AT&T Wireless 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 77

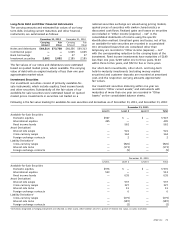

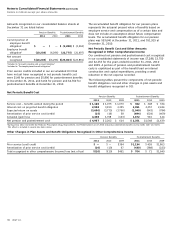

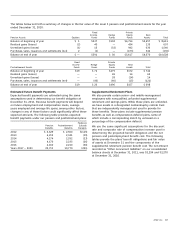

Beginning in 2013, as a result of federal healthcare reform, we

will begin contracting with a Medicare Part D plan on a group

basis to provide prescription drug benefits to certain Medicare

eligible retirees. This plan change resulted in the adoption of

plan amendments during the fourth quarter of 2011, and will

allow the Company to be eligible for greater Medicare Part D

plan subsidies over time.

Obligations and Funded Status

For defined benefit pension plans, the benefit obligation is

the “projected benefit obligation,” the actuarial present value,

as of our December 31 measurement date, of all benefits

attributed by the pension benefit formula to employee service

rendered to that date. The amount of benefit to be paid

depends on a number of future events incorporated into the

pension benefit formula, including estimates of the average

life of employees/survivors and average years of service

rendered. It is measured based on assumptions concerning

future interest rates and future employee compensation levels.

For postretirement benefit plans, the benefit obligation is the

“accumulated postretirement benefit obligation,” the actuarial

present value as of a date of all future benefits attributed

under the terms of the postretirement benefit plan to

employee service rendered to the valuation date.

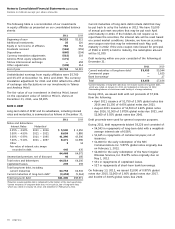

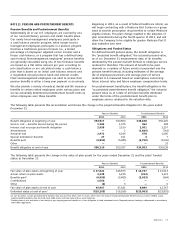

NOTE 11. PENSION AND POSTRETIREMENT BENEFITS

Pension Benefits and Postretirement Benefits

Substantially all of our U.S. employees are covered by one

of our noncontributory pension and death benefit plans.

Our newly hired management employees participate in

a cash balance pension program, while longer-service

management employees participate in a pension program

that has a traditional pension formula (i.e., a stated

percentage of employees’ adjusted career income) and a

frozen cash balance, or a program that has a defined lump

sum formula. Nonmanagement employees’ pension benefits

are generally calculated using one of two formulas: benefits

are based on a flat dollar amount per year according to

job classification or are calculated under a cash balance

plan that is based on an initial cash balance amount and

a negotiated annual pension band and interest credits.

Most nonmanage ment employees can elect to receive their

pension benefits in either a lump sum payment or an annuity.

We also provide a variety of medical, dental and life insurance

benefits to certain retired employees under various plans and

accrue actuarially determined postretirement benefit costs as

active employees earn these benefits.

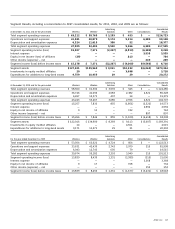

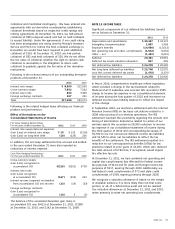

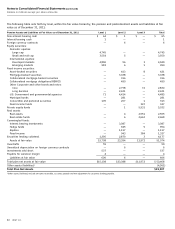

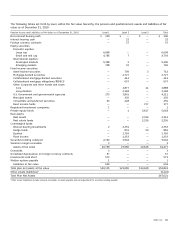

The following table presents this reconciliation and shows the change in the projected benefit obligation for the years ended

December 31:

Pension Benefits Postretirement Benefits

2011 2010 2011 2010

Benefit obligation at beginning of year $53,917 $50,850 $36,638 $36,225

Service cost – benefits earned during the period 1,186 1,075 362 348

Interest cost on projected benefit obligation 2,958 3,150 2,051 2,257

Amendments — 2 (1,830) (742)

Actuarial loss 2,972 4,224 478 1,046

Special termination benefits 27 101 4 7

Benefits paid (4,950) (5,485) (2,750) (2,536)

Other — — — 33

Benefit obligation at end of year $56,110 $53,917 $34,953 $36,638

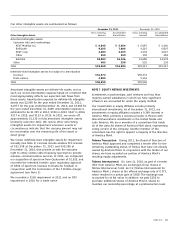

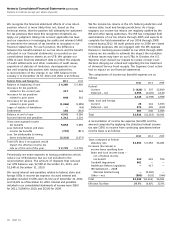

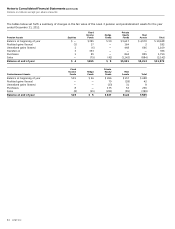

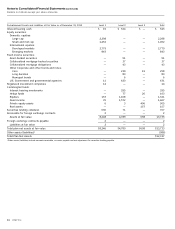

The following table presents the change in the value of plan assets for the years ended December 31 and the plans’ funded

status at December 31:

Pension Benefits Postretirement Benefits

2011 2010 2011 2010

Fair value of plan assets at beginning of year $ 47,621 $46,873 $ 12,747 $ 11,513

Actual return on plan assets 2,238 6,230 (224) 1,472

Benefits paid1 (4,950) (5,485) (2,633) (244)

Contributions 1,000 — — —

Other (2) 3 — 6

Fair value of plan assets at end of year 45,907 47,621 9,890 12,747

Unfunded status at end of year2 $(10,203) $ (6,296) $(25,063) $(23,891)

1 At our discretion, certain postretirement benefits may be paid from AT&T cash accounts, which does not reduce Voluntary Employee Beneficiary Association (VEBA) assets.

Future benefit payments may be made from VEBA trusts and thus reduce those asset balances.

2 Funded status is not indicative of our ability to pay ongoing pension benefits or of our obligation to fund retirement trusts. Required pension funding is determined in accordance

with ERISA regulations.