AT&T Wireless 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 51

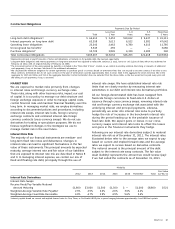

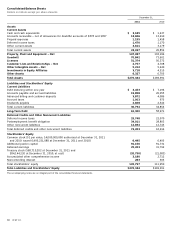

Contractual Obligations

Payments Due By Period

Less than 1-3 3-5 More than

Total 1 Year Years Years 5 Years

Long-term debt obligations1,2 $ 64,613 $ 3,453 $10,612 $ 9,437 $ 41,111

Interest payments on long-term debt2 63,358 3,613 6,522 5,581 47,642

Operating lease obligations 23,242 2,462 4,780 4,215 11,785

Unrecognized tax benefits3 3,345 259 — — 3,086

Purchase obligations4 10,709 3,845 4,339 2,185 340

Total Contractual Obligations $165,267 $13,632 $26,253 $21,418 $103,964

1 Represents principal or payoff amounts of notes and debentures at maturity or, for putable debt, the next put opportunity.

2 Long-term debt obligations and interest payments on long-term debt were not adjusted to reflect the January 13, 2012, notice to call $1,200 of debt, which was redeemed on

February 15, 2012, with an original maturity of February 15, 2056.

3 The noncurrent portion of the unrecognized tax benefits is included in the “More than 5 Years” column, as we cannot reasonably estimate the timing or amounts of additional

cash payments, if any, at this time. See Note 10 for additional information.

4 We calculated the minimum obligation for certain agreements to purchase goods or services based on termination fees that can be paid to exit the contract. If we elect to exit

these contracts, termination fees for all such contracts in the year of termination could be approximately $611 in 2012, $423 in the aggregate for 2013 and 2014, $62 in the

aggregate for 2015 and 2016, and $10 in the aggregate thereafter. Certain termination fees are excluded from the above table, as the fees would not be paid every year and

the timing of such payments, if any, is uncertain.

MARKET RISK

We are exposed to market risks primarily from changes

in interest rates and foreign currency exchange rates.

These risks, along with other business risks, impact our cost

of capital. It is our policy to manage our debt structure and

foreign exchange exposure in order to manage capital costs,

control financial risks and maintain financial flexibility over the

long term. In managing market risks, we employ derivatives

according to documented policies and procedures, including

interest rate swaps, interest rate locks, foreign currency

exchange contracts and combined interest rate foreign

currency contracts (cross-currency swaps). We do not use

derivatives for trading or speculative purposes. We do not

foresee significant changes in the strategies we use to

manage market risk in the near future.

Interest Rate Risk

The majority of our financial instruments are medium- and

long-term fixed rate notes and debentures. Changes in

interest rates can lead to significant fluctuations in the fair

value of these instruments. The principal amounts by expected

maturity, average interest rate and fair value of our liabilities

that are exposed to interest rate risk are described in Notes 8

and 9. In managing interest expense, we control our mix of

fixed and floating rate debt, principally through the use of

interest rate swaps. We have established interest rate risk

limits that we closely monitor by measuring interest rate

sensitivities in our debt and interest rate derivatives portfolios.

All our foreign-denominated debt has been swapped from

fixed-rate foreign currencies to fixed-rate U.S. dollars at

issuance through cross-currency swaps, removing interest rate

risk and foreign currency exchange risk associated with the

underlying interest and principal payments. Likewise,

periodically we enter into interest rate locks to partially

hedge the risk of increases in the benchmark interest rate

during the period leading up to the probable issuance of

fixed-rate debt. We expect gains or losses in our cross-

currency swaps and interest rate locks to offset the losses

and gains in the financial instruments they hedge.

Following are our interest rate derivatives subject to material

interest rate risk as of December 31, 2011. The interest rates

illustrated below refer to the average rates we expect to pay

based on current and implied forward rates and the average

rates we expect to receive based on derivative contracts.

The notional amount is the principal amount of the debt

subject to the interest rate swap contracts. The fair value

asset (liability) represents the amount we would receive (pay)

if we had exited the contracts as of December 31, 2011.

Maturity

Fair Value

2012 2013 2014 2015 2016 Thereafter Total 12/31/11

Interest Rate Derivatives

Interest Rate Swaps:

Receive Fixed/Pay Variable Notional

Amount Maturing $1,800 $3,000 $1,500 $1,500 $ — $1,000 $8,800 $521

Weighted-Average Variable Rate Payable1 2.3% 2.5% 2.0% 2.6% 3.6% 4.1%

Weighted-Average Fixed Rate Receivable 4.9% 4.7% 3.9% 4.5% 5.6% 5.6%

1 Interest payable based on current and implied forward rates for One, Three, or Six Month LIBOR plus a spread ranging between approximately 4 and 388 basis points.