Supercuts 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

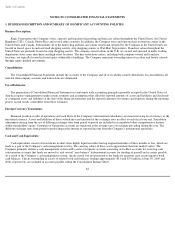

Table of Contents

maturation dates of June and August 2009. The purpose of the forward contracts is to protect against adverse movements in the Euro exchange

rate. The contracts were designated and are effective as cash flow hedges of Euro denominated foreign currency firm commitments. These cash

flow hedges were recorded at fair value within other current assets in the Consolidated Balance Sheet, with a corresponding offset in other

comprehensive income within shareholders' equity.

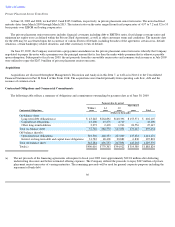

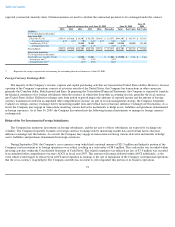

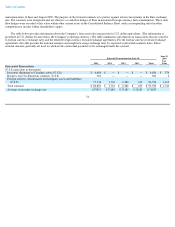

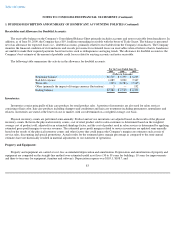

The table below provides information about the Company's forecasted sales transactions in U.S. dollar equivalents. (The information is

presented in U.S. dollars because that is the Company's reporting currency.) The table summarizes information on transactions that are sensitive

to foreign currency exchange rates and the related foreign currency forward exchange agreements. For the foreign currency forward exchange

agreements, the table presents the notional amounts and weighted average exchange rates by expected (contractual) maturity dates. These

notional amounts generally are used to calculate the contractual payments to be exchanged under the contract.

74

Expected Transaction date June 30,

June 30,

2009

Fair

Value

2010 2011 2012 2013 Total

Forecasted Transactions

(U.S.$ equivalent in thousands)

Inventory shipments to Canadian salons (U.S.$)

$

4,684

$

—

$

—

$

—

$

4,684

$

374

Business travel to European countries (U.S.$)

381

—

—

—

381

6

Foreign currency denominated intercompany assets and liabilities

(U.S.$)

77,736

1,763

6,386

639

86,524

1,163

Total contracts

$

82,801

$

1,763

$

6,386

$

639

$

91,589

$

1,543

Average contractual exchange rate

0.79315

0.71185

0.71185

0.71185

0.71185