Supercuts 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

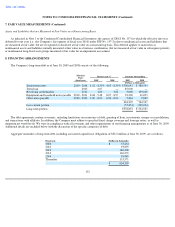

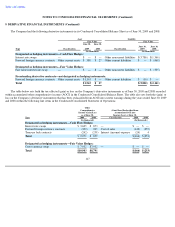

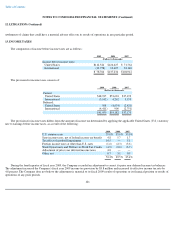

8. FINANCING ARRANGEMENTS (Continued)

Term Loan

During the three months ended December 31, 2008, the Company completed an $85.0 million term loan that matures in July 2012. The

monthly interest payments are based on a one-month LIBOR plus 1.75 percent. The term loan includes customary financial covenants including

a leverage ratio, fixed-

charge ratio and minimum net equity test. The Company used the proceeds from the term loan to pay down the Company's

revolving credit facility.

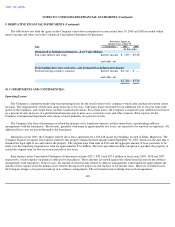

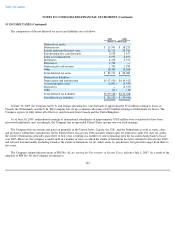

Revolving Credit Facility

The Company has an unsecured $350.0 million revolving credit facility with rates tied to LIBOR plus 60.0 basis points. The revolving

credit facility requires a quarterly facility fee on the average daily amount of the facility (whether used or unused) calculated at a rate of 15.0

basis points. Both the LIBOR credit spread and the facility fee are based on the Company's debt-to-EBITDA ratio at the end of each fiscal

quarter. The facility expires in July 2012.

On July 12, 2007, the Company amended its $350.0 million revolving credit agreement. Among other changes, the ratio of earnings before

interest, taxes, depreciation, amortization, and rent (EBITDAR), to fixed changes covenant was modified from a ratio of 1.65 on a rolling four

quarter basis to a ratio of 1.50 on a rolling four quarter basis. The Company is in compliance with all covenants and other requirements of its

credit agreements and senior notes. Additionally, the credit agreements do not include rating triggers or subjective clauses that would accelerate

maturity dates.

The maturity date for the revolving credit facility may be accelerated upon the occurrence of various events of default, including breaches

of the credit agreement, certain cross-default situations, certain bankruptcy related situations, and other customary events of default. The interest

rates under the facility vary and are based on a bank's reference rate, the federal funds rate and/or LIBOR, as applicable, and a leverage ratio for

the Company determined by a formula tied to the Company's debt and its adjusted income.

As of June 30, 2009 and 2008, the Company had outstanding borrowings under this facility of $5.0 and $139.1 million, respectively.

Because the credit agreement provides for possible acceleration of the maturity date of the facility based on provisions that are not objectively

determinable and due to recent changes in the Company's business such as the transactions described in Note 4 and Note 6 to the Consolidated

Financial Statements, the outstanding borrowings as of June 30, 2008 were classified as part of the current portion of the Company's long-term

debt. As a result of the modification to the revolving credit agreement in July 2009 including changes to the financial covenants (see Note 17 to

the Consolidated Financial Statements), the Company has classified the outstanding borrowings as of June 30, 2009 as part of the long-term

portion of the Company's long-term debt. Additionally, the Company had outstanding standby letters of credit under the facility of $28.0 and

$31.7 million at June 30, 2009 and 2008, respectively, primarily related to its self-insurance program. Unused available credit under the facility

at June 30, 2009 and 2008 was $317.0 and $179.2 million, respectively.

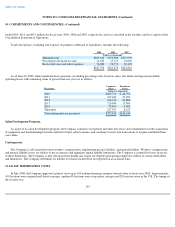

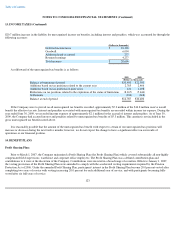

Equipment and Leasehold Notes Payable

The equipment and leasehold notes payable are primarily comprised of capital lease obligations which are payable in monthly installments

through fiscal year 2011. The capital lease obligations are collateralized by the assets purchased under the agreement.

114