Supercuts 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

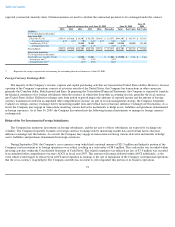

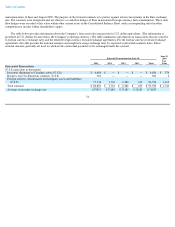

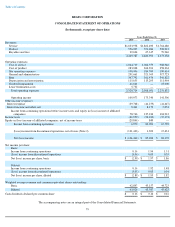

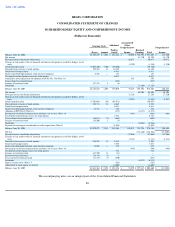

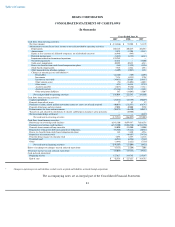

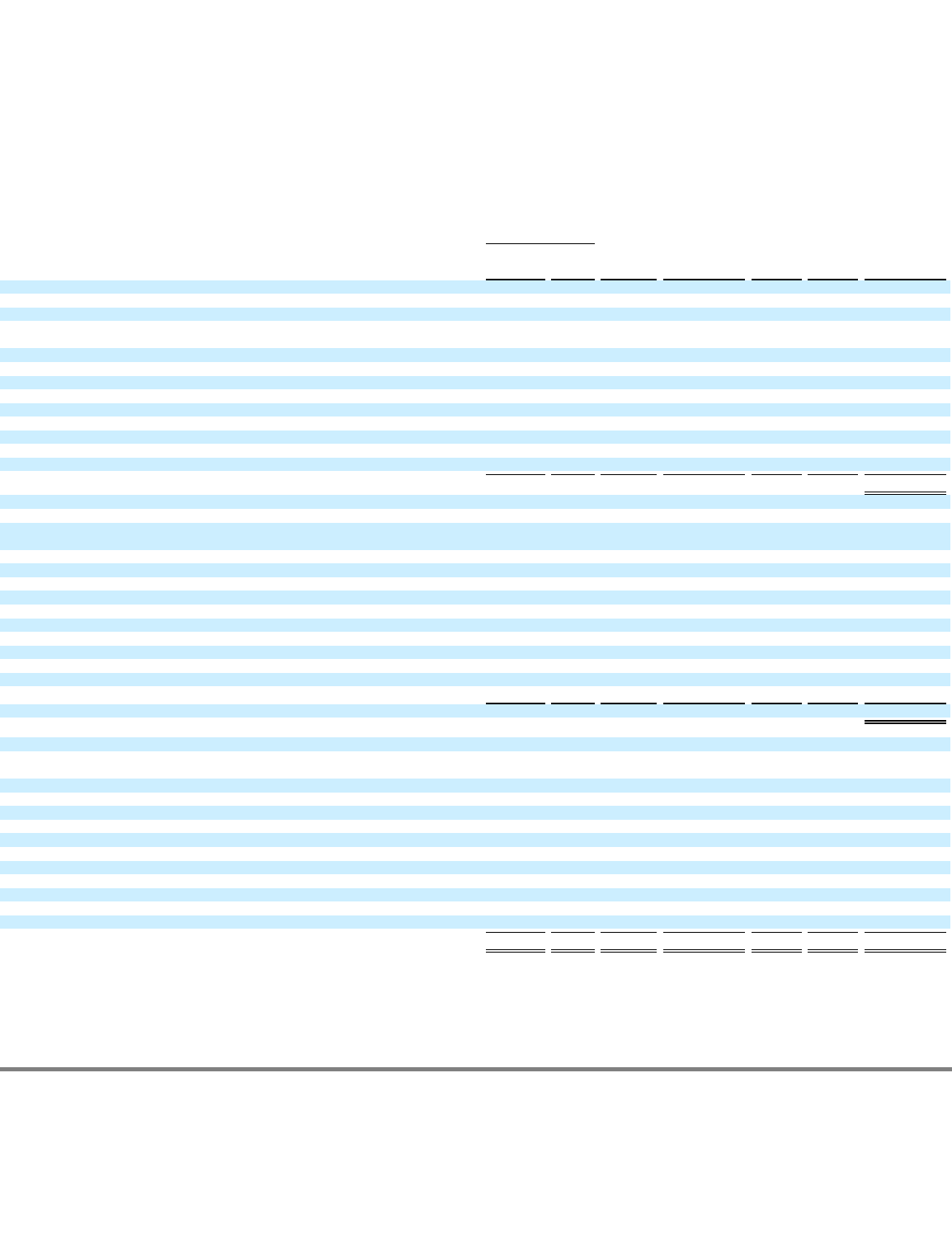

REGIS CORPORATION

CONSOLIDATED STATEMENT OF CHANGES

IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME

(Dollars in thousands)

The accompanying notes are an integral part of the Consolidated Financial Statements.

80

Common Stock

Accumulated

Other

Comprehensive

Income

Additional

Paid-In

Capital

Retained

Earnings

Comprehensive

Income

Shares

Amount

Total

Balance, June 30, 2006

45,303,459

$

2,266

$

232,284

$

58,066

$

578,791

$

871,407

$

121,520

Net income

83,170

83,170

83,170

Foreign currency translation adjustments

20,873

20,873

20,873

Changes in fair market value of financial instruments designated as cash flow hedges, net of

taxes

(1,220

)

(1,220

)

(1,220

)

Stock repurchase plan

(2,092,200

)

(104

)

(79,606

)

(79,710

)

Proceeds from exercise of stock options

829,524

41

14,269

14,310

Stock

-

based compensation

4,911

4,911

Shares issued through franchise stock incentive program

6,548

—

233

233

Tax benefit realized upon exercise of stock options

6,531

6,531

Cumulative effect adjustment for adoption of SFAS No. 158 (Note 14)

559

559

Taxes related to restricted stock

(587

)

(587

)

Issuance of restricted stock

117,314

6

(6

)

—

Dividends

(7,169

)

(7,169

)

Balance, June 30, 2007

44,164,645

2,209

178,029

78,278

654,792

913,308

102,823

Net income

85,204

85,204

85,204

Foreign currency translation adjustments

27,120

27,120

27,120

Changes in fair market value of financial instruments designated as cash flow hedges, net of

taxes

(2,557

)

(2,557

)

(2,557

)

Stock repurchase plan

(1,701,089

)

(85

)

(49,872

)

(49,957

)

Proceeds from exercise of stock options

525,774

26

8,867

8,893

Stock

-

based compensation

6,841

6,841

Shares issued through franchise stock incentive program

11,311

—

416

416

Adoption of FIN No.48 (Note 13)

(237

)

(4,237

)

(4,474

)

Recognition of deferred compensation and other, net of taxes (Note 14)

(868

)

(868

)

(868

)

Tax benefit realized upon exercise of stock options

2,784

2,784

Taxes related to restricted stock

(54,914

)

(2

)

(663

)

(665

)

Issuance of restricted stock

125,200

5

(5

)

—

Dividends

(6,964

)

(6,964

)

Payment for contingent consideration in salon acquisitions (Note 4)

(2,895

)

(2,895

)

Balance, June 30, 2008

43,070,927

2,153

143,265

101,973

728,795

976,186

108,899

Net loss

(124,466

)

(124,466

)

(124,466

)

Foreign currency translation adjustments

(47,666

)

(47,666

)

(47,666

)

Changes in fair market value of financial instruments designated as cash flow hedges, net of

taxes

(2,112

)

(2,112

)

(2,112

)

Proceeds from exercise of stock options

234,523

12

3,882

3,894

Stock

-

based compensation

7,525

7,525

Shares issued through franchise stock incentive program

13,808

—

378

378

Recognition of deferred compensation and other, net of taxes (Note 14)

(340

)

(340

)

(340

)

Tax benefit realized upon exercise of stock options

712

712

Issuance of restricted stock

617,550

31

(31

)

—

Restricted stock forfeitures

(28,119

)

(1

)

1

—

Taxes related to restricted stock

(27,325

)

(1

)

(490

)

(491

)

Dividends

(6,912

)

(6,912

)

Equity issuance costs (Note 17)

(243

)

(243

)

Adjustment to stock option tax benefit

(3,605

)

(3,605

)

Balance, June 30, 2009

43,881,364

$

2,194

$

151,394

$

51,855

$

597,417

$

802,860

$

(174,584

)