AT&T Wireless 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

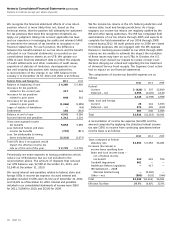

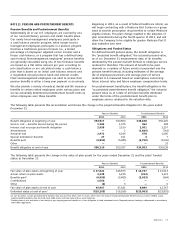

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68 AT&T Inc.

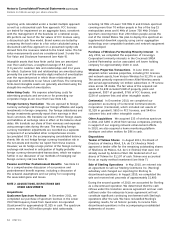

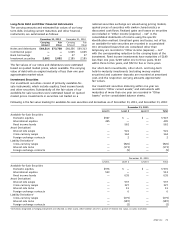

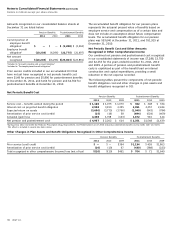

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment is summarized as follows at

December 31:

Lives (years) 2011 2010

Land — $ 1,689 $ 1,694

Buildings and improvements 10-45 28,054 25,979

Central office equipment1 3-10 83,824 79,607

Cable, wiring and conduit 10-50 78,431 75,732

Other equipment 5-20 53,104 46,622

Software 3-5 10,041 9,219

Under construction — 5,136 4,980

260,279 243,833

Accumulated depreciation

and amortization 153,192 140,637

Property, plant and

equipment – net $107,087 $103,196

1Includes certain network software.

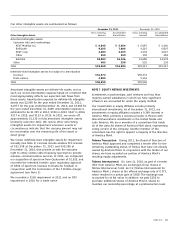

Our depreciation expense was $16,368 in 2011, $16,402 in

2010 and $15,849 in 2009. Depreciation expense included

amortization of software totaling $2,243 in 2011, $2,515 in

2010 and $1,731 in 2009.

Certain facilities and equipment used in operations are leased

under operating or capital leases. Rental expenses under

operating leases were $3,610 for 2011, $3,060 for 2010, and

$2,889 for 2009. At December 31, 2011, the future minimum

rental payments under noncancelable operating leases for

the years 2012 through 2016 were $2,462, $2,459, $2,321,

$2,183, and $2,032, with $11,785 due thereafter. Certain real

estate operating leases contain renewal options that may be

exercised. Capital leases are not significant.

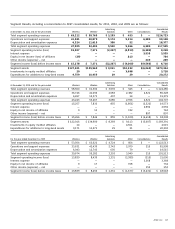

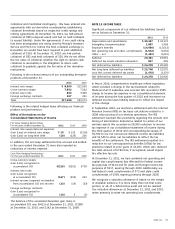

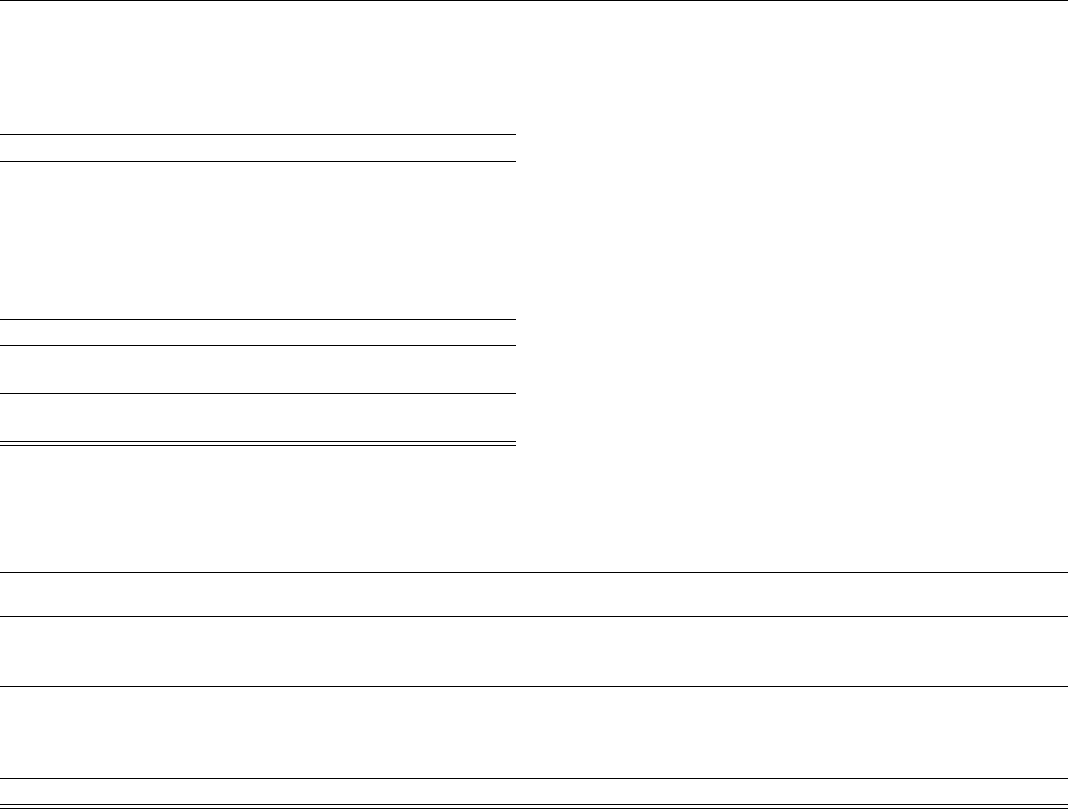

NOTE 6. GOODWILL AND OTHER INTANGIBLE ASSETS

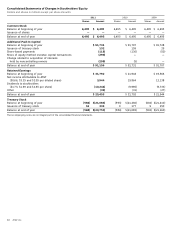

Changes in the carrying amounts of goodwill, by segment (which is the same as the reporting unit for Wireless, Wireline and

Advertising Solutions), for the years ended December 31, 2011 and 2010, were as follows:

Advertising

Wireless Wireline Solutions Other Total

Balance as of January 1, 2010 $ 35,037 $ 31,608 $ 5,731 $ 406 $ 72,782

Goodwill acquired 937 — — 43 980

Other (219) 62 — (4) (161)

Balance as of December 31, 2010 35,755 31,670 5,731 445 73,601

Goodwill acquired 5 — — — 5

Impairments — — (2,745) — (2,745)

Other (5) 1,968 (1,927) (55) (19)

Balance as of December 31, 2011 $35,755 $33,638 $1,059 $390 $70,842

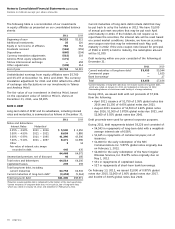

Goodwill acquisitions in 2010 related primarily to the

acquisition of certain wireless properties from Verizon Wireless

(see Note 2). In 2011, we recorded a $2,745 impairment in

the Advertising Solutions segment, triggered by declining

revenues in our directory business and the directory industry

as a whole. Changes to goodwill during 2011 also included a

$1,927 reclassification of goodwill from the Advertising

Solutions segment to the Wireline segment to align certain

advertising operations with our U-verse business, which

operates the media platform for those advertising operations.

Changes to goodwill during 2010 included adjustments

totaling $(219) related to wireless business combinations and

$62 due primarily to adjustments relating to a wireline

business combination (see Note 2).