AT&T Wireless 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

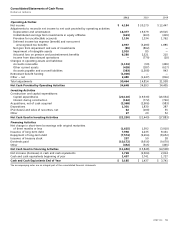

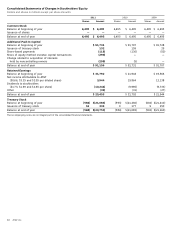

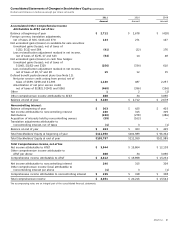

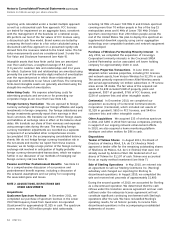

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

54 AT&T Inc.

Changes to federal, state and foreign government

regulations and decisions in regulatory proceedings

could materially adversely affect us.

Our wireline subsidiaries are subject to significant federal

and state regulation while many of our competitors are not.

In addition, our subsidiaries and affiliates operating outside

the United States are also subject to the jurisdiction of

national and supranational regulatory authorities in the

market where service is provided. Our wireless subsidiaries

are regulated to varying degrees by the FCC and some state

and local agencies. Adverse rulings by the FCC relating to

broadband issues could impede our ability to manage our

networks and recover costs and lessen incentives to invest

in our networks. The development of new technologies, such

as IP-based services, also has created or potentially could

create conflicting regulation between the FCC and various

state and local authorities, which may involve lengthy

litigation to resolve and may result in outcomes unfavorable

to us. In addition, increased public focus on potential global

climate changes has led to proposals at state, federal and

foreign government levels to increase regulation on various

types of emissions, including those generated by vehicles

and by facilities consuming large amounts of electricity.

We do not expect these proposals to have a material adverse

impact on our operating results, and they could create

increased demand for communications services as

companies seek to reduce emissions.

Continuing growth in our wireless services will depend

on continuing access to adequate spectrum, deployment

of new technology and offering attractive services to

customers.

The wireless industry is undergoing rapid and significant

technological changes and a dramatic increase in usage, in

particular demand for and usage of data and other non-voice

services. We must continually invest in our wireless network

in order to continually improve our wireless service to meet

this increasing demand and remain competitive. Improvements

in our service depend on many factors, including continued

access to and deployment of adequate spectrum. We must

maintain and expand our network capacity and coverage as

well as the associated wireline network needed to transport

voice and data between cell sites. Network service

enhancements and product launches may not occur as

scheduled or at the cost expected due to many factors,

including delays in determining equipment and handset

operating standards, supplier delays, increases in network

equipment and handset component costs, regulatory

permitting delays for tower sites or enhancements or

labor-related delays. Deployment of new technology also

may adversely affect the performance of the network for

existing services. If the FCC does not fairly allocate sufficient

spectrum to allow the wireless industry in general, and the

Company in particular, to increase its capacity or if we cannot

acquire needed spectrum or deploy the services customers

desire on a timely basis without burdensome conditions or

at adequate cost while maintaining network quality levels,

then our ability to attract and retain customers, and therefore

maintain and improve our operating margins, could be

materially adversely affected.

Increasing competition for wireless customers could

adversely affect our operating results.

We have multiple wireless competitors in each of our service

areas and compete for customers based principally on

service/device offerings, price, call quality, coverage area

and customer service. In addition, we are facing growing

competition from providers offering services using alternative

wireless technologies and IP-based networks as well as

traditional wireline networks. We expect market saturation

to continue to cause the wireless industry’s customer

growth rate to moderate in comparison with historical

growth rates, leading to increased competition for customers.

We also expect that our customers’ growing demand for

data services will place constraints on our network capacity.

This competition and our capacity issues will continue to

put pressure on pricing and margins as companies compete

for potential customers. Our ability to respond will depend,

among other things, on continued improvement in network

quality and customer service and effective marketing of

attractive products and services, and cost management.

These efforts will involve significant expenses and require

strategic management decisions on, and timely

implementation of, equipment choices, network deployment

and management, and service offerings.

Increasing costs in our wireline operations could adversely

affect wireline operating margins.

We expect our operating costs, including customer acquisition

and retention costs will continue to put pressure on pricing,

margins and customer retention levels. A number of our

competitors that rely on alternative technologies (e.g., wireless,

cable and VoIP) and business models (e.g., advertising-

supported) are typically subject to less (or no) regulation

than our wireline subsidiaries and therefore are able to operate

with lower costs. These competitors also have cost advantages

compared to us, due in part to a nonunionized workforce,

lower employee benefits and fewer retirees (as most of the

competitors are relatively new companies). Over time these

cost disparities could require us to evaluate the strategic

worth of various wireline operations. We believe our cost

disadvantages could be offset by continuing to increase the

efficiency of our operating systems and by improving employee

training and productivity; however, there can be no guarantee

that our efforts in these areas will be successful.