Supercuts 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(b) In accordance with accounting principles generally accepted in the United States of America, these obligations are not reflected in the

Consolidated Balance Sheet.

(c) As of June 30, 2009, we have liabilities for uncertain tax positions. We are not able to reasonably estimate the amount by which the

liabilities will increase or decrease over time; however, at this time, we do not expect a significant payment related to these obligations

within the next fiscal year. See Note 13 to the Consolidated Financial Statements for more information on our uncertain tax positions, the

amount that may be settled in chase, and the amount reasonably possible to change in the next 12 months.

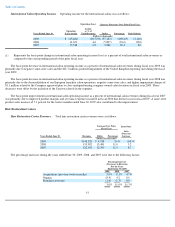

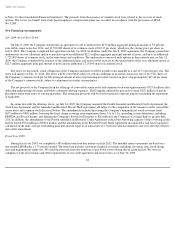

On-Balance Sheet Obligations

Our long-term obligations are composed primarily of senior term notes, term loan and a revolving credit facility. Certain senior term notes

and a portion of the term loan are hedged by contracts with financial institutions commonly referred to as interest rate swaps, as discussed in

Part II, Item 7A, "Quantitative and Qualitative Disclosures about Market Risk." Additionally, no adjustment was necessary to mark the hedged

portion of the debt obligation to fair value (a reduction to long-term debt). Interest payments on long-

term debt and capital lease obligations were

estimated based on our total average interest rate at June 30, 2009 and scheduled contractual repayments.

Other long-term liabilities include a total of $16.7 million related to the Executive Profit Sharing Plan and a salary deferral program,

$8.4 million (including $0.4 million in interest) related to established contractual payment obligations under retirement and severance payment

agreements for a small number of retired employees.

This table excludes the short-term liabilities, other than the current portion of long-term debt, disclosed on our balance sheet as the amounts

recorded for these items will be paid in the next year. We have no unconditional purchase obligations, as defined by SFAS No. 47, Disclosure of

Long

-Term Obligations . Also excluded from the contractual obligations table are payment estimates associated with employee health and

workers' compensation claims for which we are self-insured. The majority of our recorded liability for self-

insured employee health and workers'

compensation losses represents estimated reserves for incurred claims that have yet to be filed or settled.

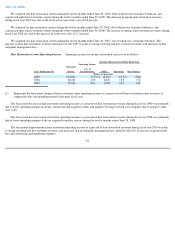

The Company has unfunded deferred compensation contracts covering certain management and executive personnel. The deferred

compensation contracts are offered to key executives based on their accomplishments within the Company. Because we cannot predict the

timing or amount of our future payments related to these contracts, such amounts were not included in the table above. Related obligations

totaled $24.5, $20.2, and $20.1 million at June 30, 2009, 2008, and 2007, respectively, and are included in other noncurrent liabilities in the

Consolidated Balance Sheet. Refer to Note 14 of the Consolidated Financial Statements for additional information. The obligations are funded

by insurance contracts.

Off-Balance Sheet Arrangements

Operating leases primarily represent long-term obligations for the rental of salon and hair restoration center premises, including leases for

company-owned locations, as well as future salon franchisee lease payments of approximately $144.1 million, which are reimbursed to the

Company by franchisees. Regarding the franchisee subleases, we generally retain the right to the related salon assets net of any outstanding

obligations in the event of a default by a franchise owner. Management has not experienced and does not expect any material loss to result from

these arrangements.

We have interest rate swap contracts and forward foreign currency contracts. See Part II, Item 7A, "Quantitative and Qualitative Disclosures

about Market Risk," for a detailed discussion of our

67