Supercuts 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

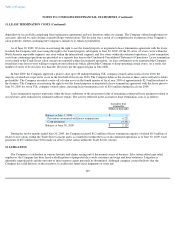

11. LEASE TERMINATION COSTS (Continued)

dependent on successfully completing lease termination agreements and was therefore subject to change. The Company offered employment to

associates affected by such closings at nearby Regis-owned salons. The decision was a result of a comprehensive evaluation of the Company's

salon portfolio, further continuing the Company's initiatives to enhance profitability.

As of June 30, 2009, 69 stores ceased using the right to use the leased property or negotiated a lease termination agreement with the lessor

in which the Company will cease using the right to the leased property subsequent to June 30, 2009. Of the 69 stores, 63 stores were within the

North America reportable segment, one store within the international segment, and five stores within discontinued operations. Lease termination

costs from continuing operations are presented as a separate line item in the Condensed Consolidated Statement of Operations. Lease termination

costs related to the Trade Secret salon concept are reported within discontinued operations. As lease settlements were negotiated the Company

found that some lessors were willing to negotiate rent reductions which allowed the Company to keep operating certain stores. As a result, the

number of stores to be closed is less than the 160 stores per the approved plan in July 2008.

In June 2009, the Company approved a plan to close up to 80 underperforming U.K. company-owned salons in fiscal year 2010, the

majority of which are expected to occur in the first half of fiscal year 2010. The Company believes the closure of these salons will add to future

profitability. The Company recorded a write-off of salon assets in the fourth quarter of fiscal year 2009 of approximately $2.9 million related to

the closures. The Company ceased using the right to use the leased property or negotiated a lease termination agreement with the lessor prior to

June 30, 2009 for seven U.K. company-owned salons, incurring lease termination costs of $0.6 million during fiscal year 2009.

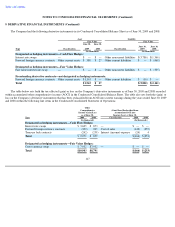

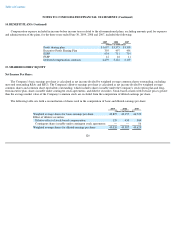

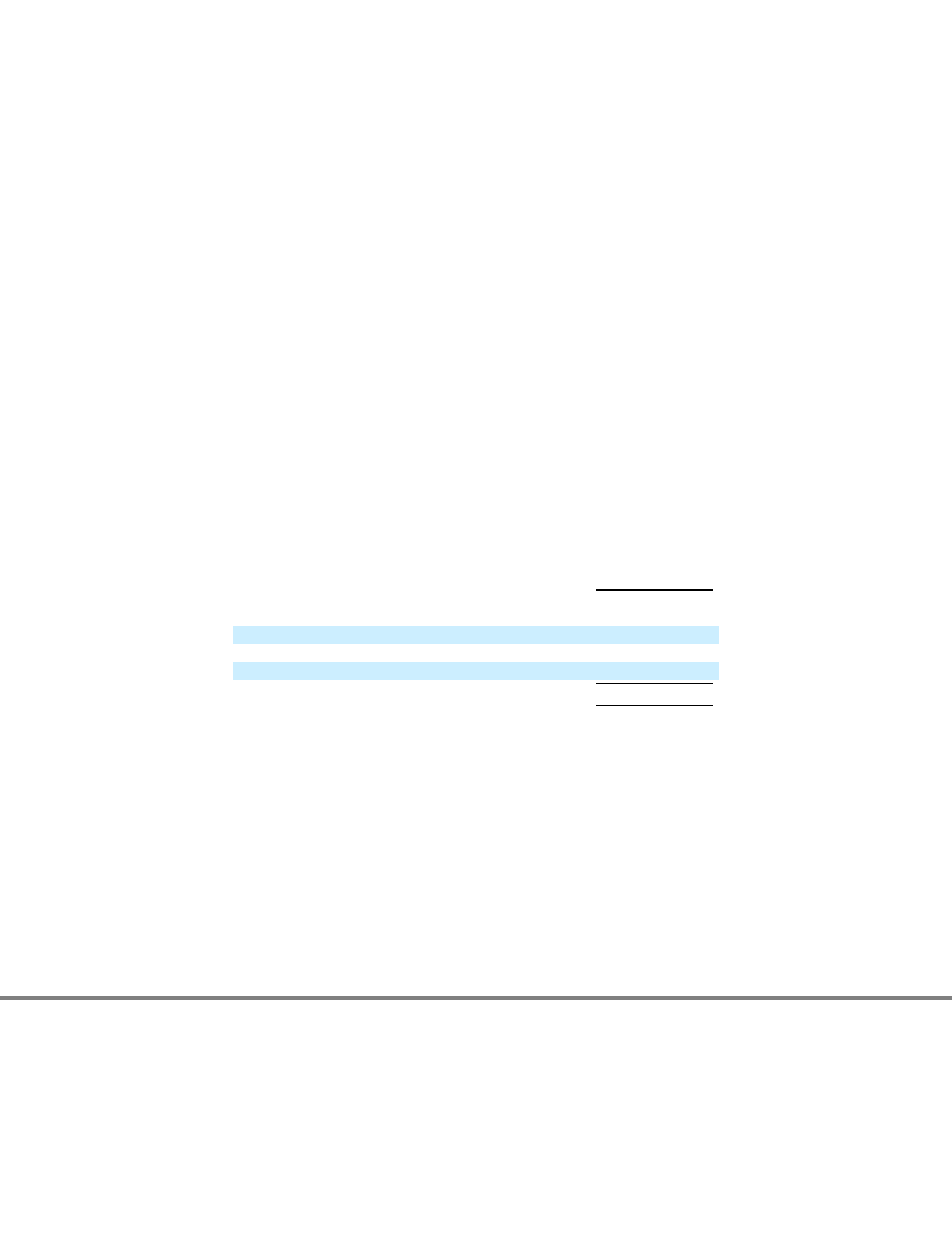

Lease termination expense represents either the lease settlement or the net present value of remaining contractual lease payments related to

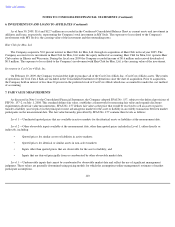

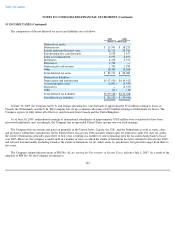

closed stores, after reduction by estimated sublease rentals. The activity reflected in the accrual for lease termination costs is as follows:

During the twelve months ended June 30, 2009, the Company incurred $6.2 million of lease termination expense of which $0.5 million of

relates to five salons within the Trade Secret concept and is accounted for within the loss on discontinued operations as of June 30, 2009. Cash

payments of $0.5 million have been made on all five of the salons within the Trade Secret concept.

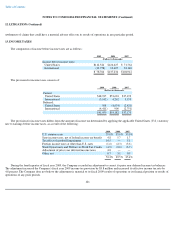

12. LITIGATION

The Company is a defendant in various lawsuits and claims arising out of the normal course of business. Like certain other large retail

employers, the Company has been faced with allegations of purported class-wide consumer and wage and hour violations. Litigation is

inherently unpredictable and the outcome of these matters cannot presently be determined. Although company counsel believes that the

Company has valid defenses in these matters, it could in the future incur judgments or enter into

120

Accrual for lease

terminations

(Dollars in thousands)

Balance at July 1, 2008

$

—

Provisions associated with lease terminations

6,221

Cash payments

(4,101

)

Balance at June 30, 2009

$

2,120