Supercuts 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

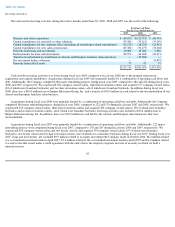

Private Placement Senior Term Notes

At June 30, 2009 and 2008, we had $267.0 and $325.0 million, respectively, in private placement senior term notes. The notes had final

maturity dates from March 2009 through March 2015. The interest rates on the notes ranged from fixed coupon rates of 4.97 to 7.2 and 52 to 55

basis points over LIBOR on floating coupon rates.

The private placement senior term notes includes financial covenants including debt to EBITDA ratios, fixed charge coverage ratios and

minimum net equity tests (as defined within the Private Shelf Agreement), as well as other customary terms and conditions. The maturity date

for the debt may be accelerated upon the occurrence of various Events of Default, including breaches of the agreement, certain cross- default

situations, certain bankruptcy related situations, and other customary events of default.

On June 29, 2009, the Company entered into a prepayment amendment on the private placement senior term notes whereby the Company

negotiated to prepay the notes with a premium over the principal amount that is less than the make-whole premium that is otherwise payable

upon redemption. Subsequent to fiscal year 2009, the net proceeds from the convertible senior notes and common stock issuances in July 2009

were utilized to repay the $267.0 million of private placement senior term notes.

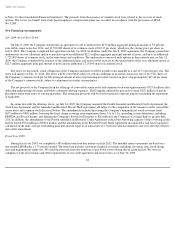

Acquisitions

Acquisitions are discussed throughout Management's Discussion and Analysis in this Item 7, as well as in Note 4 to the Consolidated

Financial Statements in Part II, Item 8 of this Form 10-K. The acquisitions were funded primarily from operating cash flow, debt and the

issuance of common stock.

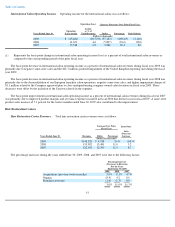

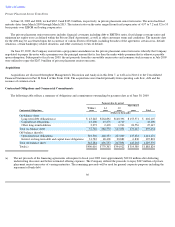

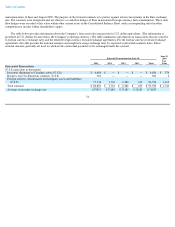

Contractual Obligations and Commercial Commitments

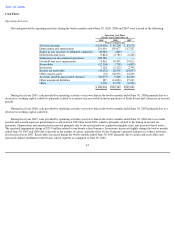

The following table reflects a summary of obligations and commitments outstanding by payment date as of June 30, 2009:

(a)

Payments due by period

Contractual Obligations

Within 1

years

1

-

3

years

3

-

5

years

More than 5

years

Total

(Dollars in thousands)

On

-

balance sheet:

Long

-

term debt obligations(a)

$

43,248

$

264,892

$

140,396

$

153,571

$

602,107

Capital lease obligations

12,206

15,275

4,719

—

32,200

Other long

-

term liabilities

2,272

2,403

1,916

18,556

25,147

Total on

-

balance sheet

57,726

282,570

147,031

172,127

659,454

Off

-

balance sheet(b):

Operating lease obligations

310,502

448,333

227,009

135,632

1,121,476

Interest on long

-

term debt and capital lease obligations

31,782

48,400

20,882

6,830

107,894

Total off

-

balance sheet

342,284

496,733

247,891

142,462

1,229,370

Total(c)

$

400,010

$

779,303

$

394,922

$

314,589

$

1,888,824

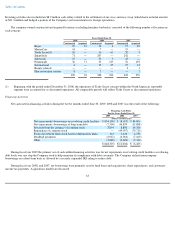

The net proceeds of the financing agreements subsequent to fiscal year 2009 were approximately $323.8 million after deducting

underwriting discounts and before estimated offering expenses. The Company utilized the proceeds to repay $267 million of private

placement senior term notes of varying maturities. The remaining proceeds will be used for general corporate purposes including the

repayment of bank debt

66