Supercuts 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

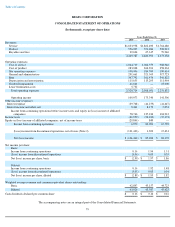

Pay fixed rates, receive variable rates

During the three months ended December 31, 2008, the Company entered into two interest rate swap contracts that pay fixed rates of

interest and receivable variable rates of interest (based on the one-month LIBOR) on notional amounts of indebtedness of $20.0 million each as

of June 30, 2009, and mature in July 2011, respectively. The Company will pay fixed rates of interest of approximately 3.0 percent and

3.4 percent on their respective $20.0 million. The contracts are on an aggregate notional amount of indebtedness of $40.0 million related to the

$85.0 million term loan, which the Company entered into during the three months ended December 31, 2008. The contracts expire in July 2011

and the debt matures in July 2012. These interest rate swap contracts were designed and are effective as cash flow hedges. They were recorded at

fair value within other noncurrent liabilities in the Consolidated Balance Sheet, with corresponding offset in deferred income taxes and other

comprehensive income within shareholders' equity.

During the three months ended December 31, 2005, the Company entered into interest rate swap contracts that pay fixed rates of interest

and receive variable rates of interest (based on the three-month LIBOR) on notional amounts of indebtedness of $35.0 and $15.0 million as of

June 30, 2009, and mature in March 2013 and March 2015, respectively. These swaps were designated and are effective as cash flow hedges.

These cash flow hedges were recorded at fair value within other noncurrent liabilities in the Consolidated Balance Sheet, with a corresponding

offset in other comprehensive income within shareholders' equity. These contracts were terminated subsequent to June 30, 2009 in conjunction

with the repayment of the private placement senior term notes as discussed in Note 17 to the Consolidated Financial Statements.

Pay variable rates, receive fixed rates

The Company had interest rate swap contracts under which it paid variable rates of interest (based on the three-month LIBOR plus a credit

spread) and received fixed rates of interest on an aggregate $5.0 million notional amount at June 30, 2008, with a maturation date of July 2008.

These swaps were designated as hedges of a portion of the Company's senior term notes and were being accounted for as fair value hedges.

During fiscal year 2003, the Company terminated a portion of a $40.0 million interest rate swap contract. The remainder of this swap

contract was terminated during the fourth quarter of fiscal year 2005. The terminations resulted in the Company realizing gains of $1.1 and

$1.5 million during fiscal year 2005 and 2003, respectively, which were deferred in long-term debt in the Consolidated Balance Sheet and were

being amortized against interest expense over the remaining life of the underlying debt that matured in July 2008. Approximately $0.3, $0.5, and

$0.5 million of the deferred gain was amortized against interest expense during fiscal years 2009, 2008 and 2007, respectively, resulting in the

deferred gain being fully amortized at June 30, 2009.

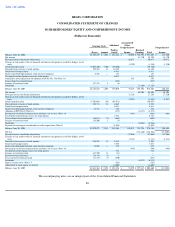

Tabular Presentation:

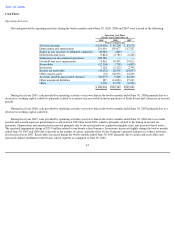

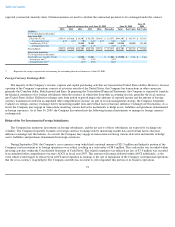

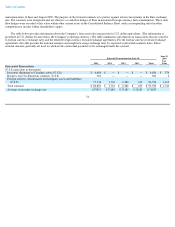

The following table presents information about the Company's debt obligations and derivative financial instruments that are sensitive to

changes in interest rates. For fixed rate debt obligations, the table presents principal amounts and related weighted-

average interest rates by fiscal

year of maturity. For variable rate obligations, the table presents principal amounts and the weighted

-average forward LIBOR interest rates as of

June 30, 2009 through June 30, 2014. For the Company's derivative financial instruments, the table presents notional amounts and weighted-

average interest rates by

71