Supercuts 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. LITIGATION (Continued)

settlements of claims that could have a material adverse effect on its results of operations in any particular period.

13. INCOME TAXES

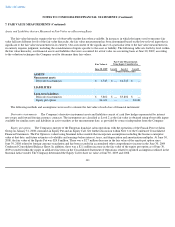

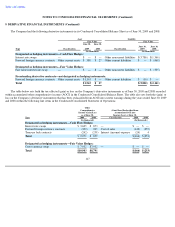

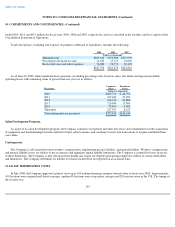

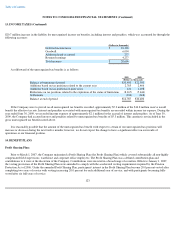

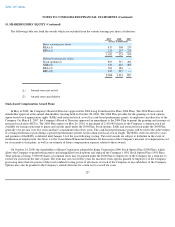

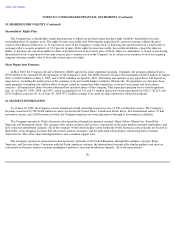

The components of income before income taxes are as follows:

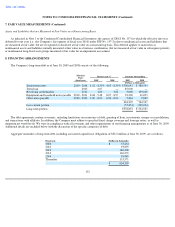

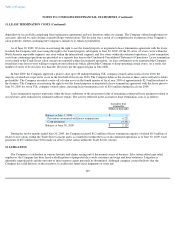

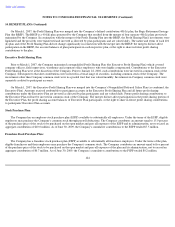

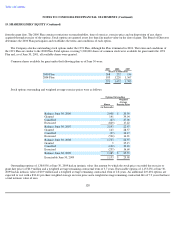

The provision for income taxes consists of:

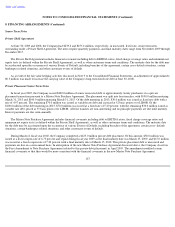

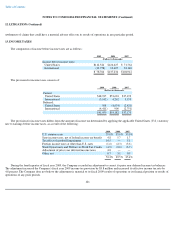

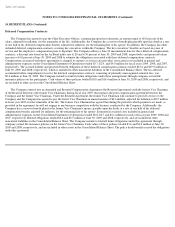

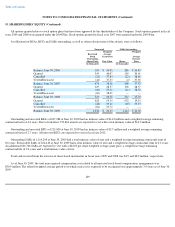

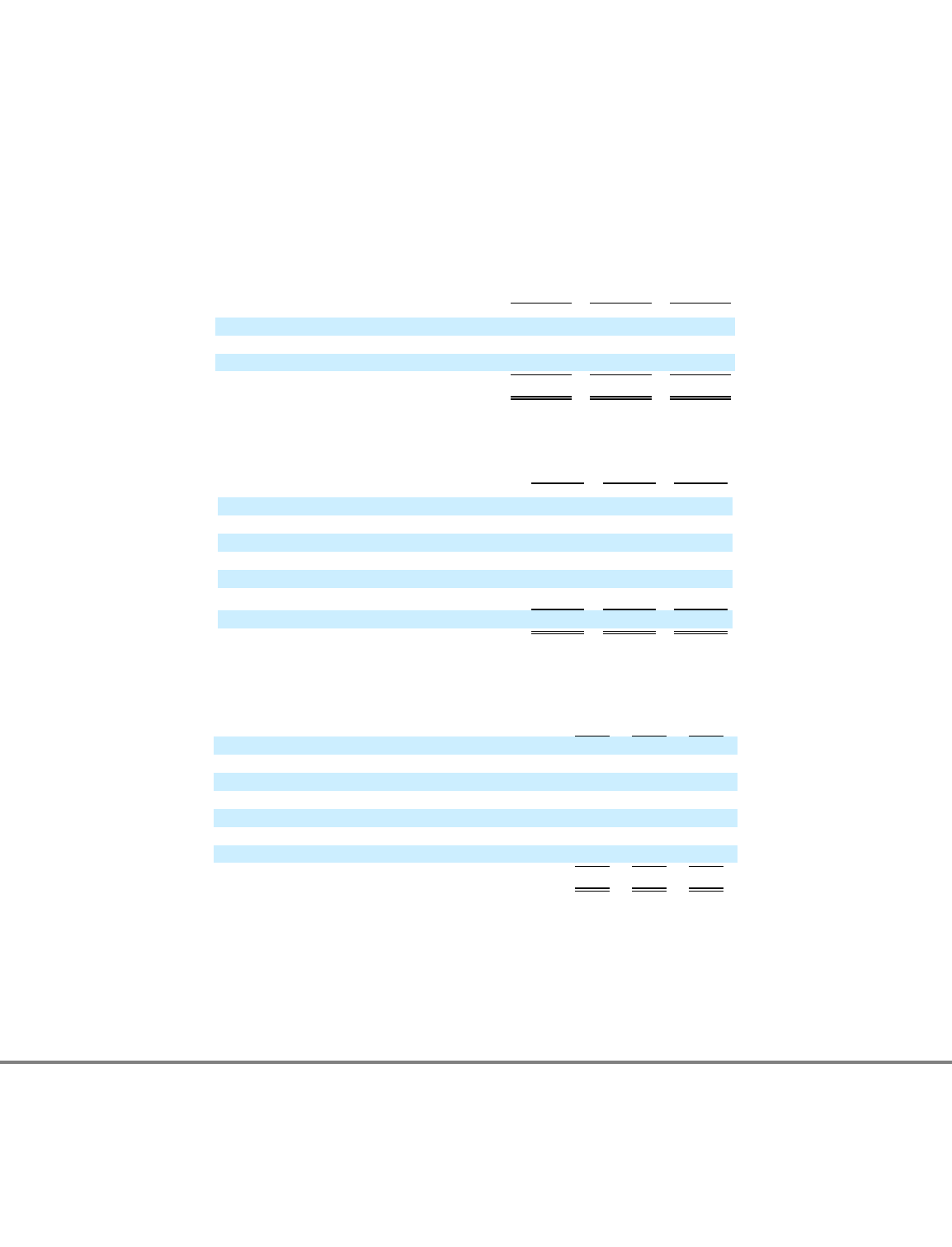

The provision for income taxes differs from the amount of income tax determined by applying the applicable United States (U.S.) statutory

rate to earnings before income taxes, as a result of the following:

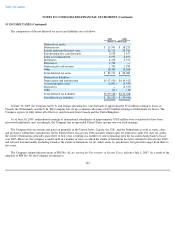

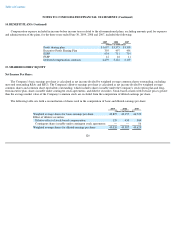

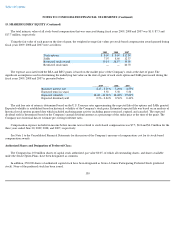

During the fourth quarter of fiscal year 2009, the Company recorded an adjustment to correct its prior year deferred income tax balances.

The adjustment increased the Company's fiscal year 2009 income tax provision by $3.8 million and increased its effective income tax rate by

4.8 percent. The Company does not believe the adjustment is material to its fiscal 2009 results of operations or its financial position or results of

operations of any prior periods.

121

2009

2008

2007

(Dollars in thousands)

Income before income taxes:

United States

$

112,524

$

126,627

$

71,764

International

(33,758

)

10,607

33,148

$

78,766

$

137,234

$

104,912

2009

2008

2007

(Dollars in thousands)

Current:

United States

$

48,935

$

53,694

$

37,192

International

(3,142

)

4,262

5,153

Deferred:

United States

568

(4,674

)

(2,421

)

International

(4,411

)

900

(2,751

)

$

41,950

$

54,182

$

37,173

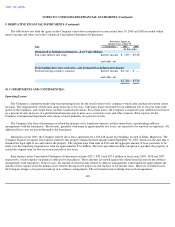

2009

2008

2007

U.S. statutory rate

35.0

%

35.0

%

35.0

%

State income taxes, net of federal income tax benefit

4.8

5.7

1.7

Tax effect of goodwill impairment

14.5

—

5.1

Foreign income taxes at other than U.S. rates

(1.6

)

(2.3

)

(3.6

)

Work Opportunity and Welfare

-

to

-

Work Tax Credits

(4.9

)

(2.0

)

(3.7

)

Adjustment of prior year deferred income taxes

4.8

—

—

Other, net

0.7

3.1

0.9

53.3

%

39.5

%

35.4

%