Supercuts 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The basis point increase in rent expense as a percent of consolidated revenues during fiscal year 2008 was primarily due to rent expense

increasing at a faster rate than location same-store sales and the deconsolidation of the schools and European franchise salon operations, offset

by recent salon acquisitions having a lower occupancy cost.

The basis point increase in rent expense as a percent of consolidated revenues during fiscal years 2007 and 2006 was primarily due to rent

expense increasing at a faster rate than location same-store sales. Additionally, fiscal year 2007 is impacted by an extra week of rent in the

United Kingdom.

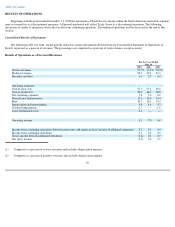

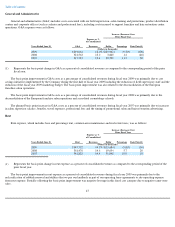

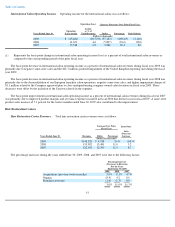

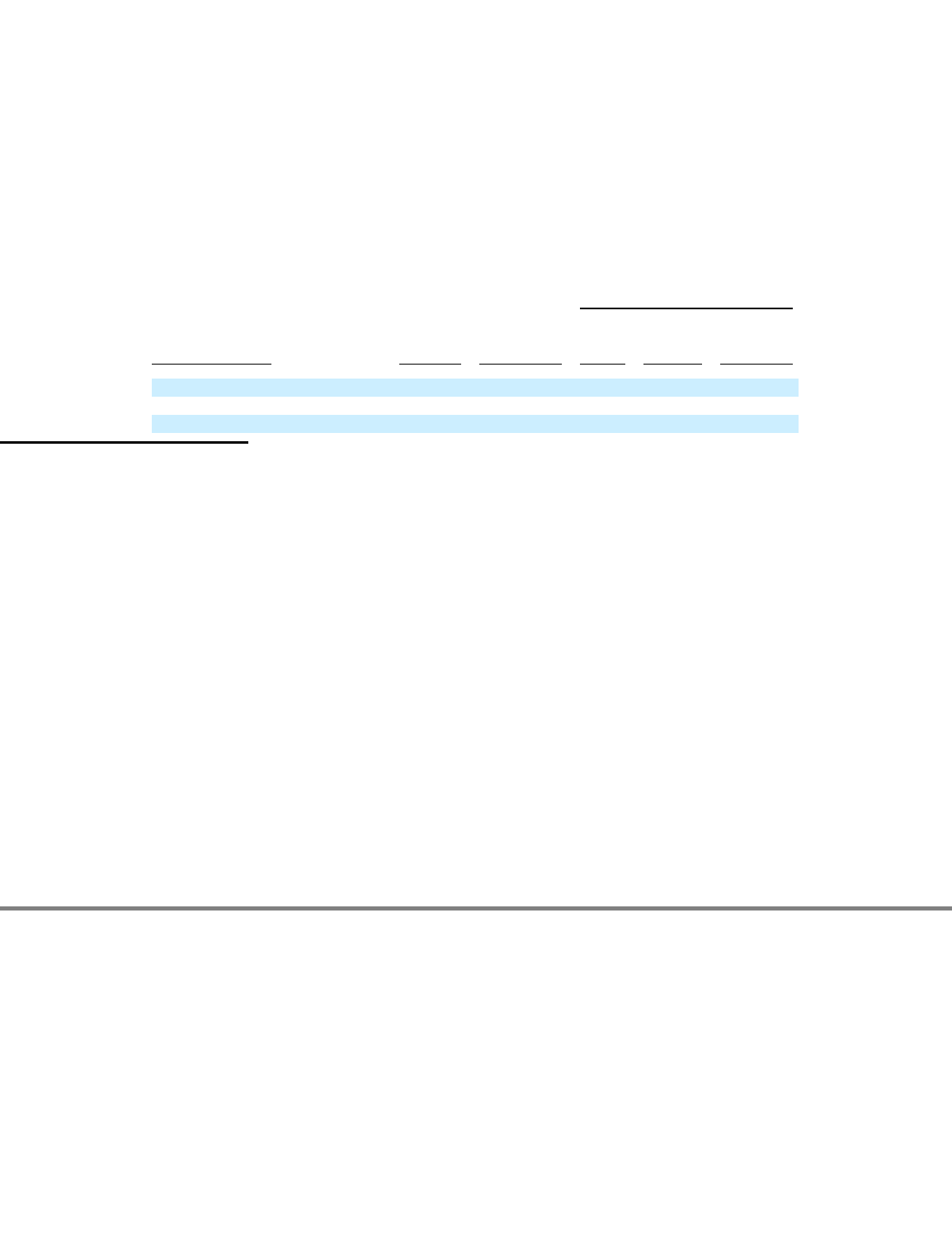

Depreciation and Amortization

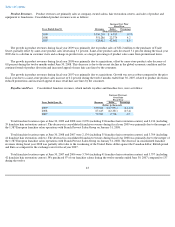

Depreciation and amortization expense (D&A) was as follows:

(1)

Increase (Decrease) Over

Prior Fiscal Year

Years Ended June 30,

D&A

Expense as %

of Consolidated

Revenues

Dollar

Percentage

Basis Point(1)

(Dollars in thousands)

2009

$

115,655

4.8

%

$

2,362

2.1

%

20

2008

113,293

4.6

1,829

1.6

(10

)

2007

111,464

4.7

8,390

8.1

(10

)

Represents the basis point change in depreciation and amortization as a percent of consolidated revenues as compared to the

corresponding period of the prior fiscal year.

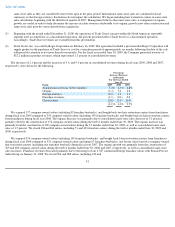

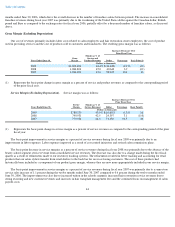

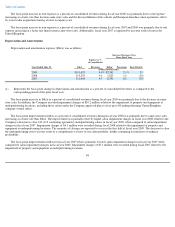

The basis point increase in D&A as a percent of consolidated revenues during fiscal year 2009 was primarily due to the decrease in same-

store sales. In addition, the Company recorded impairment charges of $10.2 million related to the impairment of property and equipment at

underperforming locations, including those salons under the Company approved plan to close up to 80 underperforming United Kingdom

company-owned salons.

The basis point improvement in D&A as a percent of consolidated revenues during fiscal year 2008 was primarily due to same-store sales

increasing at a faster rate than D&A. The improvement was partially offset by higher salon impairment charges in fiscal year 2008 related to the

Company's decision to close 160 (112 continuing operations) underperforming salons in fiscal year 2009, when compared to salon impairment

charges in fiscal year 2007. Impairment charges of $6.1 million were recorded during fiscal 2008 related to the impairment of property and

equipment at underperforming locations. The majority of closings are expected to occur in the first half of fiscal year 2009. The decision to close

the underperforming stores was the result of a comprehensive review of our salon portfolio, further continuing our initiative to enhance

profitability.

The basis point improvement in D&A for fiscal year 2007 relates primarily to lower salon impairment charges in fiscal year 2007 when

compared to salon impairment charges in fiscal year 2006. Impairment charges of $5.1 million were recorded during fiscal 2007 related to the

impairment of property and equipment at underperforming locations.

48