Supercuts 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

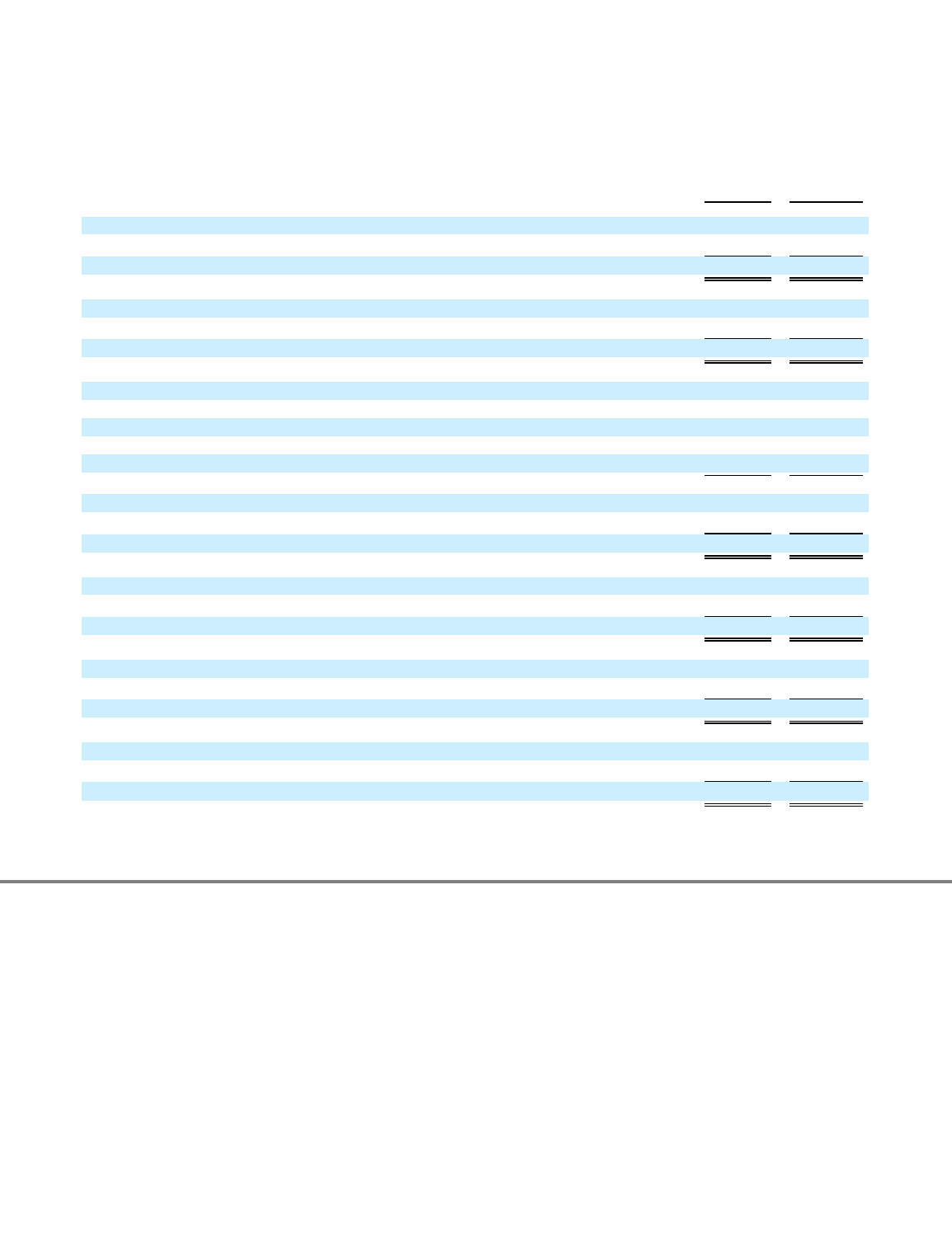

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

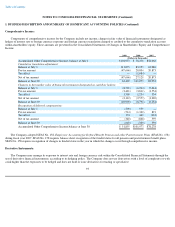

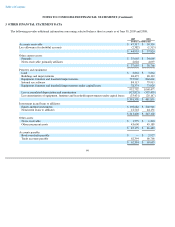

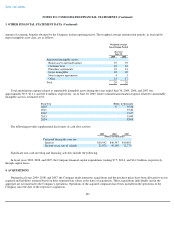

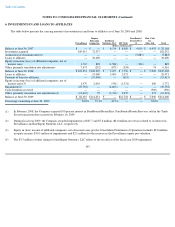

3. OTHER FINANCIAL STATEMENT DATA

The following provides additional information concerning selected balance sheet accounts as of June 30, 2009 and 2008:

99

2009

2008

(Dollars in thousands)

Accounts receivable

$

47,317

$

39,339

Less allowance for doubtful accounts

(2,382

)

(1,515

)

$

44,935

$

37,824

Other current assets:

Prepaids

$

35,665

$

34,669

Notes receivable, primarily affiliates

2,028

4,097

$

37,693

$

38,766

Property and equipment:

Land

$

3,864

$

3,864

Buildings and improvements

48,472

48,110

Equipment, furniture and leasehold improvements

737,967

862,661

Internal use software

84,115

79,913

Equipment, furniture and leasehold improvements under capital leases

78,374

73,929

952,792

1,068,477

Less accumulated depreciation and amortization

(527,823

)

(557,459

)

Less amortization of equipment, furniture and leasehold improvements under capital leases

(33,431

)

(29,167

)

$

391,538

$

481,851

Investment in and loans to affiliates:

Equity

-

method investments

$

198,682

$

202,946

Noncurrent loans to affiliates

12,718

44,156

$

211,400

$

247,102

Other assets:

Notes receivable

$

1,579

$

1,294

Other noncurrent assets

43,600

45,189

$

45,179

$

46,483

Accounts payable:

Book overdrafts payable

$

—

$

2,927

Trade accounts payable

62,394

66,766

$

62,394

$

69,693