Supercuts 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

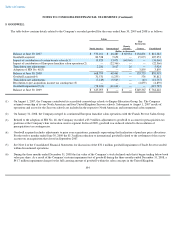

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

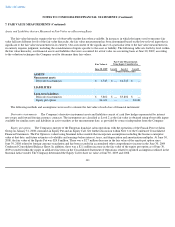

7. FAIR VALUE MEASUREMENTS (Continued)

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis

As indicated in Note 1 to the Condensed Consolidated Financial Statements, the aspects of SFAS No. 157 for which the effective date was

deferred for one year (i.e., the Company's first quarter of fiscal year 2010) under FSP No. 157-2 relate to nonfinancial assets and liabilities that

are measured at fair value, but are recognized or disclosed at fair value on a nonrecurring basis. This deferral applies to such items as

nonfinancial assets and liabilities initially measured at fair value in a business combination (but not measured at fair value in subsequent periods)

or nonfinancial long-lived asset groups measured at fair value for an impairment assessment.

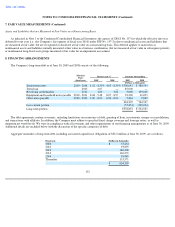

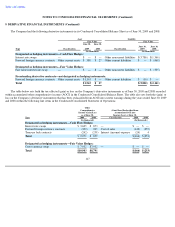

8. FINANCING ARRANGEMENTS

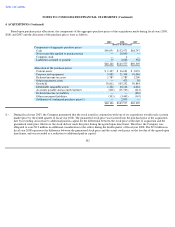

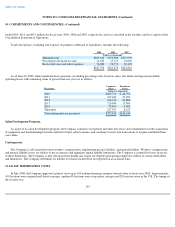

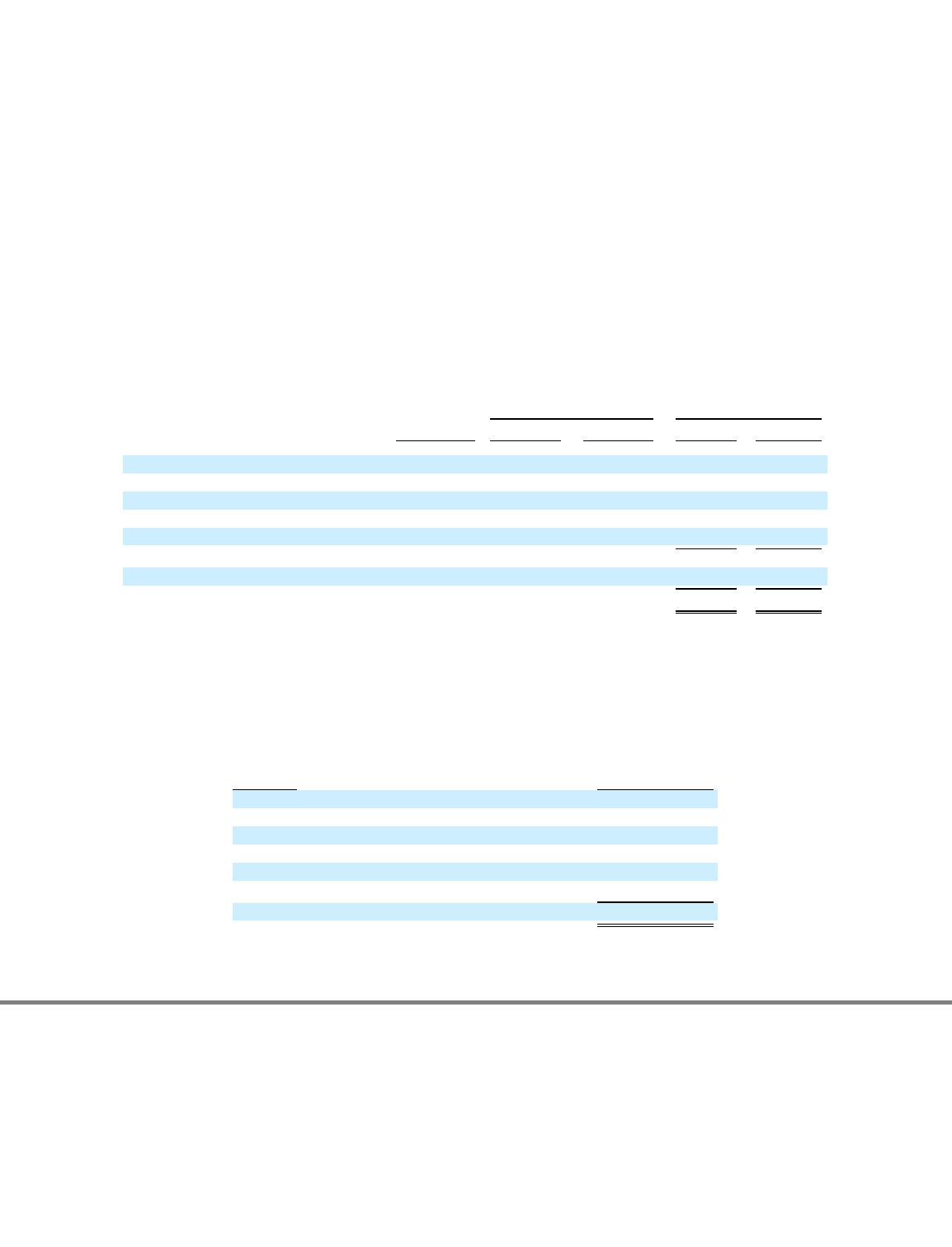

The Company's long-term debt as of June 30, 2009 and 2008 consists of the following:

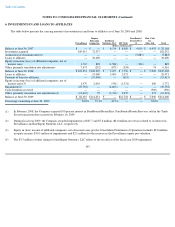

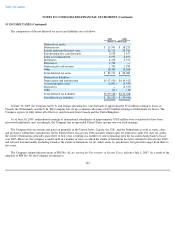

The debt agreements contain covenants, including limitations on incurrence of debt, granting of liens, investments, merger or consolidation,

and transactions with affiliates. In addition, the Company must adhere to specified fixed charge coverage and leverage ratios, as well as

minimum net worth levels. We were in compliance with all covenants and other requirements of our financing arrangements as of June 30, 2009.

Additional details are included below with the discussion of the specific categories of debt.

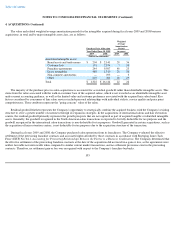

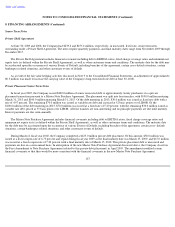

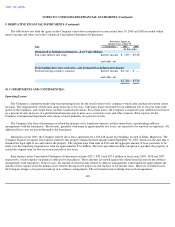

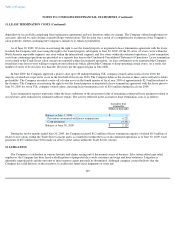

Aggregate maturities of long-term debt, including associated capital lease obligations of $32.2 million at June 30, 2009, are as follows:

112

Interest rate %

Amounts outstanding

Maturity

Dates

(fiscal year)

2009

2008

2009

2008

(Dollars in thousands)

Senior term notes

2010

-

2018

1.12

-

8.39

%

4.65

-

8.39

%

$

506,643

$

580,514

Term loan

2013

2.07

—

85,000

—

Revolving credit facility

2013

1.00

3.02

5,000

139,100

Equipment and leasehold notes payable

2010

-

2011

8.68

-

9.48

8.07

-

8.97

32,200

36,093

Other notes payable

2010

-

2013

3.00

-

8.00

6.00

-

8.00

5,464

9,040

634,307

764,747

Less current portion

(55,454

)

(230,224

)

Long

-

term portion

$

578,853

$

534,523

Fiscal year

(Dollars in thousands)

2010

$

55,454

2011

93,859

2012

186,308

2013

126,270

2014

18,845

Thereafter

153,571

$

634,307