Supercuts 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

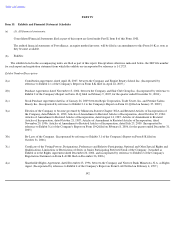

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

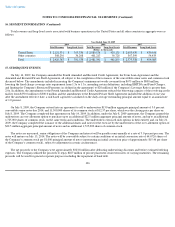

16. SEGMENT INFORMATION (Continued)

(1)

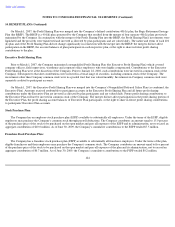

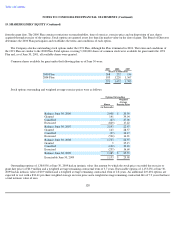

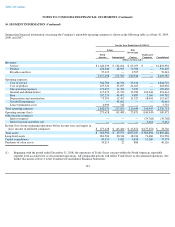

For the Year Ended June 30, 2008(1)(2)

Salons

Hair

Restoration

Centers

Unallocated

Corporate

North

America

International

Consolidated

(Dollars in thousands)

Revenues:

Service

$

1,635,238

$

165,379

$

61,873

$

—

$

1,862,490

Product

414,909

67,078

69,299

—

551,286

Royalties and fees

39,599

23,606

4,410

—

67,615

2,089,746

256,063

135,582

—

2,481,391

Operating expenses:

Cost of service

939,242

89,617

33,700

—

1,062,559

Cost of product

208,705

35,702

19,984

—

264,391

Site operating expenses

165,185

14,410

5,174

—

184,769

General and administrative

121,345

37,143

30,941

132,134

321,563

Rent

295,659

56,571

7,313

1,933

361,476

Depreciation and amortization

73,755

10,969

10,289

18,280

113,293

Total operating expenses

1,803,891

244,412

107,401

152,347

2,308,051

Operating income

285,855

11,651

28,181

(152,347

)

173,340

Other income (expense):

Interest expense

—

—

—

(

44,279

)

(44,279

)

Interest income and other, net

—

—

—

8,173

8,173

Income from continuing operations before income taxes and equity in

income of affiliated companies

$

285,855

$

11,651

$

28,181

$

(188,453

)

$

137,234

Total assets

$

1,249,827

$

120,443

$

284,898

$

580,703

$

2,235,871

Long

-

lived assets

355,287

35,902

11,616

79,046

481,851

Capital expenditures

51,057

10,624

4,191

19,927

85,799

Purchases of salon assets

119,822

6,719

19,036

—

145,577

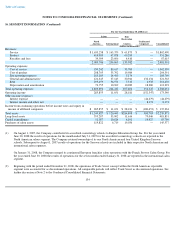

On August 1, 2007, the Company contributed its accredited cosmetology schools to Empire Education Group, Inc. For the year ended

June 30, 2008 the results of operations for the month ended July 31, 2007 for the accredited cosmetology schools are reported in the

North American salons segment. The Company retained ownership of its one North American and four United Kingdom Sassoon

schools. Subsequent to August 1, 2007 results of operations for the Sassoon schools are included in their respective North American and

international salon segments.

On January 31, 2008, the Company merged its continental European franchise salon operations with the Franck Provost Salon Group. For

the year ended June 30, 2008 the results of operations for the seven months ended January 31, 2008 are reported in the international salon

segment.

(2)

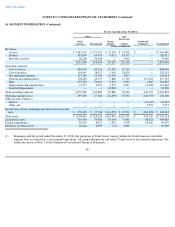

Beginning with the period ended December 31, 2008, the operations of Trade Secret concept within the North American reportable

segment were accounted for as discontinued operations. All comparable periods will reflect Trade Secret as discontinued operations. See

further discussion at Note 2 to the Condensed Consolidated Financial Statements.

134