Supercuts 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

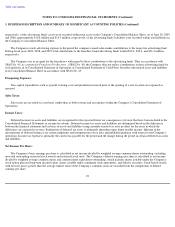

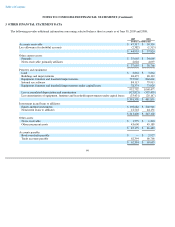

4. ACQUISITIONS (Continued)

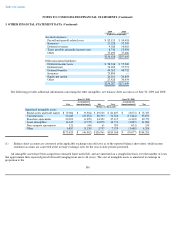

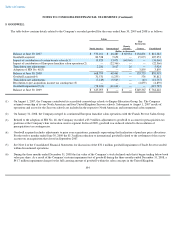

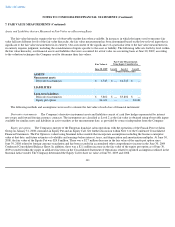

Based upon purchase price allocations, the components of the aggregate purchase prices of the acquisitions made during fiscal years 2009,

2008, and 2007 and the allocation of the purchase prices were as follows:

(1)

2009

2008

2007

(Dollars in thousands)

Components of aggregate purchase prices:

Cash

$

40,051

$

132,971

$

68,747

Note receivable applied to purchase price

—

10,000

—

Common stock

—

4

—

Liabilities assumed or payable

75

2,602

558

$

40,126

$

145,577

$

69,305

Allocation of the purchase prices:

Current assets

$

1,337

$

16,631

$

3,876

Property and equipment

5,989

21,398

10,086

Deferred income tax asset

1,787

1,789

1,200

Other noncurrent assets

—

473

50

Goodwill

30,812

105,252

50,844

Identifiable intangible assets

1,322

16,114

4,464

Accounts payable and accrued expenses

(818

)

(15,526

)

(412

)

Deferred income tax liability

—

—

(

436

)

Other noncurrent liabilities

(303

)

(3,449

)

(367

)

Settlement of contingent purchase price(1)

—

2,895

—

$

40,126

$

145,577

$

69,305

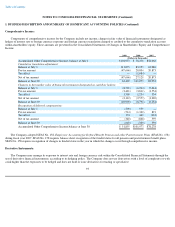

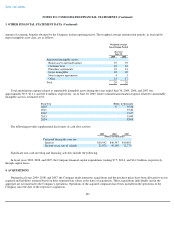

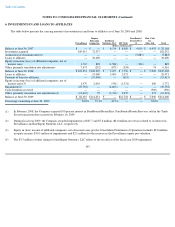

During fiscal years 2005, the Company guaranteed that the stock issued in conjunction with one of its acquisitions would reach a certain

market price by the fourth quarter of fiscal year 2008. The guaranteed stock price was factored into the purchase price at the acquisition

date by recording an increase to additional paid-in-capital for the differential between the stock price at the date of acquisition and the

guaranteed stock price. However, the stock did not reach this price during the agreed upon time frame. Therefore, the Company was

obligated to issue $2.9 million in additional consideration to the sellers during the fourth quarter of fiscal year 2008. The $2.9 million in

fiscal year 2008 represents the difference between the guaranteed stock price and the actual stock price on the last day of the agreed upon

time frame, and was recorded as a reduction to additional paid-in capital.

102