Supercuts 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

OVERVIEW OF FISCAL YEAR 2009 RESULTS

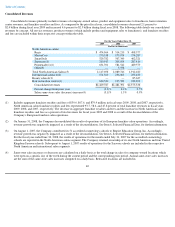

The following summarizes key aspects of our fiscal year 2009 results:

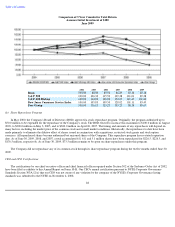

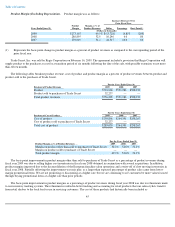

• Revenues decreased 2.1 percent to $2.4 billion and consolidated same-store sales decreased 3.1 percent during fiscal year 2009.

The Company experienced a decline in customer visitation as a result of the continued global economic decline, partially offset by

an increase in average ticket price, resulted in a decrease in consolidated same-store sales of 3.1 percent. The revenue decrease

was partially offset by $32.2 million of product sold to the purchaser of Trade Secret. The Company expects fiscal year 2010

same-store sales to be in the range of negative 3.0 to positive 1.0 percent.

•

The Trade Secret concept was sold on February 16, 2009 and results have been reported within discontinued operations within the

Consolidated Financial Statements. Reported as part of the loss on discontinued operations was a pre-tax $183.3 million non-cash

write-off consisting primarily of inventories, property and equipment, and goodwill. The Trade Secret concept locations sold

included 655 company-owned salons and 57 franchised salons.

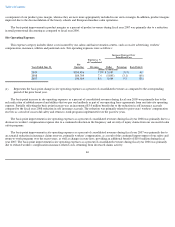

• Goodwill impairment charges of $41.7 million associated with our salon concepts in the United Kingdom were recorded during

fiscal year 2009.

• Other-than-temporary impairment charges of $25.7 million of our investment in Provalliance were recorded during fiscal year

2009.

•

Other

-

than

-

temporary impairment charges of $7.8 million for the full carrying value of our investment in and loans to Intelligent

Nutrients, LLC were recorded during fiscal year 2009.

• Long-lived asset impairment charges of $10.2 million were recorded during fiscal year 2009.

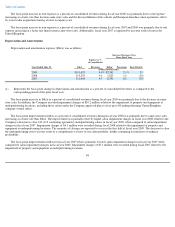

•

Total debt at the end of the fiscal year was $634.3 million and our debt

-

to

-

capitalization ratio, calculated as total debt as a

percentage of total debt and shareholders' equity at fiscal year end, increased 20 basis points to 44.1 percent as compared to

June 30, 2008.

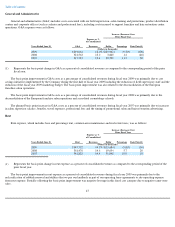

•

The annual effective income tax rate of 53.3 percent was adversely impacted by the pre

-

tax non

-

cash goodwill impairment charge

of $41.7 million and an adjustment to correct our prior year deferred income tax balances of $3.8 million. Offsetting these

amounts were favorable releases of FIN 48 reserves primarily due to the expiration of statutes of limitation resulting in a decrease

in income tax expense of $5.7 million.

• Site operating expenses were positively impacted by a $9.9 million pre-tax change in estimate of the Company's self-insurance

accruals, primarily workers' compensation, due to the continued improvement of our safety and return-to-work programs over the

recent years.

• Lease termination costs of $6.2 million ($5.7 million pre-tax included in continuing operations, with $0.5 million included in loss

from discontinued operations) were incurred as a result of the 76 salons that ceased using the right to use the leased property or

negotiated a lease termination agreement in connection with the Company's planned closure of up to 160 underperforming

company-owned salons.

38