AT&T Wireless 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

52 AT&T Inc.

Foreign Exchange Risk

We are exposed to foreign currency exchange risk through our

foreign affiliates and equity investments in foreign companies.

We do not hedge foreign currency translation risk in the net

assets and income we report from these sources. However, we

do hedge a large portion of the exchange risk involved in

anticipation of highly probable foreign currency-denominated

transactions and cash flow streams, such as those related to

issuing foreign-denominated debt, receiving dividends from

foreign investments, and other receipts and disbursements.

Through cross-currency swaps, all our foreign-denominated

debt has been swapped from fixed-rate foreign currencies to

fixed-rate U.S. dollars at issuance, removing interest rate risk

and foreign currency exchange risk associated with the

underlying interest and principal payments. We expect gains

or losses in our cross-currency swaps to offset the losses

and gains in the financial instruments they hedge.

In anticipation of other foreign currency-denominated

transactions, we often enter into foreign exchange forward

contracts to provide currency at a fixed rate. Our policy is

to measure the risk of adverse currency fluctuations by

calculating the potential dollar losses resulting from changes

in exchange rates that have a reasonable probability of

occurring. We cover the exposure that results from changes

that exceed acceptable amounts.

For the purpose of assessing specific risks, we use a sensitivity

analysis to determine the effects that market risk exposures

may have on the fair value of our financial instruments and

results of operations. To perform the sensitivity analysis, we

assess the risk of loss in fair values from the effect of a

hypothetical 10% depreciation of the U.S. dollar against foreign

currencies from the prevailing foreign currency exchange rates,

assuming no change in interest rates. For foreign exchange

forward contracts outstanding at December 31, 2011, the

change in fair value was immaterial. Furthermore, because

our foreign exchange contracts are entered into for hedging

purposes, we believe that these losses would be largely

offset by gains on the underlying transactions.

Issuer Equity Repurchases

On December 17, 2010, our Board of Directors authorized

a new share repurchase plan of 300 million shares with no

expiration date. This authorization represented approximately

5.0% of AT&T’s shares outstanding at December 31, 2011.

During 2010 and 2011, we did not repurchase any shares

under this plan. In January 2012, we started to repurchase a

portion of the shares pursuant to plans that comply with the

requirements of Rule 10b5-1(c) under the Securities Exchange

Act of 1934. We will fund any share repurchases through a

combination of cash from operations, borrowings dependent

on market conditions, or cash from the disposition of certain

non-strategic investments.

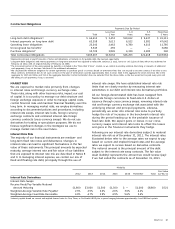

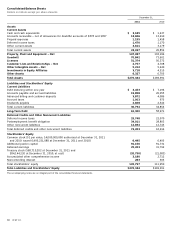

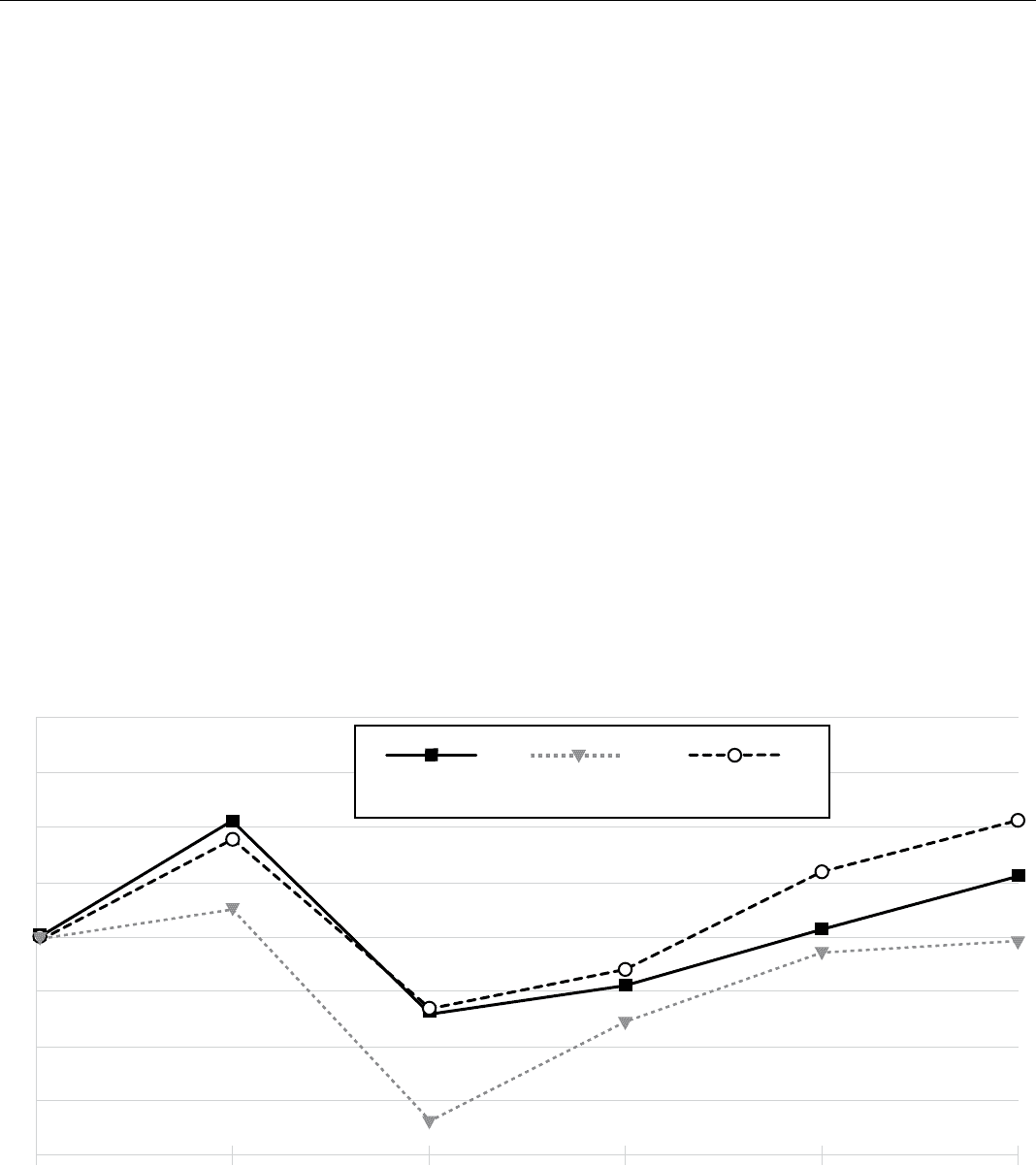

STOCK PERFORMANCE GRAPH

Comparison of Five Year Cumulative Total Return

AT&T Inc., S&P 500 Index, and S&P 500 Integrated Telecom Index

140

130

120

110

100

90

80

70

60

12/06 12/07 12/08 12/09 12/10 12/11

100

105

S&P 500 Integrated

Telecom Index

AT&T Inc. S&P 500 Index

66

84

97

99

118

88 91

112

121

121

87

102

111

94

The comparison above assumes $100 invested on December 31, 2006, in AT&T common stock, Standard & Poor’s 500 Index

(S&P 500), and Standard & Poor’s 500 Integrated Telecom Index (S&P 500 Integrated Telecom). Total return equals stock price

appreciation plus reinvestment of dividends.