AT&T Wireless 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 33

The Other segment accounted for less than 1% of our

2011 and 2010 total segment operating revenues. Since

segment operating expenses exceeded revenue in both

years, a segment loss was incurred in both 2011 and 2010.

This segment includes results from customer information

services, our portion of the results from our international

equity investments and all corporate and other operations.

Also included in the Other segment are impacts of corporate-

wide decisions for which the individual operating segments

are not being evaluated, including interest cost and expected

return on pension and postretirement benefits assets.

Operations and support expenses include bad debt expense;

advertising costs; sales and marketing functions, including

customer service centers; real estate costs, including

maintenance and utilities on all buildings; credit and collection

functions; and corporate support costs, such as finance,

legal, human resources and external affairs. Pension and

postretirement service costs, net of amounts capitalized as

part of construction labor, are also included to the extent that

they are associated with these employees. Our Wireless and

Wireline segments also include certain network planning and

engineering expenses, information technology, our repair

technicians and repair services, and property taxes as

operations and support expenses.

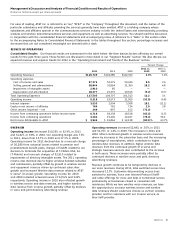

The following sections discuss our operating results by

segment. We discuss capital expenditures for each segment

in “Liquidity and Capital Resources.”

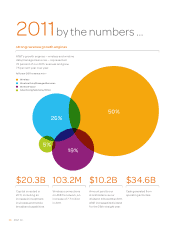

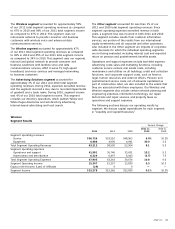

The Wireless segment accounted for approximately 50%

of our 2011 total segment operating revenues as compared

to 47% in 2010 and 94% of our 2011 total segment income

as compared to 67% in 2010. This segment uses our

nationwide network to provide consumer and business

customers with wireless voice and advanced data

communications services.

The Wireline segment accounted for approximately 47%

of our 2011 total segment operating revenues as compared

to 49% in 2010 and 45% of our 2011 total segment income

as compared to 34% in 2010. This segment uses our regional,

national and global network to provide consumer and

business customers with landline voice and data

communications services, AT&T U-verse TV, high-speed

broadband, and voice services and managed networking

to business customers.

The Advertising Solutions segment accounted for

approximately 3% of our 2011 and 2010 total segment

operating revenues. During 2011, expenses exceeded revenue

and the segment incurred a loss, due to recorded impairments

of goodwill and a trade name. During 2010, segment income

was 4% of our 2010 total segment income. This segment

includes our directory operations, which publish Yellow and

White Pages directories and sell directory advertising,

Internet-based advertising and local search.

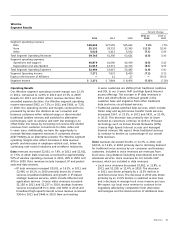

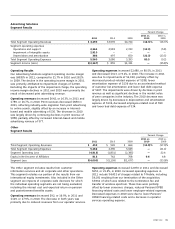

Wireless

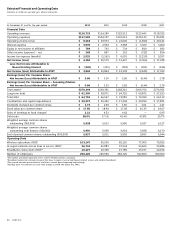

Segment Results

Percent Change

2011 vs. 2010 vs.

2011 2010 2009 2010 2009

Segment operating revenues

Service $56,726 $53,510 $48,563 6.0% 10.2%

Equipment 6,486 4,990 4,941 30.0 1.0

Total Segment Operating Revenues 63,212 58,500 53,504 8.1 9.3

Segment operating expenses

Operations and support 41,581 36,746 33,631 13.2 9.3

Depreciation and amortization 6,324 6,497 6,043 (2.7) 7.5

Total Segment Operating Expenses 47,905 43,243 39,674 10.8 9.0

Segment Operating Income 15,307 15,257 13,830 0.3 10.3

Equity in Net Income (Loss) of Affiliates (29) 9 9 — —

Segment Income $15,278 $15,266 $13,839 0.1% 10.3%