Supercuts 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

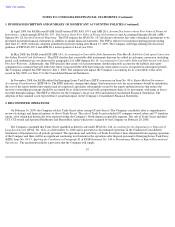

2. DISCONTINUED OPERATIONS (Continued)

product to the buyer of Trade Secret and provide certain administrative services for a transition period of six months following the date of sale

with possible extension to not more than eleven months. Under this agreement, the Company recognized $32.2 million of product revenues on

the supply of product sold to the purchaser of Trade Secret and $2.9 million of other income related to the administrative services during the year

ended June 30, 2009. The Company has a $19.1 million outstanding receivable with the buyer of Trade Secret as of June 30, 2009.

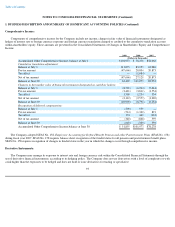

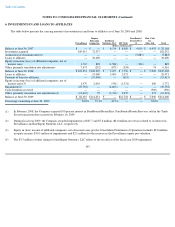

As the proceeds the Company received from the sale of Trade Secret were negligible, the Company recognized impairment charges within

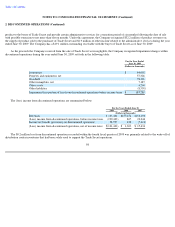

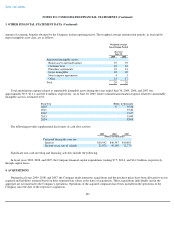

discontinued operations during the year ended June 30, 2009 set forth in the following table:

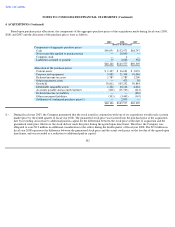

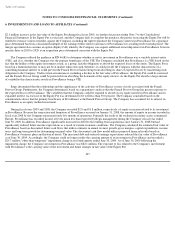

The (loss) income from discontinued operations are summarized below:

The $0.2 million loss from discontinued operations recorded within the fourth fiscal quarter of 2009 was primarily related to the write-

off of

distribution center inventories that had been solely used to support the Trade Secret operations.

98

For the Year Ended

June 30, 2009

(Dollars in thousands)

Inventories

$

44,992

Property and equipment, net

57,328

Goodwill

78,126

Other intangibles, net

7,187

Other assets

4,206

Other liabilities

(8,550

)

Impairment loss portion of loss from discontinued operations before income taxes

$

183,289

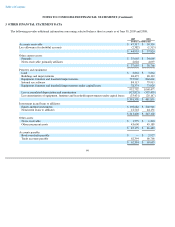

For the Years Ended June 30,

2009

2008

2007

(Dollars in thousands)

Revenues

$

163,436

$

257,474

$

253,250

(Loss) income from discontinued operations, before income taxes

(190,433

)

865

23,044

Income tax benefit (provision) on discontinued operations

58,997

438

(7,613

)

(Loss) income from discontinued operations, net of income taxes

$

(131,436

)

$

1,303

$

15,431