AT&T Wireless 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 35

and we believe our service plan offerings will help to retain

our subscribers by providing incentives not to move to a new

carrier. As is common in the industry, most of our phones are

designed to work only with our wireless technology, requiring

subscribers who desire to move to a new carrier with a

different technology to purchase a new device. While the

expiration of our iPhone exclusivity arrangement in the first

quarter of 2011 contributed slightly to the increase in

postpaid churn in 2011, this increase was largely due to

customers who were not currently using an iPhone. While the

expiration of our iPhone exclusivity arrangement may continue

to affect our net postpaid subscriber additions, we do not

expect exclusivity terminations to have a material impact on

our Wireless segment income, consolidated operating margin

or our cash flows from operations.

We also believe future wireless growth will depend upon a

wireless network that has sufficient spectrum and capacity

to support innovative services and devices, and makes these

innovations available to more wireless subscribers. Due to

substantial increases in the demand for wireless service in

the United States, AT&T is facing significant spectrum and

capacity constraints on its wireless network in certain markets.

We expect such constraints to increase and expand to

additional markets in the coming years. While we are

continuing to invest significant capital in expanding our

network capacity, our capacity constraints could affect the

quality of existing voice and data services and our ability to

launch new, advanced wireless broadband services, unless

we are able to obtain more spectrum. Any spectrum solution

will require that the Federal Communications Commission

(FCC) makes new spectrum available to the wireless industry

and allows us to obtain the spectrum we need more

immediately to meet the needs of our customers. We will

continue to attempt to address spectrum and capacity

constraints on a market-by-market basis.

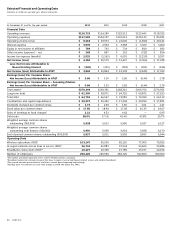

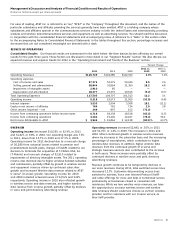

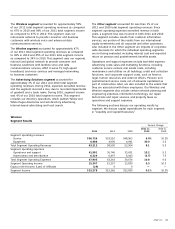

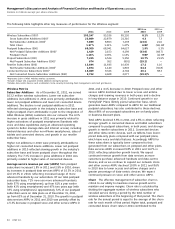

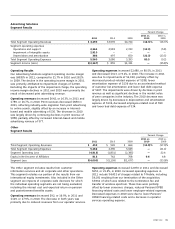

Operating Results

Our Wireless segment operating income margin was 24.2%

in 2011, compared to 26.1% in 2010 and 25.8% in 2009.

The margin decrease in 2011 reflected higher equipment

subsidies and selling costs associated with higher smartphone

sales and handset upgrades, partially offset by higher

revenues generated by our subscribers. While we subsidize

the sales prices of various smartphones, we expect to recover

that cost over time from increased usage of the devices,

especially data usage by the subscriber. We also expect a

recent change in our handset upgrade policy (to lengthen

the time between upgrades) to help our margin.

The increase in our Wireless segment operating income

margin in 2010 was primarily due to higher data revenues

generated by our subscribers during the year, partially offset

by the higher selling costs associated with more advanced

handset activations. The rate of margin growth flattened in

2010 due to a significant number of subscribers upgrading

their handsets during the second half of the year.

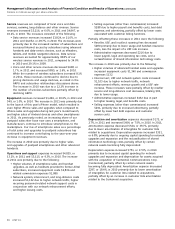

decline in net additions for the year. Postpaid churn increased

in 2011 as we transitioned former Alltel subscribers to our

network. Reseller subscribers, who comprise an increasing

share of net additions and generally have the lowest churn

rate among our wireless subscribers, had a slightly lower

churn rate in 2011. A lower prepaid churn rate in 2011,

due in part to the introduction of additional tablets to the

marketplace after the first quarter of 2010, partially offset

higher postpaid and connected device churn rates in 2011.

Improvement in our total and postpaid churn rates contributed

to our net additions in 2010. These churn rate declines

reflected network enhancements and broader coverage, more

affordable rate plans and exclusive devices, continued growth

in family plans, and free mobile-to-mobile calling among our

wireless subscribers. Data-centric device subscribers increased

their share of net additions in 2010.

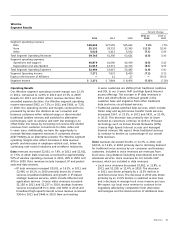

Wireless Subscriber Relationships

The wireless industry continues to mature. Accordingly, we

believe that future wireless growth will increasingly depend

on our ability to offer innovative services and devices.

To attract and retain subscribers, we offer a wide variety

of service plans in addition to offering a broad handset line.

Our postpaid subscribers typically sign a two-year contract,

which includes discounted handsets and early termination

fees. We also offer data plans at different price levels to

attract a wide variety of subscribers and to differentiate

us from our competitors. Many of our subscribers are on

family plans or business plans, which provide for service on

multiple handsets at discounted rates, and such subscribers

tend to have higher retention and lower churn rates. As of

December 31, 2011, 86% of our postpaid subscribers are on

family plans or business discount plans. We also introduced

in 2011 our Mobile to Any Mobile feature, which enables our

new and existing subscribers on these and other qualifying

plans to make unlimited mobile calls to any mobile number

in the United States as part of an unlimited text plan,

subject to certain conditions. Such offerings are intended

to encourage existing subscribers to upgrade their current

services and/or add connected devices, attract subscribers

from other providers, and minimize subscriber churn. In 2011,

we continued to see a significant portion of our subscriber

base upgrade from their current devices to smartphones.

We offer a large variety of handsets, including at least

16 smartphones with advanced operating systems from

nine manufacturers. As technology evolves, rapid changes

are occurring in the handset and device industry with the

continual introduction of new models (e.g., various Windows,

Android and other smartphones) or significant revisions of

existing models. We believe a broad offering of a wide variety

of handsets reduces dependence on any single product as

these products continue to evolve in terms of technology

and subscriber appeal. From time to time, we offer and have

offered attractive handsets on an exclusive basis. As these

exclusivity arrangements expire, we expect to continue to

offer such handsets (based on historical industry practice),