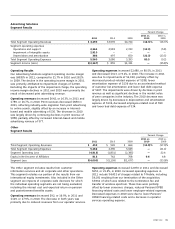

The following table highlights other key measures of performance for the Wireless segment:

2011 vs. 2010 vs.

2011 2010 2009 2010 2009

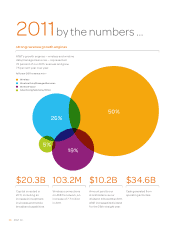

Wireless Subscribers (000)1 103,247 95,536 85,120 8.1% 12.2%

Gross Subscriber Additions (000)2 23,869 22,879 21,316 4.3 7.3

Net Subscriber Additions (000)2 7,699 8,853 7,278 (13.0) 21.6

Total Churn 1.37% 1.31% 1.47% 6 BP (16) BP

Postpaid Subscribers (000) 69,309 68,041 64,627 1.9% 5.3%

Net Postpaid Subscriber Additions (000)2 1,429 2,153 4,199 (33.6) (48.7)

Postpaid Churn 1.18% 1.09% 1.13% 9 BP (4) BP

Prepaid Subscribers (000) 7,225 6,524 5,350 10.7% 21.9%

Net Prepaid Subscriber Additions (000)2 674 952 (801) (29.2) —

Reseller Subscribers (000) 13,644 11,645 10,439 17.2 11.6

Net Reseller Subscriber Additions (000)2 1,874 1,140 1,803 64.4 (36.8)

Connected Device Subscribers (000)3 13,069 9,326 4,704 40.1 98.3

Net Connected Device Subscriber Additions (000) 3,722 4,608 2,077 (19.2)% —

1Represents 100% of AT&T Mobility wireless customers.

2Excludes merger and acquisition-related additions during the period.

3Includes data-centric devices such as eReaders, home security monitoring, fleet management, and smart grid devices.

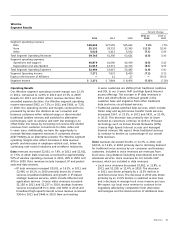

2011 and a 4.1% decrease in 2010. Postpaid voice and other

service ARPU declined due to lower access and airtime

charges and roaming revenues in both years and a decline

in long-distance usage in 2010. Continued growth in our

FamilyTalk® Plans (family plans) subscriber base, which

generates lower ARPU compared to ARPU for our traditional

postpaid subscribers, has also contributed to these declines.

About 86% of our postpaid subscribers are on family plans

or business discount plans.

Total ARPU declined 3.8% in 2011 and 1.8% in 2010, reflecting

stronger growth in connected devices and tablet subscribers

compared to postpaid subscribers, in both years, and stronger

growth in reseller subscribers in 2011. Connected devices

and other data-centric devices, such as tablets, have lower-

priced data-only plans compared with our postpaid plans,

which have voice and data features. Accordingly, ARPU for

these subscribers is typically lower compared to that

generated from our subscribers on postpaid and other plans.

Data services ARPU increased 9.8% in 2011 and 14.7% in

2010, reflecting subscriber growth trends. We expect

continued revenue growth from data services as more

customers purchase advanced handsets and data-centric

devices, and as we continue to expand our network. Voice

and other service ARPU declined 10.8% in 2011 and 8.6%

in 2010 due to lower access and airtime charges and a

greater percentage of data-centric devices. We expect

continued pressure on voice and other service ARPU.

Churn The effective management of subscriber churn is

critical to our ability to maximize revenue growth and to

maintain and improve margins. Churn rate is calculated by

dividing the aggregate number of wireless subscribers who

canceled service during a period by the total number of

wireless subscribers at the beginning of that period. The churn

rate for the annual period is equal to the average of the churn

rate for each month of that period. Higher total, postpaid and

connected device churn rates in 2011 contributed to the

Wireless Metrics

Subscriber Additions As of December 31, 2011, we served

103.2 million wireless subscribers. Lower net subscriber

additions (net additions) in 2011 were primarily attributable to

lower net postpaid additions and lower net connected device

additions. The decline in net postpaid additions in 2011

reflected slowing growth in the industry’s subscriber base and

higher postpaid churn attributable in part to the integration of

Alltel Wireless (Alltel) customers into our network. The 4.3%

increase in gross additions in 2011 was primarily related to

higher activations of postpaid smartphones (handsets with

voice and data capabilities using an advanced operating

system to better manage data and Internet access), including

Android devices and other non-iPhone smartphones, sales of

tablets and connected devices, and growth in our reseller

subscriber base.

Higher net additions in 2010 were primarily attributable to

higher net connected device additions. Lower net postpaid

additions in 2010 reflected slowing growth in the industry’s

subscriber base and lower postpaid churn throughout the

industry. The 7.3% increase in gross additions in 2010 was

primarily related to higher sales of connected devices.

Average service revenue per user (ARPU) from postpaid

subscribers increased 1.8% in 2011 and 2.9% in 2010, driven

by increases in postpaid data services ARPU of 15.3% in 2011

and 19.3% in 2010, reflecting increased usage of more

advanced handsets by our subscribers. Of our total postpaid

subscriber base, 71% now use more advanced handsets

(with 57% using smartphones), up from 61% a year earlier

(with 43% using smartphones) and 47% two years ago (with

33% using smartphones). Approximately 72% of our postpaid

subscribers were on data plans as of December 31, 2011,

up from 63% as of December 31, 2010. The growth in postpaid

data services ARPU in 2011 and 2010 was partially offset by

a 5.3% decrease in postpaid voice and other service ARPU in