Supercuts 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Goodwill

Goodwill is tested for impairment annually or at the time of a triggering event in accordance with the provisions of Statement of Financial

Accounting Standard (SFAS) No. 142, Goodwill and Other Intangible Assets . In evaluating whether goodwill is impaired, the Company

compares the carrying value of each reporting unit, including goodwill, to the estimated fair value of the reporting unit. The carrying value of

each reporting unit is based on the assets and liabilities associated with the operations of the reporting unit, including allocation of shared or

corporate balances among reporting units. Allocations are generally based on the number of salons in each reporting unit as a percent of total

company-owned salons.

The Company calculates the estimated fair value of the reporting units based on discounted future cash flows that utilize estimates in annual

revenue growth, gross margins, fixed expense rates, allocated corporate overhead, and long-term growth for determining terminal value. The

Company's estimated future cash flows also take into consideration acquisition integration and maturation. Where available and as appropriate,

comparative market multiples are used to corroborate the results of the discounted cash flow. We consider our various concepts to be reporting

units when we test for goodwill impairment because that is where we believe goodwill resides. We periodically engage third-party valuation

consultants to assist in evaluation of the Company's estimated fair value calculations. Our policy is to perform our annual goodwill impairment

test during our third quarter of each fiscal year ending June 30.

The discounted cash flow model utilizes projected financial results for each reporting unit. The projected financial results are created from

critical assumptions and estimates which are based on management's business plans and historical trends. A summary of the critical assumptions

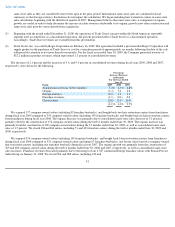

utilized during the fiscal year 2009 annual impairment test are outlined below:

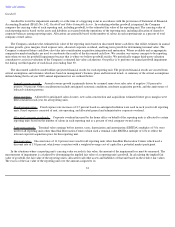

Annual revenue growth. Annual revenue growth is primarily driven by assumed same-store sales rates of negative 3.0 percent to

positive 3.0 percent. Other considerations include anticipated economic conditions, moderate acquisition growth, and the anniversary of

reduced visitation patterns.

Gross margins. Adjusted for anticipated salon closures, new salon construction and acquisitions estimated future gross margins were

held constant in each year for all reporting units.

Fixed expense rates. Fixed expense rate increases of 2.5 percent based on anticipated inflation were used in each year for all reporting

units. Fixed expenses consisted of rent, site operating, and allocated general and administrative corporate overhead.

Allocated corporate overheads. Corporate overhead incurred by the home office on behalf of the reporting units is allocated to certain

reporting units based on the number of salons in each reporting unit as a percent of total company-owned salons.

Long-term growth. Terminal value earnings before interest, taxes, depreciation and amortization (EBITDA) multiples of 5.0x were

used for all reporting units other than Hair Restoration Centers which used a terminal value EBITDA multiple of 6.0x to reflect the

relevant expected acquisition price for this reporting unit.

Discount rates. Discount rates of 11.0 percent were used for all reporting units other than Hair Restoration Centers which used a

discount rate of 13.0 percent, which were consistent with a weighted average cost of capital for a potential market participant.

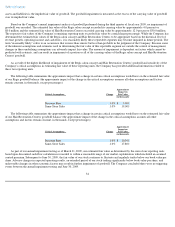

In the situations where a reporting unit's carrying value exceeds its fair value, the amount of the impairment loss must be measured. The

measurement of impairment is calculated by determining the implied fair value of a reporting unit's goodwill. In calculating the implied fair

value of goodwill, the fair value of the reporting unit is allocated to all other assets and liabilities of that unit based on the relative fair values.

The excess of the fair value of the reporting unit over the amount assigned to its

33