Supercuts 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

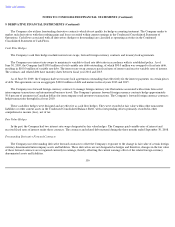

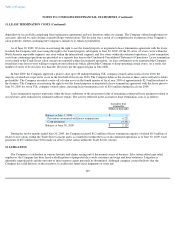

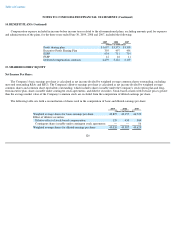

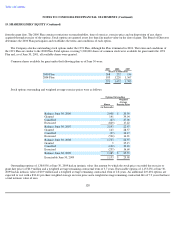

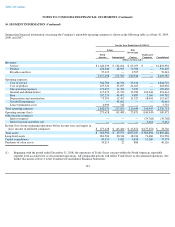

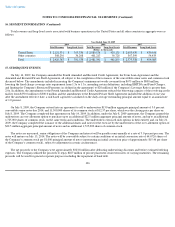

14. BENEFIT PLANS (Continued)

Compensation expense included in income before income taxes related to the aforementioned plans, excluding amounts paid for expenses

and administration of the plans, for the three years ended June 30, 2009, 2008 and 2007, included the following:

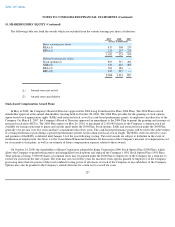

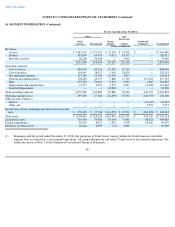

15. SHAREHOLDERS' EQUITY

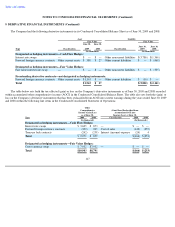

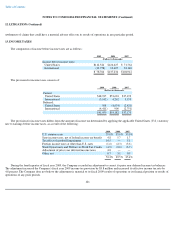

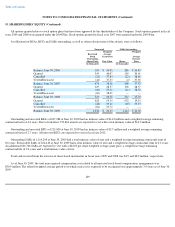

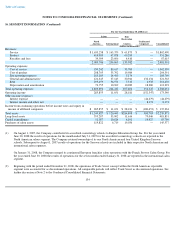

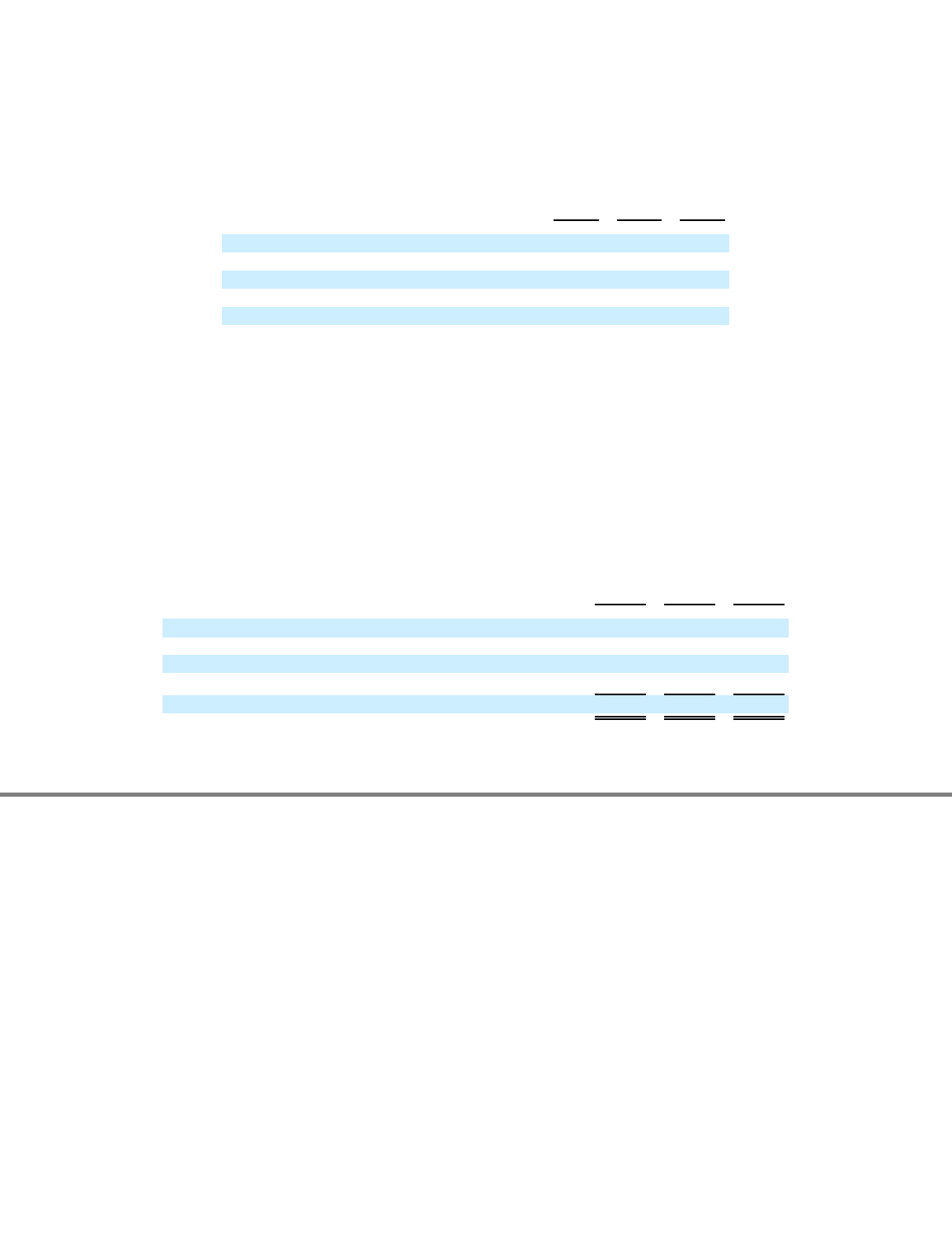

Net Income Per Share:

The Company's basic earnings per share is calculated as net income divided by weighted average common shares outstanding, excluding

unvested outstanding RSAs and RSUs. The Company's dilutive earnings per share is calculated as net income divided by weighted average

common shares and common share equivalents outstanding, which includes shares issuable under the Company's stock option plan and long-

term incentive plan, shares issuable under contingent stock agreements, and dilutive securities. Stock-based awards with exercise prices greater

than the average market value of the Company's common stock are excluded from the computation of diluted earnings per share.

The following table sets forth a reconciliation of shares used in the computation of basic and diluted earnings per share:

126

2009

2008

2007

(Dollars in thousands)

Profit sharing plan

$

1,697

$

3,373

$

3,305

Executive Profit Sharing Plan

303

497

491

ESPP

634

711

714

FSPP

12

18

11

Deferred compensation contracts

4,479

3,122

6,107

2009

2008

2007

(Shares in thousands)

Weighted average shares for basic earnings per share

42,897

43,157

44,723

Effect of dilutive securities:

Dilutive effect of stock

-

based compensation

129

430

844

Contingent shares issuable under contingent stock agreements

—

—

56

Weighted average shares for diluted earnings per share

43,026

43,587

45,623