Supercuts 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

In April 2009, the FASB issued FASB Staff Position (FSP) FAS 107-1 and APB 28-1, Interim Disclosures about Fair Value of Financial

Instruments

, which amends SFAS No. 107, Disclosures about Fair Value of Financial Instruments and Accounting Principles Board (APB)

Opinion No. 28, Interim Financial Reporting

. The FSP requires the SFAS No. 107 disclosures about the fair value of financial instruments to be

presented in interim financial statements in addition to annual financial statements. The FSP is effective for interim reporting periods ending

after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009. The Company will begin utilizing the disclosure

guidance of FSP FAS 107-1 and APB 28-1 in first quarter of fiscal year 2010.

In May 2008, the FASB issued FSP APB 14-1,

Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion

(Including Partial Cash Settlement) . This FSP clarifies that convertible debt instruments that may be settled in cash upon conversion (including

partial cash settlement) are not addressed by paragraph 12 of APB Opinion No. 14, Accounting for Convertible Debt and Debt Issued with Stock

Purchase Warrants

. Additionally, this FSP specifies that issuers of such instruments should separately account for the liability and equity

components in a manner that will reflect the entity's nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods.

The Company adopted this FSP effective July 1, 2009. The adoption will impact the Company's accounting for its convertible senior notes

issued in July 2009, see Note 17 to the Consolidated Financial Statements.

In November 2008, the FASB ratified the Emerging Issues Task Force (EITF) consensus on Issue No. 08-6, Equity Method Investment

Accounting Considerations

(EITF 08-6). The EITF indicates, among other things, that transaction costs for an investment should be included in

the cost of the equity-method investment (and not expensed) and shares subsequently issued by the equity-method investee that reduce the

investor's ownership percentage should be accounted for as if the investor had sold a proportionate share of its investment, with gains or losses

recorded through earnings. The EITF is effective for the Company's fiscal year 2010 and interim Consolidated Financial Statements. The

adoption of this standard is not expected have a material impact on the Company's Consolidated Financial Statements.

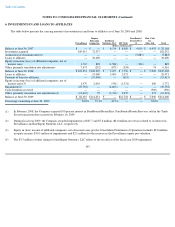

2. DISCONTINUED OPERATIONS

On February 16, 2009, the Company sold its Trade Secret salon concept (Trade Secret). The Company concluded, after a comprehensive

review of strategic and financial options, to divest Trade Secret. The sale of Trade Secret included 655 company-owned salons and 57 franchise

salons, all of which had historically been reported within the Company's North America reportable segment. The sale of Trade Secret included

CCI. CCI owned and operated PureBeauty and BeautyFirst salons which were acquired by the Company on February 20, 2008.

The Company concluded that Trade Secret qualified as held for sale under SFAS No. 144, Accounting for the Impairment or Disposal of

Long

-Lived Assets (SFAS. No. 144), as of December 31, 2008 and is presented as discontinued operations in the Condensed Consolidated

Statements of Operations for all periods presented. The operations and cash flows of Trade Secret have been eliminated from ongoing operations

of the Company and there will be no significant continuing involvement in the operations after disposal pursuant to Emerging Issues Task Force

(EITF) Issue No. 03-13, Applying the Conditions in Paragraph 42 of FASB Statement No. 144 in Determining Whether to Report Discontinued

Operations . The agreement includes a provision that the Company will supply

97