Supercuts 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

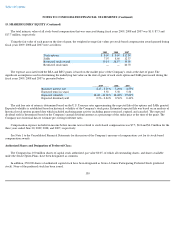

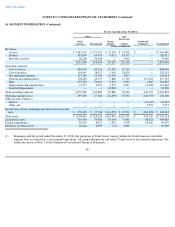

15. SHAREHOLDERS' EQUITY (Continued)

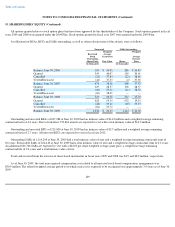

All options granted relate to stock option plans that have been approved by the shareholders of the Company. Stock options granted in fiscal

years 2009 and 2008 were granted under the 2004 Plan. Stock options granted in fiscal year 2007 were granted under the 2000 Plan.

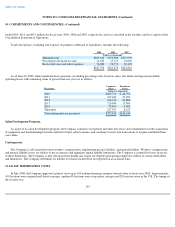

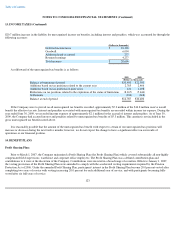

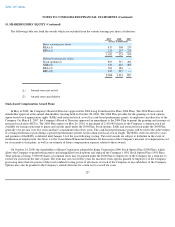

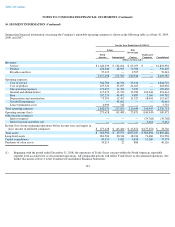

A rollforward of RSAs, RSUs and SARs outstanding, as well as other relevant terms of the awards, were as follows:

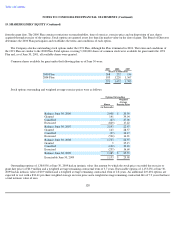

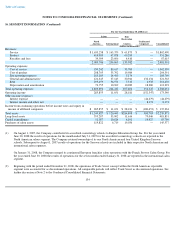

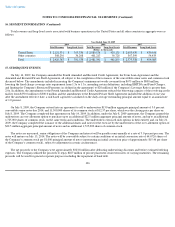

Outstanding and unvested RSAs of 817,288 at June 30, 2009 had an intrinsic value of $14.2 million and a weighted average remaining

contractual term of 4.4 years. Due to forfeitures 799,881 awards are expected to vest with a total intrinsic value of $13.9 million.

Outstanding and unvested RSUs of 215,000 at June 30, 2009 had an intrinsic value of $3.7 million and a weighted average remaining

contractual term of 2.7 years. All unvested RSUs are expected to vest in fiscal year 2012.

Outstanding SARs of 1,114,200 at June 30, 2009 had a total intrinsic value of zero and a weighted average remaining contractual term of

8.6 years. Exercisable SARs of 264,410 at June 30, 2009 had a total intrinsic value of zero and a weighted average contractual term of 6.2 years.

An additional 836,766 SARs are expected to vest with a $22.83 per share weighted average grant price, a weighted average remaining

contractual life of 9.4 years and a total intrinsic value of zero.

Total cash received from the exercise of share-based instruments in fiscal years 2009 and 2008 was $3.9 and $8.9 million, respectively.

As of June 30, 2009, the total unrecognized compensation cost related to all unvested stock-based compensation arrangements was

$30.9 million. The related weighted average period over which such cost is expected to be recognized was approximately 3.9 years as of June 30,

2009.

129

Nonvested

SARs Outstanding

Restricted

Stock

Outstanding

Shares/Units

Weighted

Average

Grant Date

Fair Value

Shares

Weighted

Average

Exercise

Price

(in thousands)

(in thousands)

Balance, June 30, 2006

193

$

36.92

286

$

36.87

Granted

343

40.07

139

39.01

Cancelled

(21

)

37.84

(23

)

38.41

Vested/Exercised

(41

)

37.33

(2

)

37.92

Balance, June 30, 2007

474

38.36

400

37.53

Granted

125

28.57

138

28.57

Cancelled

(10

)

37.71

(11

)

38.53

Vested/Exercised

(66

)

38.05

—

—

Balance, June 30, 2008

523

36.76

527

35.70

Granted

618

19.14

632

19.14

Cancelled

(28

)

35.41

(45

)

35.73

Vested/Exercised

(81

)

35.72

—

—

Balance, June 30, 2009

1,032

$

26.33

1,114

$

26.30