Supercuts 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

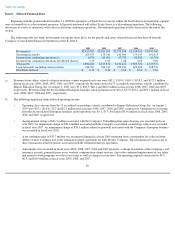

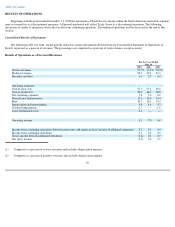

Item 6. Selected Financial Data

Beginning with the period ended December 31, 2008 the operations of Trade Secret concept within the North American reportable segment

were accounted for as a discontinued operation. All periods presented will reflect Trade Secret as a discontinued operation. The following

discussion of results of operations will reflect results from continuing operations. Discontinued operations will be discussed at the end of this

section.

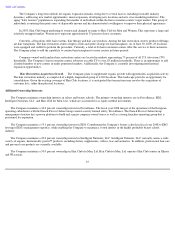

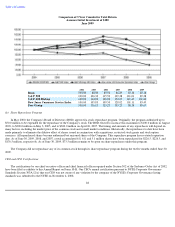

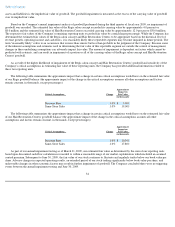

The following table sets forth, in thousands (except per share data), for the periods indicated, selected financial data derived from the

Company's Consolidated Financial Statements in Part II, Item 8.

a)

2009

2008

2007

2006

2005

Revenues(a)

$

2,429,787

$

2,481,391

$

2,373,338

$

2,168,002

$

1,941,360

Operating income(b)

109,073

173,340

141,506

179,147

101,613

Income from continuing operations(c)

6,970

83,901

67,739

92,903

41,791

Income from continuing operations per diluted share(c)

0.16

1.92

1.48

2.00

0.90

Total assets

1,892,486

2,235,871

2,132,114

1,985,324

1,725,976

Long

-

term debt, including current portion

634,307

764,747

709,231

622,269

568,776

Dividends declared

$

0.16

$

0.16

$

0.16

$

0.16

$

0.16

Revenues from salons, schools or hair restorations centers acquired each year were $82.1, $110.0, $105.1, $158.3, and $172.5 million

during fiscal years 2009, 2008, 2007, 2006, and 2005, respectively. Revenues from the 51 accredited cosmetology schools contributed to

Empire Education Group, Inc. on August 1, 2007 were $5.6, $68.5, $48.2 and $18.2 million in fiscal years 2008, 2007, 2006 and 2005,

respectively. Revenues from the deconsolidated European franchise salon operations were $36.2, $57.0, $52.7 and $55.1 million in fiscal

years 2008, 2007, 2006 and 2005, respectively.

b) The following significant items affected operating income:

• Operating (loss) income from the 51 accredited cosmetology schools contributed to Empire Education Group, Inc. on August 1,

2007 was ($0.3), ($18.6), $2.3 and $2.5 million in fiscal years 2008, 2007, 2006 and 2005, respectively. Operating (loss) income

from the deconsolidated European franchise salon operations was $5.1, $7.5, $4.8 and ($31.0) million in fiscal years 2008, 2007,

2006 and 2005, respectively.

•

An impairment charge of $41.7 million associated with the Company's United Kingdom salon division, was recorded in fiscal

year 2009. An impairment charge of $23.0 million associated with the Company's accredited cosmetology schools was recorded

in fiscal year 2007. An impairment charge of $38.3 million related to goodwill associated with the Company's European business

was recorded in fiscal year 2005.

• A net settlement gain of $33.7 million was recognized during fiscal year 2006 stemming from a termination fee collected from

Alberto-Culver Company due to the terminated merger agreement for Sally Beauty Company. The termination fee gain is net of

direct transaction-related expenses associated with the terminated merger agreement.

• Adjustments were recorded in fiscal years 2009, 2008, 2007, 2006 and 2005 related to a change in estimate of the Company's self-

insurance accruals, primarily prior years' workers' compensation claims reserves, due to the continued improvement of our safety

and return-to-work programs over the recent years as well as changes in state laws. Site operating expenses decreased by $9.9,

$6.9, and $10.0 million in fiscal years 2009, 2008, and 2007,

29