Supercuts 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

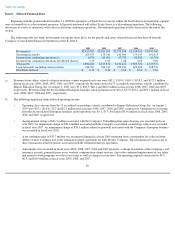

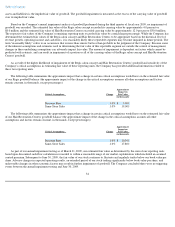

respectively, and increased by $0.9 and $2.3 million in fiscal years 2006 and 2005, respectively, as a result in the change in

estimate.

•

Expenses of $10.2, $6.1, $5.1, $6.9, and $3.1 million related to the impairment of property and equipment at underperforming

locations were recorded during fiscal years 2009, 2008, 2007, 2006, and 2005, respectively.

• A $5.7 million charge associated with disposal charges and lease termination fees related to the closure of salons other than in the

normal course of business was recorded in fiscal year 2009. A $5.7 million charge associated with disposal charges and lease

termination fees related to the closure of salons other than in the normal course of business was recorded in fiscal year 2006.

• Fiscal year 2006 includes a $2.8 million charge related to the settlement of a wage and hour lawsuit under the Fair Labor

Standards Act (FLSA).

c) The following significant items affected income from continuing operations and income from continuing operations per diluted share:

•

An income tax charge of approximately $3.8 million was recorded during fiscal year 2009 associated with an adjustment to

correct our prior year deferred income tax balances. An income tax charge of approximately $3.0 million of which $1.3 million

was recorded through income tax expense and $1.7 million was recorded through other comprehensive income during fiscal year

2008 was associated with repatriating approximately $30.0 million of cash previously considered to be indefinitely reinvested

outside of the United States. An income tax benefit increased reported net income by approximately $4.1 million during fiscal

year 2007 due to the reinstatement of the Work Opportunity and Welfare-to-Work Tax Credits. Approximately $1.3 million of

this benefit related to credits earned during fiscal year 2006, as the change in tax law during fiscal year 2007 was retroactive to

January 1, 2006. Work Opportunity and Welfare-to-Work Tax Credits increased reported net income by $0.8 and $1.8 million

during fiscal years 2006 and 2005, respectively.

•

Impairment charges of $25.7 and $7.8 million associated with the Company's investment in Provalliance and for the full carrying

value of our investment in and loans to Intelligent Nutrients, LLC were recorded in fiscal year 2009.

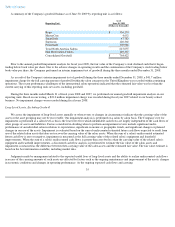

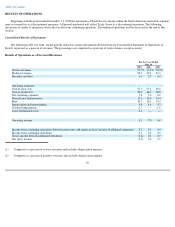

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is designed to provide a reader of our

financial statements with a narrative from the perspective of our management on our financial condition, results of operations, liquidity and

certain other factors that may affect our future results. Our MD&A is presented in five sections:

• Management's Overview

• Critical Accounting Policies

•

Overview of Fiscal Year 2009 Results

• Results of Operations

• Liquidity and Capital Resources

MANAGEMENT'S OVERVIEW

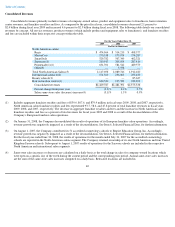

Regis Corporation (RGS) owns or franchises beauty salons and hair restoration centers. As of June 30, 2009, we owned, franchised or held

ownership interests in over 12,900 worldwide locations. Our locations consisted of 10,026 system wide North American and international salons,

95 hair restoration centers, and 2,804 locations in which we maintain an ownership interest less than 100 percent. Our salon concepts offer

generally similar products and services and serve mass market consumers. Our salon operations are organized to be managed based on

geographical location. Our

30